What should investors know about the current state of corporate climate action?

Together with climate activists, policymakers and consumers, investors are putting increasing pressure on companies to act on climate change – and companies are responding. Where even a year or two ago it was unthinkable, now all the large European oil and gas producers have set emissions reduction targets, in some cases even ‘net zero’ targets that promise carbon neutrality for at least part of their business.

But how much progress are companies really making on climate change? To what extent are they on course to deliver the goals of the Paris Agreement on climate change? These are the questions the investor-backed Transition Pathway Initiative or TPI tries to answer and TPI’s latest annual assessment was published this month.

We assess companies on two important metrics: first, their Management Quality – how they manage their greenhouse gas emissions and govern the risks and opportunities arising from the low-carbon transition; and second on their Carbon Performance – their current and future carbon emissions intensity and how it compares with the Paris Agreement goals. So, Management Quality focuses on inputs and management effort, and Carbon Performance on the ultimate outcome: emissions.

What does the 2020 assessment show?

Companies are slowly improving on Management Quality, including boardroom oversight, emissions disclosure and target-setting

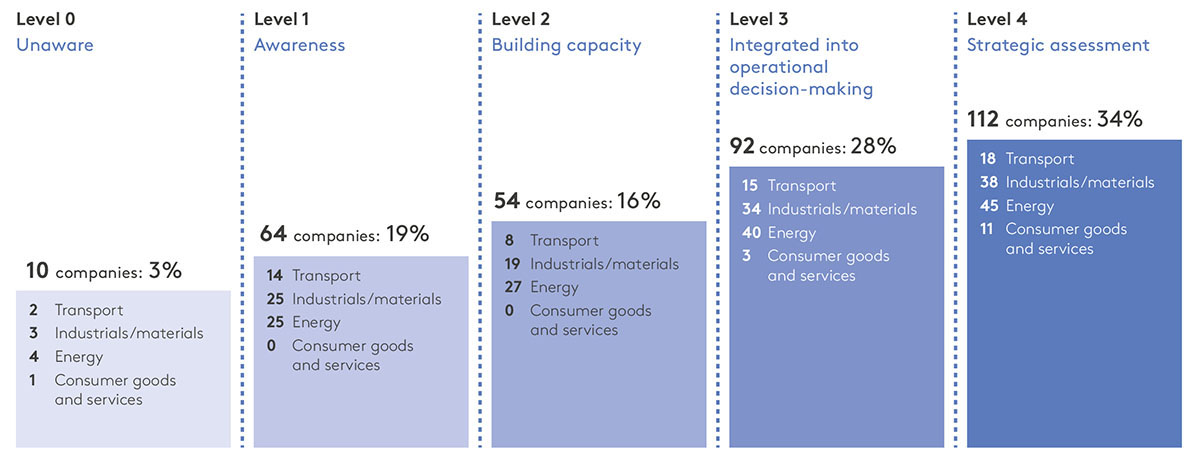

Using 19 individual indicators or management practices tracked by TPI’s data partner FTSE Russell, we assign companies to five Management Quality levels, ranging from Level 0, unaware of (or not acknowledging) climate change as a business issue, to Level 4, strategic assessment (see Figure 1). Our new report shows progress, albeit slow progress. A total of 62 per cent of companies are now on Levels 3 or 4, up from 54 per cent last year. The average company in the database now has a Management Quality score of 2.7 (i.e. between Levels 2 and 3), up from 2.5 last year.

However, nearly 40 per cent of companies remain on Levels 0, 1 or 2

These companies are still failing to implement some basic carbon management practices, such as introducing a climate change policy or disclosing their operational emissions.

Figure 1. Management Quality level of all TPI companies

Nearly 30 per cent of companies moved up at least one level in the last year

The single biggest factor behind this increase was companies nominating a board member/committee with explicit responsibility for climate change for the first time. Climate change is moving into the C-suite in such companies.

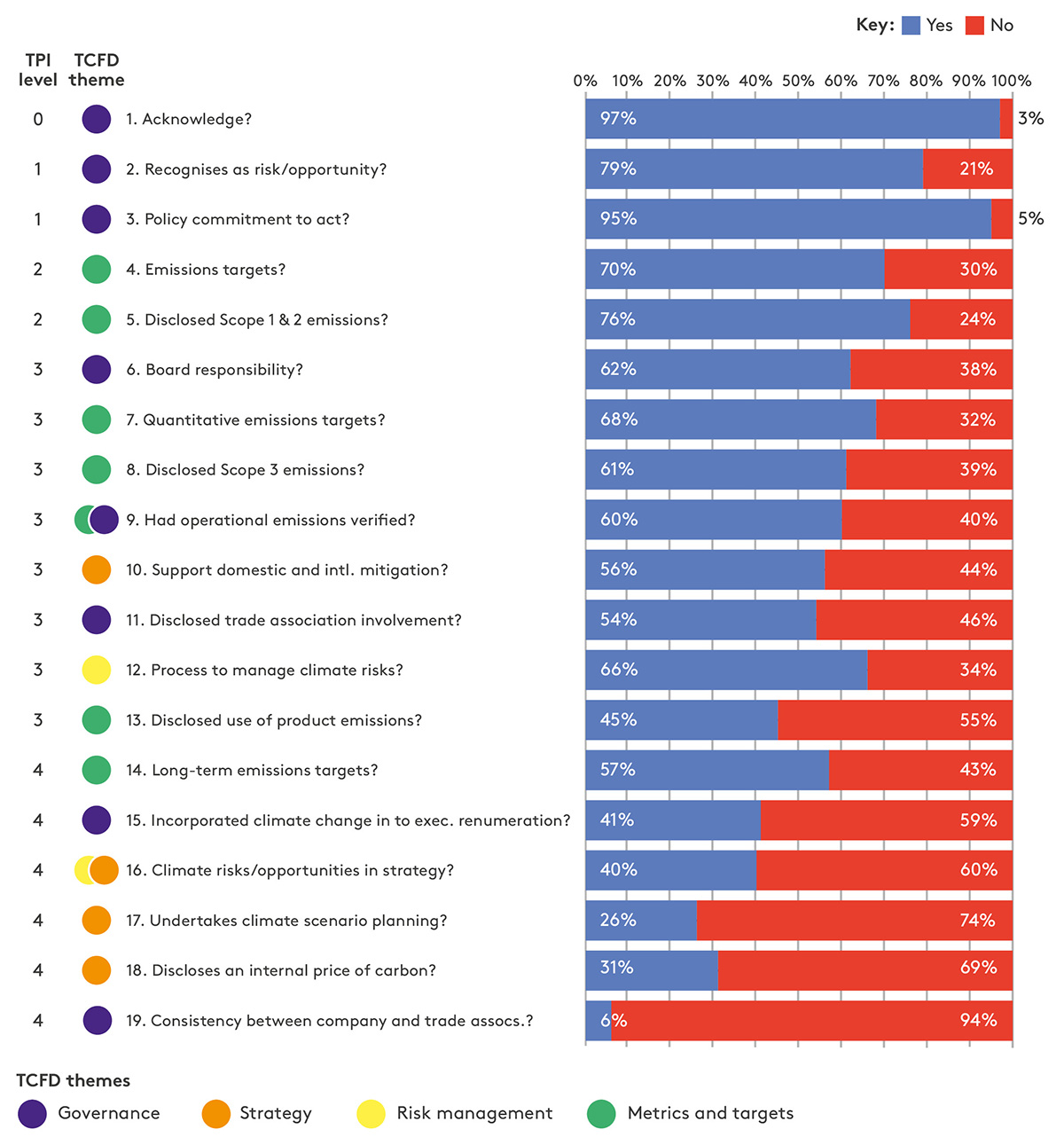

Figure 2 shows how the companies in our database perform against each of the Management Quality criteria.

Figure 2. Management Quality, indicator by indicator, mapped against TCFD themes (% of companies assessed)

Note: TCFD = Task Force on Climate-related Financial Disclosures

Improvements have been made in disclosure and target-setting

Elsewhere, we see progress on disclosure of companies’ operational emissions, and, exemplified by those new emissions reduction targets from the European oil and gas majors, we find a general increase in target-setting. This year, 37 per cent of companies had set emissions reduction targets for 2025 or beyond, up from 25 per cent last year.

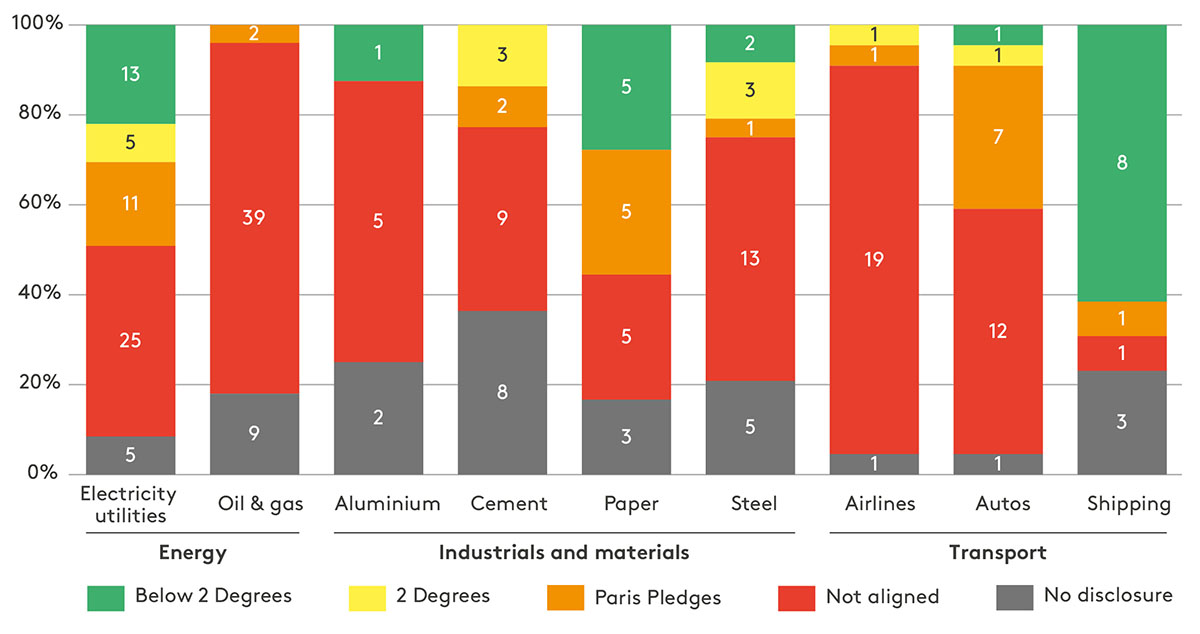

The electricity sector performs particularly well on Carbon Performance

Almost half of assessed electricity utilities (admittedly mostly concentrated in the Europe and North America) are now aligned with our Paris Pledges/Nationally Determined Contributions (NDCs) benchmark and about 30 per cent of assessed electricity utilities are aligned with a scenario in which global temperature rise is kept to a maximum of 2˚C above pre-industrial levels. This is particularly noteworthy, given the role electrification will play in the low-carbon transition.

On net-zero targets, 21 energy companies out of the 132 we assess had set net-zero targets as of February 2020, compared with 13 in August 2019.

Still, less than one company in five aims for 2˚C alignment

Despite several positive developments, corporate climate action is not on a path to a 2˚C world. Less than one company in five is aiming to be aligned with a 2˚C scenario (Figure 3), representing no progress compared with last year. Of those companies that have set a long-term target to 2025 or beyond, over 60 per cent have set one that is not aligned with 2˚C.

Figure 3. Carbon Performance – alignment with the Paris Agreement benchmarks in 2030 by sector and cluster (2050 alignment for Oil & Gas) (no. and % of companies)

Our aggregate results hide some concerning challenges at the sector level

The coal mining sector performs particularly poorly on Management Quality and large parts of it seem in denial about the low-carbon transition: so far, only 39 per cent of coal mining companies have explicitly recognised climate change as a relevant business risk/opportunity. In international freight shipping, a sector that performs very well on Carbon Performance, only 15 per cent of companies have nominated a board member/committee with explicit responsibility for climate change. Moreover, cement and steel sectors did not reduce the emissions intensity at which they produce their products between 2014 and 2018.

We find that some regions are performing worse than others

European companies are leading the pack both on Management Quality and Carbon Performance. While North American companies perform relatively well on Management Quality, relatively few aim for alignment with the Paris temperature goals. Companies in China and elsewhere in Asia are not yet disclosing sufficiently on how they manage their greenhouse gas emissions. In fact, about 30 per cent of companies in this region disclose insufficient information for us to be able to calculate their Carbon Performance.

Corporate climate action needs to go further, faster

While there are reasons for optimism, most companies are not aiming for a 2˚C world. Investors first need basic emissions disclosures from companies, especially in Asia. To get on track with the Paris goals, corporates need to set emissions reduction targets and those targets need to be more ambitious than we have seen in the past. And once companies publish emissions reduction targets, it is important for investors to probe to what extent those companies plan to rely on offsets. While offsets are in principle a means of delivering climate goals at least cost, excessive reliance on them has financial and reputational risks.

TPI State of Transition Report 2020 by Simon Dietz, Rhoda Byrne, Dan Gardiner, Glen Gostlow, Valentin Jahn, Michal Nachmany, Jolien Noels and Rory Sullivan is available now on the TPI website. The Grantham Research Institute on Climate Change and the Environment is TPI’s academic partner.