Our vision

Pursued through research, policy analysis and training on climate change and the environment

Featured

Climate change: economics, policy and strategy in an age of uncertainty

This 5-day LSE Executive course provides leaders with a comprehensive understanding of the economic, policy, and governance dimensions of climate change.

Latest publications

View allAssociated websites and data tools

Centre for Economic Transition Expertise (CETEx)

CETEx is a specialised research and policy centre which aims to support the ambitious reforms required to deliver sustainable, inclusive and resilient economies and financial systems across Europe.

Just Transition Finance Lab

The Just Transition Finance Lab is supporting the transformation of the global financial system in order to achieve progress on climate and wider environmental goals through a people-centred approach.

Climate Change Laws of the World

Climate Change Laws of the World builds on a decade of data collection and analysis by the Grantham Research Institute on Climate Change and the Environment at LSE.

TPI Global Climate Transition Centre

The TPI Global Climate Transition Centre (TPI Centre) is an independent, authoritative source of research and data into the progress being made by the financial and corporate world in making the transition to a low-carbon economy.

Macroeconomics of Green and Resilient Transitions

This website showcases concrete examples, practical guidance, and tools from the Coalition of Finance Ministers for Climate Action and a broader community of researchers, analysts, and practitioners.

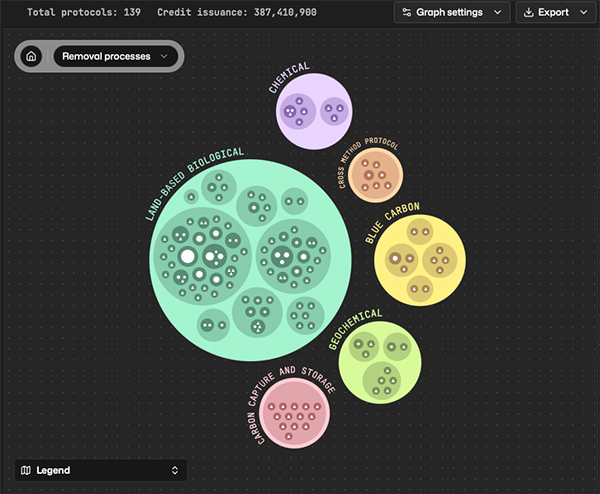

TRACEcdr Tool

Transparent Reporting and Certification for CDR, or TRACEcdr, is an interactive tool to improve transparency in the carbon dioxide removal (CDR) industry.