Frank Venmans

Background

Frank Venmans was a monthly visitor since 2013 at the Grantham Institute. Before joining Grantham full time in 2020, he was Associate Professor in microeconomics and environmental economics at the University of Mons, Belgium. He did his PhD thesis in the finance department of UMONS, focussing on the European carbon market. He is also the president of the Walloon Expert Committee on Climate since 5 years, a body assisting the government in reducing carbon emissions by 55% in 2030 in Wallonia, the French-speaking part of Belgium.

Research interests

- Integrated assessment modelling and risk,

- Discounting and inequality aversion,

- Carbon markets,

- Policy evaluation.

Methods

- Stochastic dynamic optimization,

- Financial econometrics,

- Causal inference.

Research

Research - 2025

To shed light on the practical issues involved in policing carbon markets, this study presents the first comprehensive analysis of the EU Emissions Trading System, a single programme that was policed by up to 31 different national regulators. Read more

Research - 2024

The authors of this paper construct a comprehensive database of filings and decisions relating to 108 climate lawsuits against US- and European-listed firms between 2005 and 2021. Read more

The authors of this paper analyse the impacts of applying different constraints to climate model cost-effectiveness analysis on optimal carbon prices, emissions and human welfare. Read more

The authors of this paper review the literature on estimates of future emissions for current/stated policy scenarios and current pledge scenarios. Read more

This paper assesses the effect of technical change on optimal climate policy in integrated assessment models, which provide key inputs to decision-makers for economically efficient climate policies. Read more

Governments are catching up with economic theory and practice by increasingly integrating ecosystem service values into national planning processes, including... Read more

Research - 2023

The authors of this paper develop a flexible framework for estimating the net social benefit of impermanent nature-based interventions. Read more

This working paper analyses the impacts of applying different constraints to climate model cost-effectiveness analysis on optimal carbon prices, emissions and human welfare. Read more

This working paper aims to shed light on the practical issues involved in policing carbon markets, such as new regulators with narrow authority and lack of legal precedent. Read more

The authors of this paper we outline a carbon and biodiversity co-crediting scheme based on the multi-kingdom molecular and carbon analyses of soil samples, along with remote sensing estimation of aboveground carbon as well as video and acoustic analyses-based monitoring of aboveground macroorganisms. Read more

Reducing global forest losses is essential to mitigate climate change and its associated social costs. Multiple market and non-market factors... Read more

The authors of this paper develop a method to establish the value of temporary offset projects with a given risk of failure and show that this value is always positive. They find that to compensate for one tonne of fossil fuel emissions, 2 to 3 tonnes of carbon need to be stored in a forest if the project stops being additional after 50 years. Read more

This working paper presents evidence that litigation reduces firm value. This means that climate litigation should be considered a relevant financial risk by lenders, financial regulators and governments. Read more

This letter to Science, co-authored by 17 conservation and climate researchers, argues that carbon credits can be a valuable tool for climate change mitigation and forest conservation, but their success depends on improving their credibility. Read more

Research - 2022

How best to make the transition from a high- to low-carbon economy remains open for debate, involving complex dynamics that go beyond basic models of emissions abatement. It is these dynamics that the authors aim to analyse with the model they develop in this paper, showing that it is optimal to repurpose and strand a substantial amount of capital. Read more

This paper investigates the impact of the European Union Emissions Trading System (EU ETS) on carbon emissions and economic performance using the largest dataset published to date. Read more

This paper develops a method to estimate the ‘probability distribution’ of future temperatures to be used in long-term climate change adaptation strategies, investing and insurance. Read more

Research - 2021

This article examines the relationship between capital ratios and returns on US bank stocks between 1973 and 2019. Read more

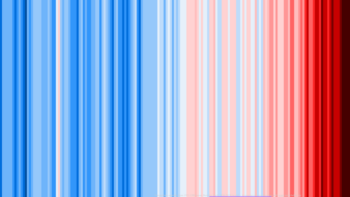

This paper shows that economic models of climate change produce climate dynamics inconsistent with current climate science models. Read more

Measures of inequality aversion are elicited using hypothetical decision tasks. The tasks require an assessment of projects in the presence of environmental inequalities across space and time. Read more

Research - 2020

This paper reviews ex-post empirical assessments on the impact of carbon pricing on competitiveness in OECD and G20 countries, primarily... Read more

Lemoine and Rudik (2017) argues that it is efficient to delay reducing carbon emissions, due to supposed inertia in the... Read more

Research - 2019

In this paper the authors provide experimental evidence to illustrate that aversion to environmental inequality is as pronounced as aversion to income inequality and varies across different types of environmental quality. Read more

We exploit recent advances in climate science to develop a physically consistent, yet surprisingly simple, model of climate policy. It... Read more

There is a considerable body of evidence showing that our preferences exhibit both reference dependence and loss aversion, a.k.a. the... Read more

The authors of this comment respond to a recent argument put forward by Lemoine and Rudik (2017), that it is efficient to delay reducing carbon emissions because there is substantial inertia in the climate system. Mattauch et al. show that there is no such inertia, which means there is no lag between carbon emissions and warming. Read more

Research - 2017

The authors of this paper have built a model of economically-efficient carbon dioxide emissions, which provides solutions for economically optimal peak warming of the planet, optimal emissions along the transition to peak warming, and optimal carbon prices, including under a temperature constraint consistent with the Paris Agreement. Read more

Research - 2016

There is a considerable body of evidence from behavioural economics and contingent valuation showing that our preferences exhibit both reference... Read more

Events

Events - 2025

Events - 2023

Events - 2022

News

News - 2025

paper co-authored by a team of researchers including the Institute’s Frank Venmans and Ben Groom has been announced as one of nineteen winners of the Frontiers Planet Prize which aims to recognise “scientists offering scalable solutions to help keep humanity safely within planetary boundaries”. Read more

News - 2023

A paper by researchers from the Grantham Research Institute at LSE has been awarded the Best Paper Prize at the 6th annual conference of the Global Research Alliance on Sustainable Finance and Investment (GRASFI). Read more