Neglect of duty: Why cutting fuel duty is incompatible with a net-zero UK

Reports that the British Government will reveal plans to cut fuel duty in this week’s pre-Budget announcement are dismaying just four months after it committed to reaching net-zero greenhouse gas emissions by 2050. Strengthening the emissions target – from the 80 per cent reduction on 1990 levels legislated for under the 2008 Climate Change Act – is meaningless without credible policies in place to deliver that target. This fact is made even starker if the Government adds a financial incentive for motorists to continue using polluting non-electric transport.

Fuel duty has been frozen since 2010; in the nine intervening years, the Government has significantly reduced its tax base, air quality has declined, and the UK’s policies and plans to achieve the fourth and fifth carbon budgets are increasingly falling short.

Instead of giving ground to the arguments about ‘waging war on motorists’ promoted by some parts of the media and lobby groups, the Government has an opportunity to show true commitment to the net-zero target by tackling transport sector emissions. Bringing forward its pledged phase-out of internal combustion engine vehicles from 2040 to 2030, as advised by the Committee on Climate Change, would be the right first step. In the interim, taxing petrol and diesel – through fuel duty – is one of the most important policies the Government can use to nudge consumers towards less polluting transport options. The result will be a cleaner, less congested country for all.

In understanding why the Government might be proposing a cut and why this is such a bad move for the environment (and the Exchequer), we look at the political trends in how governments approach fuel duty and why a carbon tax in the form of fuel duty is such an important tool in the climate policy arsenal.

Freezing – let alone cutting – fuel duty is bad for the environment and our health

Fuel duty has been frozen at 57.95p per litre of petrol and diesel in the UK since 2010. Since then, starting from 2016, road transport has become the country’s most greenhouse gas-emitting sector, responsible for 23 per cent of total emissions last year. In other parts of the economy, notably the power sector, significant progress has been made in reducing emissions, but the story is different for road transport: emissions in the sector have only just begun to fall (by 2 per cent in 2018) following three consecutive years of growth, from 2014 to 2016.

If we are to achieve net-zero emissions by 2050, emissions must fall much faster in this sector. Unlike more challenging sectors such as heat, there is clear consensus from the scientific and policymaker communities on how to do this: – a combination of applying a carbon tax through fuel duty, incentivising electric cars so that they are the new light vehicle of choice, and improving hydrogen transport options for freight are widely seen as the right moves. This makes the Government’s likely move to cut fuel duty all the more frustrating.

Transport is also a major source of local air pollution, which is harmful to human health. In 2010 the annual cost of the health impacts of air pollution, notably particulate matter and nitrogen dioxide, were estimated at £8–20 billion by the Environment Audit Committee, and Public Health England estimates that long-term exposure equates to 28,000 – 36,000 deaths annually. Poorer areas, for example in London, are often affected to a greater extent than wealthier neighbourhoods. Ten cities in the UK currently break World Health Organisation guidelines on safe levels for small particulate matter pollution.

There is a clear urgent need to act on air pollution in the UK, as ruled by the European Court of Justice, yet the Government is yet to step up to the mark; its strategies to date have been woefully inadequate, to the extent that environmental lawyers ClientEarth have won three cases against it over air pollution and argue that the current Clean Air Strategy “ignores road transport pollution”.

What is the true cost of car travel and why is the Government mooting a cut in fuel duty now?

When any government proposes to increase fuel duty, it feeds into a perception that motorists are being unfairly penalised. Through this lens, fuel duty is viewed as mostly fiscally motivated (a way to raise government revenue) rather than environmentally motivated (a way to reduce emissions and local air pollution).

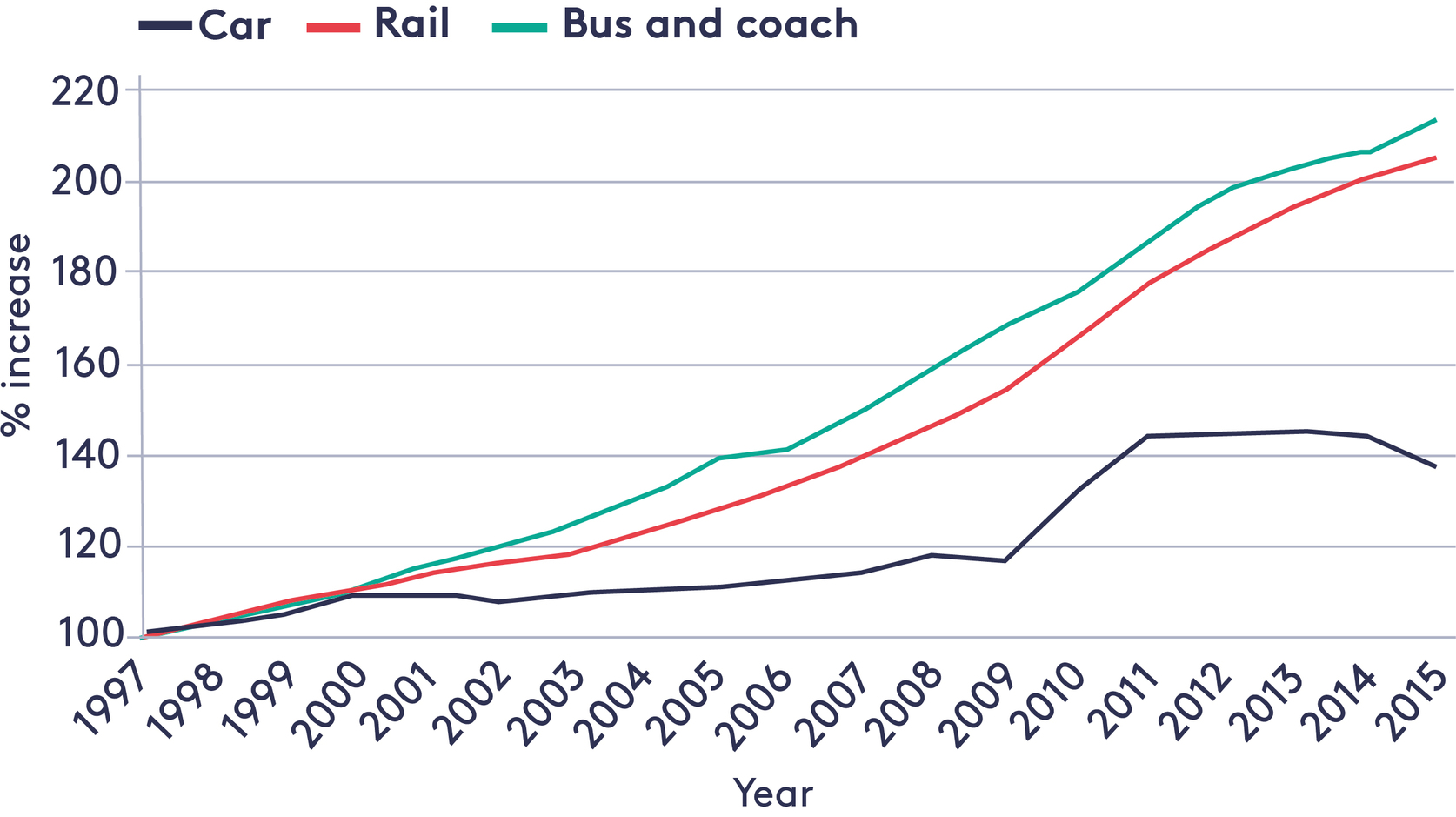

But motorists are in fact getting a better deal for using private cars than commuters who take less emissions-intensive public transport. As Figure 1 shows, since 1997 the cost of car travel has risen far less sharply than the cost of the less polluting (per head) rail, bus and coach travel. This points to a Government that is making decisions based on political considerations over the national interest.

Figure 1. Percentage increase in travel cost by mode (UK)

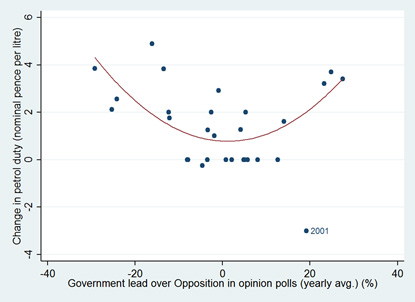

The timing of the Government announcing it may cut fuel duty comes as the prospect of a snap general election looms – and of course this is no coincidence. Research by the Grantham Research Institute has shown that governments tend to increase fuel tax rates when they are enjoying a substantial electoral lead over their rivals and thus do not fear being voted out of office. However, as this lead shrinks and political competition increases, governments tend not to increase rates (Figure 2), as they are more concerned over the impact this would have on votes. At the moment, the balance of electoral power in the UK is constantly changing and the outcome of any forthcoming general election remains uncertain.

Figure 2. UK fuel duty changes and electoral competition over time

Incentivising the uptake of electric vehicles through carbon pricing

Ultra-low emission vehicles (ULEVs), including electric vehicles (EVs), made up just 1.7 per cent of all newly registered vehicles in the UK in 2017 – although this was up from 0.9 per cent in 2015. To make a serious dent in emissions from transport, stronger incentives are needed for ULEVs.

The Grantham Research Institute’s research has shown that carbon pricing – applied through fuel duty – can play a role in incentivising the uptake of EVs, by increasing the price difference between them and conventional vehicles. For example, in 2018 EVs in the UK were around only 5 per cent cheaper than a diesel-powered vehicle, including purchase price, fuel and all taxes. In contrast, in Norway, EVs were 27 per cent cheaper, reflecting the Norwegian government’s significant investment in financial incentives (including a 25 per cent tax break for EVs), as well as charging infrastructure: EV ownership in Norway is now the highest in the world per capita, accounting for almost 60 per cent of new cars sold in March 2019 (comparing with 0.9 per cent that month in the UK).

A carbon price can be applied using existing policies, including fuel duty. The fuel duty accelerator – which works to inflate fuel duty by 1 pence per litre over the rate of inflation – should be reinstated to quicken the uptake of zero-emissions cars, incentivise fuel efficiency and discourage the use of private cars for short journeys. Our calculations show that in order for it to be effective, the carbon price component of fuel duty should start at £40 per tonne of carbon dioxide (tCO2) in 2020, rising to £100/tCO2 in 2050. This would raise the price of petrol duty by just under 10p/litre on current levels to 67.19p/litre in 2020 and diesel duty by just over 10p to 68.67p/litre (excluding VAT). Had the fuel duty escalator not been frozen in 2010, its level would already be aligned with this trajectory.

An even stronger differentiation in vehicle excise duty between EVs and petrol/diesel cars could encourage even greater uptake of zero-carbon vehicles, as could more funding for expanding the electric vehicle recharging infrastructure. If fuel duty is ultimately not going to rise due to political considerations, these measures become even more important.

The continued freeze has hit the taxpayer and the public purse

Successive decisions to freeze fuel duty have had a significant impact on fuel duty receipts in the UK. The continued freezing of the duty has cost the taxpayer around £9 billion per year, according to the Institute for Fiscal Studies.

The tax base is likely to be further eroded as the transport sector decarbonises: research by Policy Exchange, for example, has found that if we achieve the fifth carbon budget, fuel duty receipts could be £9–23 billion lower in 2030 than the Office for Budgetary Responsibility assumes in its long-term fiscal forecasts. On a cumulative basis, this represents a loss of £60–170 billion in tax receipts compared with the OBR’s long-term forecasts between now and 2030.

Net-zero by 2050?

A new record level of 327 billion motor vehicle miles was reached in Britain in 2017, the vast majority of those made by cars, and congestion increased by 2.3 per cent on 2016. The Department for Transport forecasts that road traffic will grow by between 17 and 51 per cent by 2050 in England and Wales. It is vital that we tackle the associated emissions, health impacts and congestion problems concurrently to pursue climate change objectives and improve health and quality of life. Cutting fuel duty is a step firmly in the wrong direction.

Additional research and writing by Georgina Kyriacou.