The sovereign transition to sustainability: Understanding the dependence of sovereign debt on nature

Downloads

The transition to sustainability is the strategic challenge sovereign bonds face in the 2020s. Overcoming this challenge requires that the financial system recognises the fundamental economic dependencies on nature, which are currently ignored and mispriced, storing up instabilities for the future.

This report examines the case for the structural inclusion of natural capital into the issuance, assessment and stewardship of sovereign bonds, with a particular focus on Argentina and Brazil. The authors examine a hitherto overlooked aspect: the importance for sovereign bonds of reliable flows of ecosystem services from land. How successfully the world transitions to a sustainable economy will impact on countries that rely on land-based natural capital for their economy.

The report, produced with Planet Tracker, is the first in a series that will aim to understand the relationship between natural capital and the future prospects for sovereign bonds and it is anticipated that it will encourage stakeholders in the sovereign bond market to analyse further alternatives to assess and incorporate natural capital into their decision-making.

Headline issues

- In the 2020s sovereign bonds will face the strategic challenge of achieving alignment with the Sustainable Development Goals.

- Agriculture and the soft commodity trade are heavily linked to natural capital, as drivers of depletion and as processes reliant on a secure stream of ecosystem services.

- The value of sovereign bonds relies in part on the management of natural capital by the countries concerned. However, this dependency is still largely ignored or mispriced in sovereign bond markets.

- Pressures to achieve alignment between sovereign bonds and environmental sustainability are set to intensify in the decade ahead, with increasing focus on sovereign bonds as an asset class which connects macro-economic performance and capital markets.

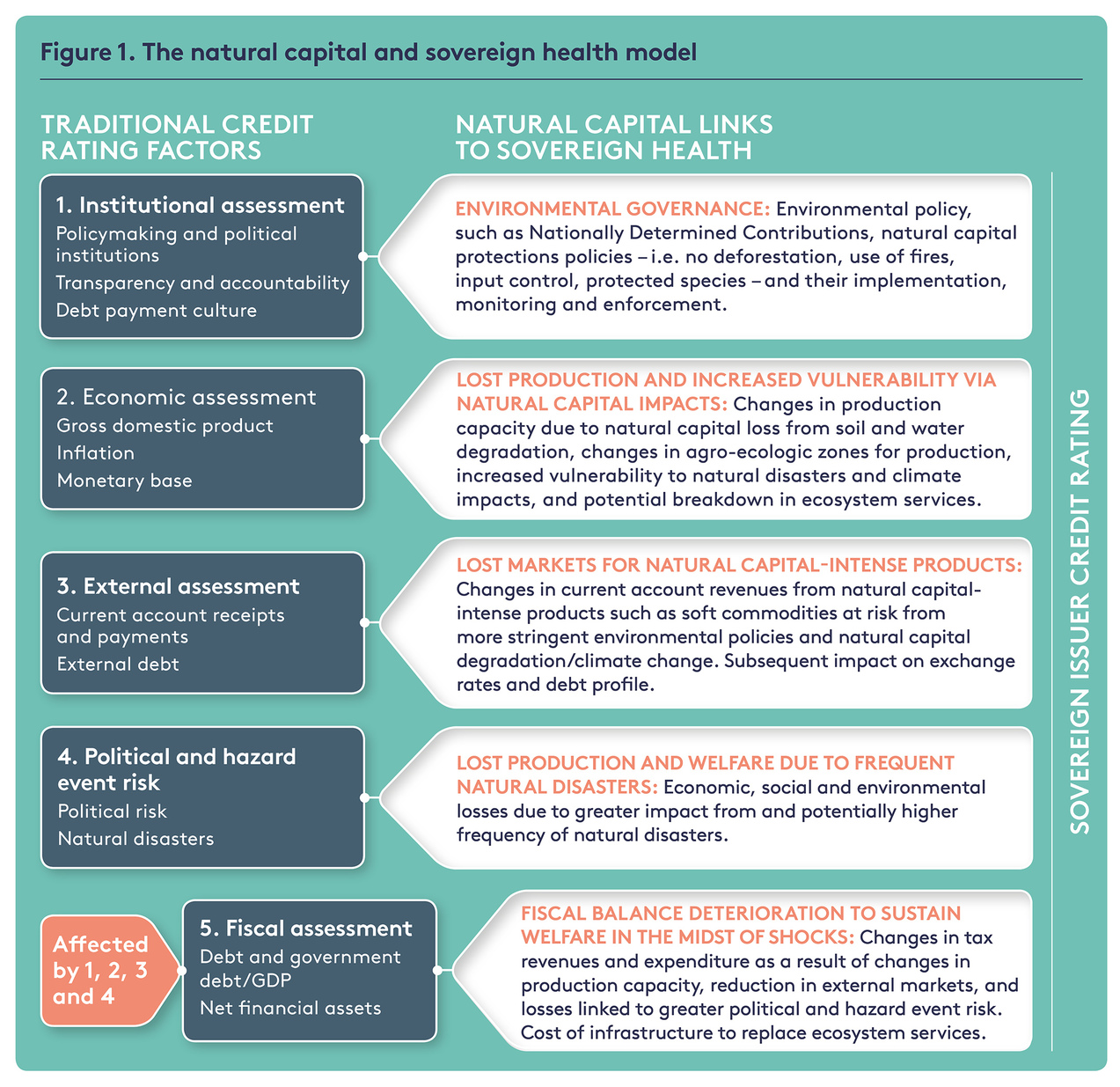

- To enable analysts to integrate the value of natural capital into the issuance, analysis and stewardship of sovereign bonds, we have developed a new research framework (see Fig 1 below). This identifies Argentina and Brazil as the G20 countries most dependent on natural capital for their exports.

- The authors estimate that 28 per cent of Argentina’s sovereign bonds and 34 per cent of Brazil’s sovereign bonds will be exposed to an anticipated tightening of climate and anti-deforestation policy in the 2020s, while 44 per cent and 22 per cent of their sovereign bonds, respectively, are exposed to changes in policy after 2030.

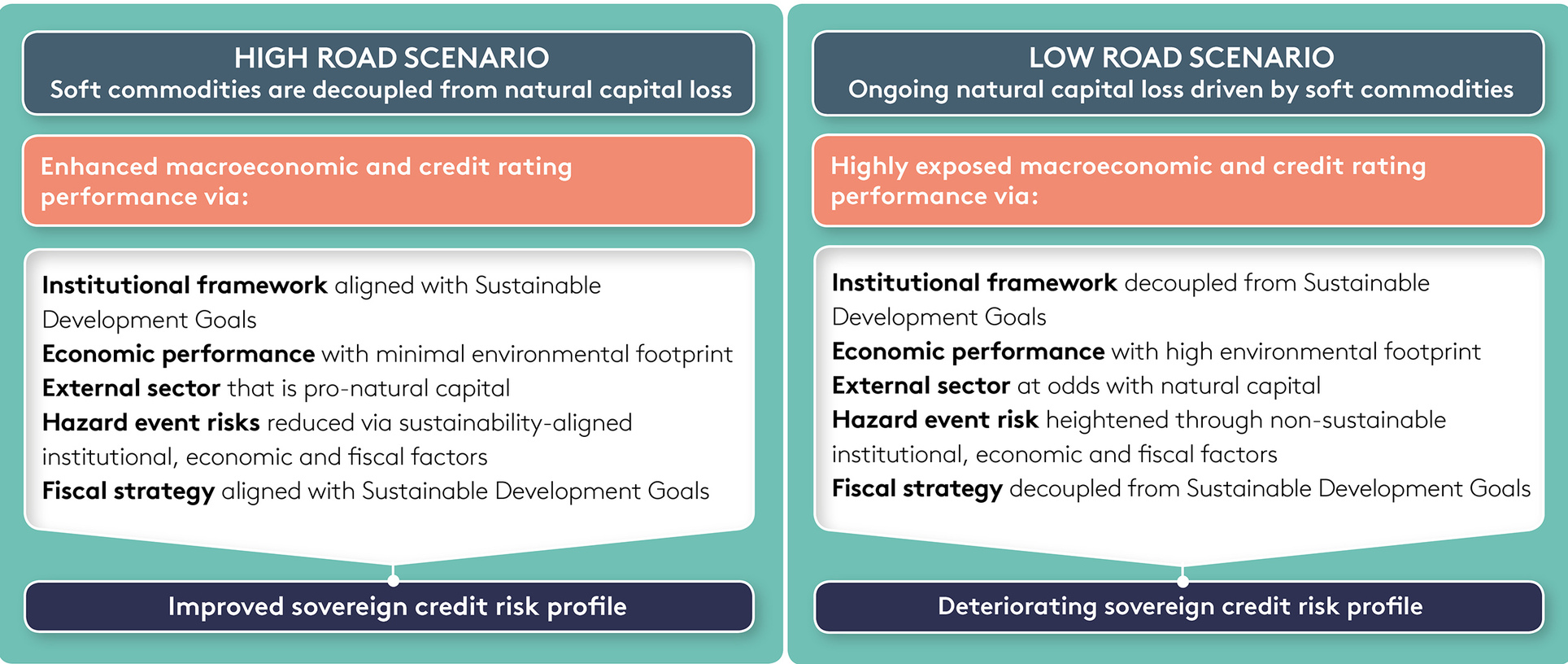

- Sovereign bond issuers face a choice (see Fig 2): either following a High Road scenario where countries actively protect and enhance the benefits of natural capital and reinforce the environmental fundamentals of sovereign bonds, or a Low Road scenario where business-as-usual undermines flows of ecosystem services, increases vulnerability to natural disasters and intensifies market risks.

- For sovereign bonds to develop the required resilience in the disruptive decade that lies ahead, decisive action is needed from issuers, investors, credit rating agencies and international institutions, as well as researchers and civil society, to ensure the full value of nature is incorporated.

Figure 2. Choices for sovereign bond issuers: High road and Low Road scenarios for natural capital

Report produced with

The authors acknowledge funding from the Gordon and Betty Moore Foundation through the Finance Hub, which was created to advance sustainable finance.