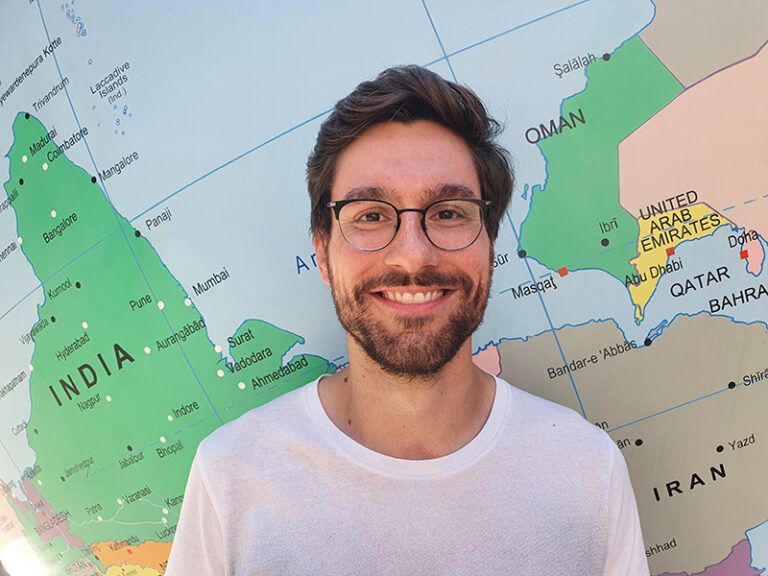

Matthias Täger

Matthias is an economic sociologist with the Centre for Economic Transition Expertise (CETEx). He is interested in how finance governs and organises its relationship with the natural environment. In this context, his focus lies in particular on the role of knowledge and devices on the one hand and temporalities on the other hand. He has conducted interview-based and ethnographic fieldwork on the genesis of climate-related disclosure frameworks and institutions (TCFD), the design of climate scenarios for central banking (NGFS reference scenarios), and the development and use of climate-related knowledge and devices in asset management. His research brings together and advances debates in economic sociology, science & technology studies, and political sociology. Matthias is also an Honorary Research Fellow at Warwick Business School.

Background

Matthias obtained his PhD on the construction of climate risk at LSE’s Department of Geography & Environment where his research was funded by the UK Economic and Social Research Council. Before joining LSE, Matthias was a Fulbright student and research assistant at the School for the Environment, University of Massachusetts Boston. Previously, he held several roles as research assistant at the University of Bremen, the European Institute for Public Participation in Bremen, the LMU Munich and the Institute for Contemporary History Munich. He received a BA in Political Science and History from LMU Munich and an MA in International Relations from the University of Bremen and the Jacobs University Bremen.

Research interests

- Temporalities of climate change

- Calculative devices

- Green central banking

- Green Finance

Policy

Policy - 2023

This policy insight presents an initial conceptual framework on the application of climate scenario analysis and associated design requirements, focusing on the need for a clear purpose. Read more

Policy - 2021

Following the recent establishment of a Joint NGFS-INSPIRE Study Group on Biodiversity and Financial Stability by the Network for Greening the Financial System (NGFS) and INSPIRE, this vision paper sets out the rationale for the Study Group’s work, its initial agenda and its research focus. Read more

Policy - 2020

This is a response to the Bank of England's discussion paper, 'The 2021 biennial exploratory scenario on the financial risks from climate change'. The response has been prepared by authors from the Grantham Research Institute on Climate Change and the Environment at LSE, the Grantham Institute – Climate Change and the Environment at Imperial College London, and the University of Edinburgh Business School. Read more

Policy - 2019

This paper charts the rise of central bank and supervisor action on climate change and wider sustainability issues, analyses the key features of the 'new normal' and highlights priority themes for policy and research in the years ahead. Read more

Events

Events - 2025

News

News - 2021

The concept of double materiality brings environmental impacts into the focus of standard-setting in accounting. Different reasons for adopting this concept might lead to widely varying interpretations, as Matthias Täger explains. Read more

News - 2019

As recognition grows rapidly among central banks of the need for routine consideration of climate change risks, robust research is required to guide and underpin their actions. Nick Robins and Matthias Täger introduce a new global research network designed to build these foundations. Read more