The UK should lead on a green industrial strategy – not roll back

The UK Government has watered down its commitments to net zero, breaking the cross-party consensus on the need for Britain to lead in the global battle against climate change. Yet now is the time to double down on policy action before it is too late, argue Anna Valero, John Van Reenen and Esin Serin.

We stand at a critical juncture on net zero in the UK and globally, as the impacts of climate change are increasingly being felt all around us and as some countries – notably the US – are racing ahead with their transitions to a green economy. Yet the UK Government has chosen this time to set out its “new approach to Net Zero”, weakening commitments in particular on decarbonising surface transport and homes that are seen as necessary for the UK to deliver on its ambitious targets.

While there were also some positive announcements, for example increasing financial support in the Boiler Upgrade Scheme (which supports investment in energy-efficient heating) and forthcoming reforms on energy infrastructure, the backtracking is a mistake for many reasons. Crucially, this policy volatility and weakened incentives for businesses in key areas will damage much needed investment and innovation in the UK, in exactly the areas that are required to minimise the costs of the transition, improve resilience and give the UK a chance of capturing growth opportunities along the way.

Increasing business investment and innovation is key to restoring productivity growth which has been stagnant since the financial crisis. Delivering on the UK’s net zero commitment also requires large-scale and system-wide investment this decade, much of it coming from the private sector. Green industrial policies, woven into a lasting and coordinated UK growth strategy, along with policies to ensure that costs and benefits are shared, will be crucial for achieving this.

The rise of green industrial policies, and why we need them

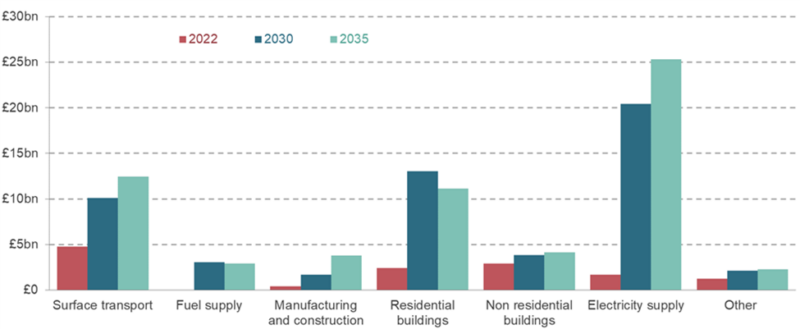

In this context, industrial policies are those that involve interventions that seek to change the structure of the economy in order to achieve a key, typically growth-related, goal. So green industrial policies can be thought of as the set of such policies that are targeting green growth. These are increasingly being adopted given the urgency of tackling the climate crisis, and the recognition that net zero by 2050 requires a large-scale increase in investment (see Figure 1), most of which will need to occur in the private sector. There is a key role for policies that create the appropriate incentives for firms.

Figure 1. Annual additional capital investment needed to deliver net zero to 2035, £ millions

Notes: ‘Other’ represents agriculture, aviation, shipping, waste, F-gases, LULUCF and removals. Source: Climate Change Committee (2020) Sixth Carbon Budget. Chart taken from Curran et al., (2022) Growing Clean: Identifying and investing in sustainable growth opportunities across the UK. Resolution Foundation and CEP.

In the US, the Inflation Reduction Act (IRA) has committed large-scale and long-term government support to specific clean technologies and sectors seeking to crowd in substantial private sector investment, while the EU is responding with its Green Deal Industrial Plan. We await a full policy response in the UK, where recent years have seen an on-off relationship with industrial strategy (in terms of whether we have one, what it looks like and how it is communicated) and where there are serious concerns about falling behind on its ambitious net zero targets and international climate leadership – even before the recent announcements.

Net zero investments are attractive investments, which in addition to addressing the climate crisis can improve energy security and resource efficiency, and generate a variety of co-benefits. Indeed, many (including the Independent Review of Net Zero in the UK) have called net zero the “growth opportunity of the 21st century”. But it is unrealistic to assume that we can rely on the private sector alone to naturally find the most efficient and smooth path to net zero given the presence of numerous market failures and path dependencies in innovation systems. The obvious market failure is the greenhouse gas externality whereby the costs of emissions are not captured in market prices. This provides the economic justification for crucial environmental policies such as carbon taxes, regulation and standards. While such levers are necessary for the net zero transition, experience shows how they can be politically difficult to implement at the required scale and pace.

Policymakers therefore turn to other instruments that are also justified by market failures such as research and development externalities, capital market imperfections, networks, information frictions and the lack of a price for public goods such as clean air. Different market failures point to the need for different instruments across tax incentives, R&D grants, finance and risk sharing, public infrastructure investment, skills programmes and information campaigns. Ideally, in order to maximise certainty for businesses making long-term investment decisions, individual policies are woven into an overall growth strategy that can outlive political cycles.

Many cite concerns over a ‘subsidy race’ or policy competition between governments leading to waste and misallocation of public resources. Such concerns call for carefully designed policies and international collaboration, as well as some elements of competition to attract mobile capital. But a more positive view – given the global and urgent nature of tackling the climate crisis – is that these forces will ultimately spur an increase in global investment, innovation and associated spillovers, bring the price of key technologies down, and boost resilience within countries or broader trading blocs.

How can the UK target green industrial policies?

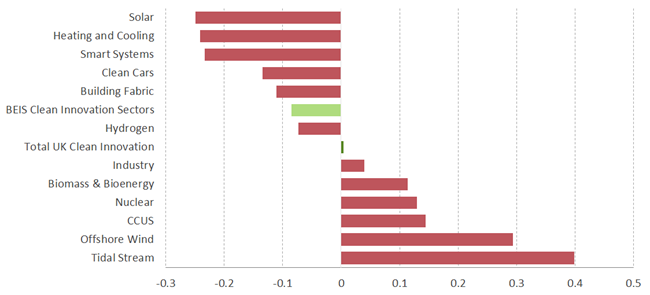

For advanced economies such as the UK, the challenge relates not only to supporting investments needed to achieve its own net zero targets, but also to capturing growth opportunities where domestic firms and innovators are able to create products and services competitively and meet growing global demand. Such an approach must recognise the UK’s comparative advantages in services, its status as one of the major green finance hubs, and as a knowledge economy with significant strengths across its research system and areas of high value manufacturing. The UK has strengths in the innovation of key clean technologies such as offshore wind, Carbon Capture Usage and Storage (CCUS) and tidal stream which generate high spillovers (as measured through forward citations in patents). Many of these strengths are found in less productive parts of the UK, suggesting that support for key green technologies can help to address longstanding regional inequalities. Offshore wind provides an interesting case study – while the UK has led in its deployment, and is specialised in related innovation, supply chain benefits have been largely retained within non-UK businesses that have led the process.

Figure 2. Revealed Technological Advantage by selected clean technologies: UK, 2015–2018

Notes: Revealed Technological Advantage (RTA) compares a country’s share of total innovation in a particular technology area to the global share for the categories. Positive values suggest that the UK is specialised in a particular area. Chart taken from Curran et al. (2022) Growing Clean: Identifying and investing in sustainable growth opportunities across the UK. Resolution Foundation and CEP.

However, there are also areas where the UK is not specialised, but where domestic capabilities are necessary for security and resilience purposes, such as battery technologies which are seen as crucial for the future of the automotive industry. Countries must therefore balance the need for domestic supply capabilities versus openness to trade – particularly with China which now dominates in many areas.

Which policies should the UK focus on?

The UK can learn a lot from the incentives provided in the IRA – their scale, longevity, and how they contain support on both the supply and demand side. But the UK’s response must be tailored to its unique context: targeted towards technologies where the UK has or must have strengths; operating within its smaller economy and under significant fiscal constraints; and a greater political ability (in comparison with the US) to use regulatory levers and carbon pricing at the national level. Key short-term priorities should include removing policy barriers to investment (e.g. planning restrictions), making full tax deductibility of capital investment permanent, and considering where to enhance tax incentives for net zero-aligned investments – or using Government levers to de-risk them.

Stronger institutions surrounding growth policy (e.g. a new National Growth Board) can help to ensure the longevity of such green industrial policies as part of a broader growth strategy, drawing inspiration from other areas of policy – for example, the Climate Change Committee, which provides advice and reports on progress towards net zero. Such structures will provide investors with confidence to make the long-term investments that are needed for sustainable growth and give citizens a clear vision for the UK’s potential over the next decade.

How can public support be maintained and built?

The support of citizens, consumers and workers is necessary for the delivery of net zero policies. Like other periods of structural change, net zero will create winners and losers. While net zero creates many opportunities, some communities will oppose plans for net zero infrastructure in their locality, some workers will be displaced and find it hard to transition into other occupations or adjust to new tasks and skills, and some households will find it hard to afford the upfront costs of energy efficiency improvements, heat pumps and electric vehicles – particularly in a cost-of-living crisis. The experience of ULEZ expansion in London shows how opposition voices in specific areas can be very prominent and shape the national debate on broader net zero policies even when public support overall is high.

It is therefore crucial that the distributional aspects of related policies are understood, managed fairly (with targeted support for those that need it) and perceived to be so. A clearer national vision (ideally cross-party) and communication of net zero and green industrial policies, accompanied by more participatory decision-making at the local level, are likely to help to achieve lasting support for policies that can make the economy stronger as well as more sustainable in the years ahead.

This blog summarises insights and lessons for the UK from LSE Environment Week lectures and events, in particular the public lecture on ‘An Industrial Strategy for the Green Economy‘, with guest speakers Heather Boushey, Ed Miliband and Arkebe Oqubay.

This commentary was first published by the LSE British Politics and Policy blog on 20 September 2023.