Nick Robins

Nick joined the Grantham Research Institute in February 2018 as Professor in Practice for Sustainable Finance. Nick leads the sustainable finance research theme. The focus of his work is on how to mobilise finance for climate action in ways that support a just transition, promoting the role of central banks and regulators in achieving sustainable development and investigating how the financial system can support the restoration of nature. Nick was Executive Director of the Institute’s Just Transition Finance Lab from 2024 until 2025 and is currently its Chair.

Nick is author of The Road to Net Zero Finance for the UK’s Climate Change Committee and co-founder of the Financing the Just Transition Alliance and is also a Commissioner on Scotland’s Just Transition Commission. He leads the finance platform for the Place-based Climate Action Network, and is co-chair of the International Network for Sustainable Finance Policy Insights, Research and Exchange (INSPIRE).

Background

From 2014 to 2018, Nick was co-director of UN Environment’s Inquiry into a Sustainable Finance System. As part of this, Nick established the Sustainable Insurance Forum of regulators and the Financial Centres for Sustainability network, as well as leading country activities in Brazil, the EU, India, Italy and the UK.

Before joining UNEP, he was Head of the Climate Change Centre of Excellence at HSBC. Prior to HSBC, Nick was head of Sustainable and Responsible Investment (SRI) funds at Henderson Global Investors. Nick has also worked at the International Institute for Environment and Development, the European Commission and the Business Council for Sustainable Development.

Nick is co-founder of Carbon Tracker and also co-founder of Planet Tracker. Nick has published widely and is the author of The Corporation that Changed the World: How the East India Company Shaped the Modern Multinational‘ (2005) and co-editor of Sustainable Investing: the Art of Long-Term Performance (2008). He is currently working on an ecological history of England and a book on finance, climate change and justice. He has a BA in History from Cambridge University and an MSc in International Relations from LSE.

Research

Research - 2024

The article outlines steps towards incorporating transition plans into prudential policy, thereby enabling supervisors to effectively use transition plans as a forward-looking instrument to better manage and overcome some of the challenges associated with climate transition risks. Read more

Research - 2022

This book chapter discusses the role that central banks and financial supervisors (CBFSs) can play in scaling up sustainable finance and investment. Read more

Policy

Policy - 2024

This publication consists of a series of short articles in which political and business leaders, academics and leading figures from the world of finance and climate governance outline the role of finance in tackling climate change and supporting a just transition. Read more

This report sets out the importance of a just transition in the mining sector, both out of coal mining and... Read more

This Final Report covers the ESRC-funded activities of PCAN between 2019 and 2024. Read more

This report focuses on the increasing role that institutional investors will play in advancing the just transition in India, given... Read more

This briefing examines the just transition agenda at the Port Talbot steel works, South Wales, and compares the UK experience with steps to achieve green steel in other European countries. Read more

Sovereign bonds are central to aligning finance flows with the net zero transition. This report aims to understand the system-wide context within which central banks can make a responsible contribution to this alignment. Read more

This report marks the launch of the Just Transition Finance Lab by the Grantham Research Institute, outlining the urgency of the just transition, obstacles to progress and how the Lab will address these through four priority work areas in 2024. Read more

This report consists of a submission by the Grantham Research Institute on Climate Change and the Environment on different elements of the UNFCCC work programme on just transition pathways (JTWP). Read more

Policy - 2023

To deliver a just transition, significant investment needs to be mobilised. Global debt markets could be a vital source of this finance, in particular green, social, sustainable and sustainability-linked (GSS+) bonds. This report considers how GSS+ bonds could be used to finance a just transition. Read more

This presentation was given by Nick Robins at the ‘First Annual High-level Ministerial round table on just transition’ which was held on 3 December 2023 at the COP28 in Dubai. Read more

This submission aims to support the work of the UNFCCC Just Transition Work Programme by providing recommendations on its necessary priorities and objectives. Read more

This briefing outlines the opportunities for the G20 to provide momentum to further the agenda of mobilising private sources for climate action. Read more

This report examines social risks and opportunities for stakeholders affected by environmental transitions in UK food and agriculture and makes recommendations to financial institutions for how they can support a just transition in the sector. Read more

The consultation response urges the Transition Plan Taskforce (TPT) to make an explicit acknowledgement of the importance of supporting the just transition to net zero and provide guidance for those preparing Transition Plans. Read more

This report contains results of the second phase of the India Just Transition Finance Roadmap project. Read more

The Quarterly Forecast Tracker monitors momentum and level of ambition on global energy and land transition policy and technology developments.... Read more

Policy - 2022

This paper sets out why it is important for central banks and supervisors to actively support the just transition, suggests a three-step roadmap for achieving this goal, and explores policy options for aligning monetary policy operations and financial regulation with the just transition. Read more

The impacts of biodiversity loss call for urgent and transformative changes to economic and financial systems. This paper discusses the need to extend the scope of central banks’ approach to the environmental crisis. Read more

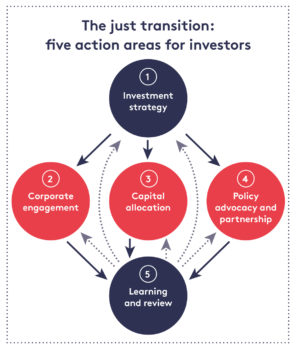

This tool describes the concept of a Just Transition and makes the business case for financial institutions to partner with stakeholders and peers to support a just climate transition. Read more

Net zero transition plans can provide an additional dynamic instrument for financial supervisors to assess and address financial risks. This report provides steps towards incorporating transition plans into prudential supervision. Read more

This report provides guidance to financial Institutions on how they can incorporate the social dimension of climate action – the just transition – into their net zero transition plans. Read more

This report explores how financial institutions can support the ‘just nature transition’: a shift to a net zero economy that delivers decent work, social inclusion and the eradication of poverty while delivering biodiversity goals. Read more

This presentation given at the Inevitable Policy Response Quarterly Forecast Tracker event on 30th June 2022 provides an assessment of the international policy response to the Just Transition. Read more

This Final Report provides the conclusions of the NGFS-INSPIRE Study Group on Biodiversity and Financial Stability on the scale of the threats from 'biodiversity-related risk' to the global financial system, reviews the actions that central banks, supervisors and other financial actors are already taking in response, identifies policy options for evaluating and mitigating financial risks arising from biodiversity loss and makes recommendations for near-term action. Read more

Policy - 2021

This policy brief reviews the attention given to a crucial aspect of climate change action - the just transition - at the COP26 climate summit and the priorities that lie ahead for 2022. Read more

This policy brief looks at actions the energy sector and finance are starting take to ensure there is a just transition for workers and communities affected by the transition away from coal, and how those actions can be scaled up. Read more

This report sets out what the delivery of a just transition in the UK will require, highlights initial efforts by leading financial institutions towards achieving a just transition, and points to what is needed to achieve system-wide change. Read more

This paper, co-authored with the Impact Investing Institute, emphasises the strategic potential for a green sovereign bond with well-defined social and economic benefits to support the European Commission’s new Strategy for “financing the transition to a sustainable economy.” Read more

This report is intended as a stocktake of the current context for central bank and financial supervisory action on biodiversity loss. It sets out the state of understanding on the linkages between biodiversity-related risks and financial stability, provides examples of emerging central bank and private finance activity, and identifies key themes, challenges and open questions. Read more

This note from the Impact Investing Institute and the Grantham Research Institute outlines a practical and implementable framework for delivering the social co-benefits dimension of the UK’s green gilt, laying the foundations for further development in subsequent green giltissuances. Read more

This report sets out a framework of just transition expectations that investors can use in conducting due diligence and assessments of companies, engaging with portfolio holdings and allocating capital. The framework is based on international standards and emerging practice and is applied to five companies in the European electric utilities sector. Read more

This report presents the results of the first phase of the India Just Transition Finance Roadmap project, which involved scoping the landscape and highlighting priorities for further work to be presented ahead of the United Nations Climate Change Conference (COP26). Read more

This report from Planet Tracker and the Grantham Research Institute sets out four steps Brazil could take to change direction, including issuing an innovative Deforestation-Linked Sovereign Bond tying interest payments to its success in reducing deforestation. Read more

Una “transizione giusta” per i lavoratori e le comunità mentre l’economia mondiale risponde ai cambiamenti climatici è stata inclusa come... Read more

Following the recent establishment of a Joint NGFS-INSPIRE Study Group on Biodiversity and Financial Stability by the Network for Greening the Financial System (NGFS) and INSPIRE, this vision paper sets out the rationale for the Study Group’s work, its initial agenda and its research focus. Read more

This policy report sets out why central banks in the EU need to adopt net-zero strategies, and provides seven concrete recommendations for how they can. Read more

This report examines the role that central banks and financial supervisors could play in supporting the transition to net-zero greenhouse gas emissions, providing recommendations for action across seven areas of central bank and supervisory practice. Read more

Policy - 2020

The Road to Net-Zero critically assesses the UK financial system’s ability to deliver a Net Zero target. The report comprises independent... Read more

A toolbox for central banks and financial supervisors of options to align their COVID-19 crisis response measures with climate and sustainability objectives and mitigate potential sustainability risks, updated with new analysis. Read more

The UK has a proud tradition of leadership in climate action and global finance. The urgent need to rebuild the... Read more

This brief sets out the net-zero transition requirements for SMEs in the UK and how issues of demand and supply of finance for the transition can be addressed. It provides recommendations to banks and finance providers, and to government. Read more

This policy brief looks at what a just transition to net zero in the UK’s housing sector means in practice and how banks can make it happen, underpinned by government policy and institutions. Read more

Banks need to show how they are aligning their balance sheets with the UK’s net-zero greenhouse gas emissions target, how they are enabling households and companies to become climate-resilient, and how the transition can be steered so that it is fair and inclusive. This report presents research findings and recommendations for how to achieve these aims. Read more

This briefing paper sets out the key areas where strong economic policies and institutions will be needed to foster investment for the post-COVID-19 recovery, building on discussions in the Royal Economic Society's webinar series chaired by Professor Lord Stern. Read more

This is a response to the Bank of England's discussion paper, 'The 2021 biennial exploratory scenario on the financial risks from climate change'. The response has been prepared by authors from the Grantham Research Institute on Climate Change and the Environment at LSE, the Grantham Institute – Climate Change and the Environment at Imperial College London, and the University of Edinburgh Business School. Read more

This working paper published by Oxford Smith School of Enterprise and the Environment outlines how the transition to net zero emissions could significantly contribute to the UK’s recovery from COVID-19. Read more

This briefing identifies key recovery policies that the UK government could introduce to both respond to the crisis of COVID-19, and support the country in meeting its commitment to reaching net-zero emissions by 2050. Read more

Transcript of the keynote speech delivered by Nick Robins on 20 April 2020 as part of Earth Day Week, in which he suggests five priorities for how we should reset sustainable finance in the decade to 2030. Read more

In advance of the Budget, this policy report highlights areas of the UK economy where the public sector could leverage private investment and in so doing contribute to achieving the strategic priorities of regionally balanced growth and decarbonisation. Read more

The transition to sustainability is the strategic challenge sovereign bonds face in the 2020s. Overcoming this challenge requires that the... Read more

Policy - 2019

This paper charts the rise of central bank and supervisor action on climate change and wider sustainability issues, analyses the key features of the 'new normal' and highlights priority themes for policy and research in the years ahead. Read more

This paper was submitted to the Dasgupta Review on the Economics of Biodiversity – Call for Evidence, an independent global review to assess the economic value of biodiversity and to identify actions that will enhance biodiversity and deliver economic prosperity. Read more

This policy insight looks at looks at the contribution the banking sector can make to ensuring that a just transition happens in the UK, under the Government's commitment to a net-zero-carbon economy by 2050. Read more

This report sets out the role that investors can play in delivering a just transition in the UK as the country works towards net-zero emissions, illustrating the implications through a set of place-based examples from Yorkshire and the Humber and setting out recommendations for investor action. Read more

The Grantham Research Institute’s response to the Commons Select Committee inquiry into decarbonisation of the UK economy highlights the Treasury’s unique position in government to drive the transition towards net-zero greenhouse gas emissions while maintaining a focus on economic growth. Read more

Chapter in the Banque De France’s Financial Stability Review no. 23 – June 2019. Read more

En esta guía se indica cómo los inversores pueden alcanzar el objetivo de una transición justa en el marco de sus prácticas operativas fundamentales. (Spanish translation of ‘Climate change and the just transition: A guide for investor action’.) Read more

Ce guide présente les leviers d’action dont disposent les investisseurs en vue de poursuivre l’objectif d’une transition juste dans le cadre de leurs pratiques opérationnelles. (French translation of 'Climate change and the just transition: A guide for investor action'.) Read more

In the first report from the Investing in a Just Transition UK project, the authors explore the extent of the challenge to ensure that action on climate change supports an inclusive economy in the UK, efforts that are already underway, and what actions investors can take. It includes a regional case study of Yorkshire and the Humber. Read more

Policy - 2018

A ‘just transition’ for workers and communities as the world’s economy responds to climate change was included within the Paris Agreement. This guide sets out how investors can address the social dimension of climate change and pursue the goal of a just transition as part of their core operating practices. Read more

This discussion paper explores why investors should contribute to the ‘just transition’ as the world’s economy decarbonises, and how they... Read more

Books

Books - 2022

This book chapter discusses the role that central banks and financial supervisors (CBFSs) can play in scaling up sustainable finance and investment. Read more

Events

Events - 2025

Events - 2021

Launch of From the Grand to the Granular: Translating Just Transition Ambitions into Investor Action – video

Event Type: Online eventFinancing the Green Transition: what role for multilateral development banks?

Event Type: Online eventJust Transition Finance Roadmaps in South Africa and India: Project launch – video

Event Type: Online eventEvents - 2020

Addressing Sustainability-related Financial Risks in Asia during the COVID-19 Crisis and beyond: The Role of Monetary and Financial Authorities

Event Type: Online eventA Toolbox of Sustainable Crisis Response Measures for Central Bank and Supervisors | 2nd Edition – Lessons from Practice

Event Type: Online eventThe sovereign transition to sustainability and healthy food systems – the case of Brazil

Event Type: Online eventFinancing place-based climate action: how to deliver a green and just recovery from COVID-19 Video

Event Type: Online eventMaking Use of Moral and Social Capital: faith communities and climate finance

Event Type: Online eventA Toolbox for Sustainable Crisis Response Measures for Central Banks and Supervisors

Event Type: Online eventA Toolbox for Sustainable Crisis Response Measures for Central Banks and Supervisors

Event Type: Online eventA Toolbox for Sustainable Crisis Response Measures for Central Banks and Supervisors

Event Type: Online eventNews

News - 2025

An examination of lessons from initiatives to scale up finance for climate action that actively seeks positive outcomes for people, drawing on the first six case studies from the Just Transition Finance Lab. Read more

This commentary article considers the impact of recent US policy changes on the global market for clean energy goods. Read more

The International Sustainability Standards Board, Global Reporting Initiative and UK government have made new announcements that offer opportunities to make the just transition a core part of corporate climate planning, writes Nick Robins. Read more

Nick Robins sets out the policy and investment levers that are needed to ensure that fossil fuel phase-out and clean energy expansion go hand in hand with good jobs and stronger communities. Read more

Three priorities for moving the just transition forward in 2025. Read more

News - 2024

The closure of Port Talbot’s Tata Steel, which may lead to 2,800 direct job losses, is a prime example of... Read more

This ‘Moral Money’ article in the FT features a discussion on the meaning of the term a ‘just transition’. The... Read more

How can we mobilise finance in support of a just transition? In this episode of the London Stock Exchange Group... Read more

News - 2023

Nick Robins reviews outcomes from the latest UN climate summit and explores how the just transition emerged as key to achieving net zero and climate resilience. Read more

This article discusses the UK Labour Party’s green prosperity plan, which includes proposals to create Great British Energy company and... Read more

In this letter to the FT Nick Robins explains how the international shipping sector provides an example of how a... Read more

G20 leaders recognise the pivotal role the multilateral development banks play in tackling global challenges and supporting sustainable development; now they must more clearly define and carry forward the agenda with urgency and at scale, this commentary argues. Read more

Strategies that deliver a just transition for workers and communities are increasingly seen as essential to speed progress to net zero. This will involve changes across the financial system, as Nick Robins explains. Read more

Central banks and financial supervisors are essential to securing finance for a low-emissions, resilient world. This commentary explores how to make progress on this goal, an important part of the Paris Agreement. Read more

This video podcast for NinetyOne considers the decarbonisation opportunity for investors in India. Read more

Article covers trade unions support of Extinction Rebellion’s multi-day climate protest, known as the “Big One. Brendan Curran and Nick... Read more

This episode of the Talking Responsibly Podcast with Adam Matthews and Kaisie Rayner features Nick Robins discussing the Just Transition what role investors should play, examples of best practice and who needs to be in the room when Just Transition dialogues are happening. Read more

In the year of India’s presidency of the G20, Nick Robins shows how key pieces of the country’s sustainable finance framework are falling into place and how an ambitious approach connecting net zero with the human dimension could help to mobilise the trillions the country needs. Read more

Nick Robins contemplates differences in approach between sustainable finance interventions made by the US Fed and the European Central Bank and calls for a second phase of sustainable central banking in 2023. Read more

This article reports on how the US Federal Reserve and European Central Bank have differed in their responses to tackling... Read more

News - 2022

With $468 trillion in assets across the globe, there is no shortage of cash to prevent climate harm; the problem is that the priorities, rules and incentives that govern public and private finance have long been pointing in the wrong direction. Nick Robins writes from COP27 on the steps being made to transform finance for a net zero and resilient world. Read more

This video profiles why central banks are taking action on climate and nature. It includes presentations by Nick Robins and representatives of central banks from Chile, Malaysia and Zambia. Read more

Nick Robins discusses some of the major challenges facing the COP27 climate summit. Read more

In this TV panel discussion, for Asset.tv, Nick Robins discusses the importance of a Just Transition to net zero for investors. He is joined on the panel by Faith Ward (Chief Responsible Investment Officer Brunel Pension Partnership & Chair, IIGCC) and Annika Brouwer (Sustainability Specialist, Ninety One). Read more

This Reuters report considers the implications of rising interest rates for green investment and the transition to a greener economy. Includes quotes from Nick Robins. Read more

In this article, Nick Robins argues that the just transition, centralising impacts that are positive to people, and a shift to sustainability must be core to financed climate plans. Read more

Soaring energy prices, the war in Ukraine and further stark evidence from the IPCC on the severity of the climate threat requires sustainable finance to move into a new phase. Nick Robins sets out what financial policymakers, regulators and institutions can do to help resolve the great issues of our time. Read more

Transition finance is a relatively new addition to the suite of sustainable finance instruments. Sabrina Muller and Nick Robins explain how and why the ‘just transition’ to net-zero, an inclusive process that takes into account the impacts on all people and places, needs to be fully incorporated. Read more

Building on the outcomes of COP26 will be critical to achieving a sustainable financial system, say Nick Robins and Danae Kyriakopoulou, as they highlight 10 areas of opportunity to be seized this year. Read more

News - 2021

to the announcement at COP26 that banks, insurers and investors with $130 trillion at their disposal have pledged to put combating climate change at the centre of their work. Read more

How can we decarbonise international finance to deliver net-zero central banking? Nick Robins, Simon Dikau and Ulrich Volz present a roadmap for greening global finance. Read more

Action by the finance sector in the coal-to-clean transition now needs to be scaled up, focusing on local needs and delivering tangible social impact, say Sabrina Muller and Nick Robins. Read more

Nick Robins and Ma Jun examine how the financial sector should respond to the global biodiversity crisis, which, with climate change, is threatening the global economy. Read more

Nick Robins explains why the real test for the just transition to net zero will be in the global south. Read more

Sabrina Muller and Nick Robins explain how the Social Value framework offers a mechanism to drive a green and just recovery from COVID-19 across the UK. Read more

This episode of The Real Story on the BBC World Service considers what is happening to communities at risk of... Read more

Katarzyna Szwarc, Nick Robins and Sabrina Muller explain how the UK Infrastructure Bank could drive forward the creation of a net-zero economy that is fair for all workers and communities, across the country. Read more

Nick Robins and Ciara Shannon suggest a green recovery plan from COVID-19 for the northern English county of Cumbria now that its council is reviewing its controversial decision to open a new colliery. Read more

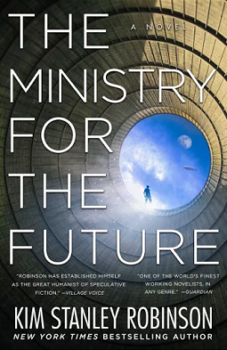

Nick Robins reviews Kim Stanley Robinson’s recent novel ‘The Ministry for the Future’. Read more

The net-zero target needs to become core to the purpose of the financial system to deliver an investment-led green recovery in the UK, writes Nick Robins. Read more

News - 2020

Nick Robins describes how the just transition is rising to the top of the agenda as the connective tissue that binds together climate goals with social outcomes. Read more

Phasing out coal requires expanding the notion of a ‘just transition’ and a roadmap that specifies the sequence of coal... Read more

Alexandra Pinzon, Nick Robins and Gabriel Thoumi explore how investors in sovereign bonds can take action to confront the risks of deforestation, with a focus on Brazil. Read more

Against the backdrop of the COVID-19 crisis, a trio of sustainable finance innovations could enable emerging economies to overcome sovereign debt problems and support their delivery of the Sustainable Development Goals, write Alexandra Pinzon, Nick Robins and Mike Hugman Read more

Allianz CIO Günther Thallinger and LSE’s Nick Robins on how to “recover better” from the crisis Read more

As the financial system gears up for the COP26 UN climate summit in November, leaders of financial institutions will need to know the answer to two questions: what is your temperature score and how will you bring it down to 1.5°C as soon as possible? Nick Robins looks at the progress being made. Read more

Article makes reference to a report by the Grantham Research Institute and Planet Tracker which says that countries need to protect their natural capital or face increased sovereign credit risk. Read more

It is clear that 2020 has to be the year when the global financial system makes the irreversible shift towards... Read more

News - 2019

This commentary describes five priorities to turn the goal of a just transition into practical policy in the UK following the general election and as the country plans to leave the EU and prepares to host 2020’s UN climate conference. Read more

Investors are demanding that companies disclose and implement zero deforestation policies. This commentary outlines three further steps sovereign investors can take. Read more

Scotland is targeting a net-zero transition that is inclusive and fair. Here, the authors report from a recent gathering of finance and government stakeholders in Edinburgh that explored how finance can be mobilised as part of the just transition. Read more

Responding to a comment by BlackRock vice-chairman Philipp Hildebrand, Nick Robins wrote to the Financial Times on Friday calling for any direct creation of central bank money to be “tightly aligned with global climate change goals”. Read more

Nick Robins explores how UK banks and investors are starting to get behind the just transition that is needed for the country to reach its new net-zero target. Read more

Nick Robins explores what the recent upsurge in commitment to a net-zero economy could mean for Europe’s financial system. Read more

As recognition grows rapidly among central banks of the need for routine consideration of climate change risks, robust research is required to guide and underpin their actions. Nick Robins and Matthias Täger introduce a new global research network designed to build these foundations. Read more

Sustainable finance ended 2018 on a high. Never before has so much capital been committed to integrating environmental, social and governance factors. But financial markets also entered an unnerving cycle. If we are not careful, growing financial turbulence could divert attention away from the urgent need to scale up investment in climate action and sustainable development, writes Nick Robins. Read more

News - 2018

Monday 3 December 2018 was the date when the ‘just transition’ emerged onto the global policy scene as a geopolitical... Read more

The global financial system needs to undertake its own transition, to play its role in limiting global warming to 1.5 degrees. Nick Robins identifies three ‘leaps’ for banks, capital markets, insurers and investors to take. Read more

This commentary reviews how both the insurance sector and its partners could build on the growing momentum and overcome the continuing barriers to deep implementation of sustainable insurance practices over the coming decade. Read more

Partners from the Investing in a Just Transition project explain the arguments for an equitable low-carbon transition and report on important progress that is being made. Read more

The Paris Agreement does not just commit countries to cut emissions. All countries also need to put in place a policy framework for climate-consistent finance. Nick Robins argues that the UK could take a leadership position by setting out how this complex task could be achieved. Read more

2018 is turning out to be the year of the “just transition”. In December, the UN’s annual climate conference, COP24,... Read more