What is the effect of border carbon adjustments on Britain’s electricity flows?

The EU’s carbon border adjustment mechanism (CBAM) has the potential to impact Britain’s electricity flow and undermine renewable energy exports. To mitigate these impacts, strategic policy measures are needed, write Luca Taschini, Gian Luca Vriz and Josh Burke.

Carbon pricing policies around the world vary greatly, with some nations enforcing stringent restrictions on greenhouse gas emissions, while others maintain minimal or no such restrictions. This asymmetry in climate policy implementation has critical implications, particularly in the context of energy generation and energy-intensive industries. These industries frequently face the temptation to move to areas with lenient or non-existent emissions policies or to import from such regions, a situation known as ‘carbon leakage’. This could lead to two interrelated issues: firstly, it could diminish the global environmental effectiveness of emissions regulations and secondly, it could reduce the global competitiveness of regulated firms.

In this context, a ‘border carbon adjustment’ or ‘carbon border adjustment mechanism’ (CBAM) becomes a viable solution. It aims to make sure that companies from different countries face the same carbon-related costs when competing in the same market. Essentially, a CBAM adds a fee to the carbon content of imports, adjusted for the difference between the carbon prices in the importing and exporting countries. The aim is to ensure that the carbon emissions from foreign producers’ products are subject to the same fiscal pressure as those from local producers.

Enter the EU carbon border adjustment mechanism

The European Union introduced its carbon border adjustment mechanism in October 2023 for the reasons described above. Initially, the CBAM will only apply to cement, iron and steel, aluminium, fertilizers, hydrogen, and certain intermediate inputs and downstream products (those considered to be at the highest risk of carbon leakage, which account for about 50% of overall EU Emission Trading System [ETS] emissions). Electricity is also subject to the CBAM. Consequently, the flow of electricity to Europe is set to become more expensive, with Great Britain and the Western Balkans expected to be significantly impacted.

How will the EU’s policy affect electricity flow to Britain?

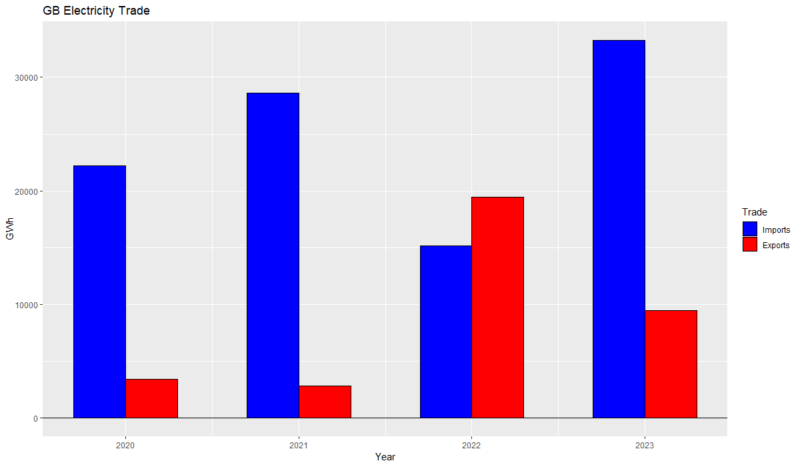

Great Britain could be one of the regions most significantly affected in terms of electricity flow by the implementation of the EU’s CBAM. Historically, Britain has imported electricity from neighbouring countries – France, Belgium, Denmark, the Netherlands and Ireland (see the blue bars in Figure 1), which has benefited consumers through reduced bills and enhanced security of supply. Recently, however, Britain has increased its electricity exports to the EU, driven by a rise in renewable generation (primarily wind) and various factors affecting European energy markets, such as reduced reliance on Russian gas, technical issues with the French nuclear fleet, and low water levels in Norway (affecting hydro generation), as indicated by the red bars in Figure 1. This can help explain why Britain became a net electricity exporter in 2022.

A key element of the new British government’s climate policy is to accelerate the target of achieving 100% clean power by 2030, with a strong emphasis on renewables. Rachel Reeves, the new Chancellor, took decisive action by ending the nine-year-old de facto ‘ban’ on onshore wind power and in September 2024 a further 9.6 gigawatts (GW) of renewable capacity was awarded through Britain’s Contract for Difference auction mechanism. Additionally, Britain’s regulator recently approved a low-carbon electricity ‘superhighway’ between Scotland and England. Britain has explicitly stated its goal to become a net exporter of electricity within the next 10 years. Meanwhile, achieving the associated target of clean power by 2030 will necessitate substantial shifts in infrastructure planning and significant investment in electricity transmission.

A challenge with applying a CBAM to electricity imports is the difficulty in identifying the exact source of imported electricity and any carbon price already paid in the exporting jurisdiction, in this particular case Europe. Electricity is traded anonymously via exchange-based platforms, and a single electron of electricity may be traded multiple times before crossing borders. Due to the difficulty in determining whether an imported electron originates from renewables or a thermal power plant, regulators have decided to base CBAM adjustments on average historical carbon intensity.

This pragmatic choice of using a single coefficient representing the market-wide carbon intensity, combined with the rapid decarbonisation of British power in recent years, means that the calculation of the CBAM adjustment may not accurately reflect Britain’s current significantly lower carbon intensity. In fact, from 2020 to 2023, the annual carbon intensity of electricity generation in Great Britain was consistently lower than that of the Netherlands and Ireland and comparable to Denmark.

Figure 1. Great Britian’s annual electricity trade with the EU (GWh) – imports (blue) and exports (red)

Data sourced from GOV-UK platform

A potential negative outcome of the introduction of the CBAM is that electricity flows from Britain to the EU could diminish. Depending on the penetration of renewables, this may force both Britain and EU countries to rely more on domestic thermal power generation to fill the supply gap in response to fluctuating conditions for wind and solar generation, instead of importing electricity from each other. This could significantly complicate the new British government’s ambition to decarbonise the power grid by 2030 and slow down the delivery of net zero emissions across the economy. In Britain’s case, it could deter investment in renewable power plants, as the business incentive to export to the EU would diminish, making it even more challenging for the British government to resolve issues in the transmission and distribution system.

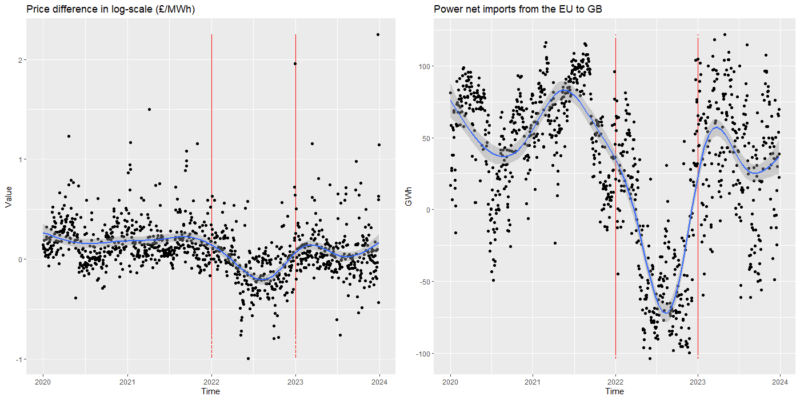

A simple example illustrates this point. In Figure 2, we plot the price difference (on a logarithmic scale for clarity) between the price in Great Britain and the average electricity price in the five EU countries to which Great Britain exports electricity, essentially where there is a connector and electricity flows. For the sake of the example, we consider the period between January 2022 and December 2022. During this period, the price difference trend (GB v. EU – the blue line) fluctuated from positive (indicating net imports of electricity into Great Britain) to negative (indicating exports of electricity to the EU), and back to positive (indicating imports again).

Depending on the magnitude of the border carbon adjustment, specifically the level of the CBAM price adjustment, the negative price differential needed to support British exports to the EU could be significantly reduced. This means that in a future where renewable generation in Britain becomes more prominent, resulting in cheaper electricity due to the larger share of low marginal cost renewable energy, the added cost of the CBAM could make this electricity less competitive compared with domestic EU electricity. The competitiveness of Britain’s electricity exports might diminish, potentially leading to a decrease in export opportunities, which could in turn dampen investment in new renewable projects and slow down the progress of Britain’s energy transition and its efforts to achieve net zero emissions (entities that rely solely on renewable electricity sales or electricity transmission could be significantly impacted). For example, in 2021, Great Britain imported US$3.63 billion worth of electricity from the EU, while its exports amounted to only $0.739 billion. However, by 2022, exports rose to approximately $4.28 billion, while imports from the EU dropped to $2.91 billion, resulting in a net export value of around $1.37 billion (data sourced from the OEC platform).

Figure 2. Left: Daily log-scale differences between electricity prices (£/MWh) in Great Britain and EU countries (France, Belgium, Denmark, the Netherlands and Ireland). Right: Daily net imports to Great Britain from the EU

Red dashed lines mark the beginning and end of 2022. The blue line represents the smoothing model (GAM). Data sourced from ENTSO-e, Electricity Map and EPEX SPOT

Simulating the impact of the EU CBAM on Britain’s electricity flow

To evaluate the potential impact of the CBAM on Britain’s electricity flow, we need to consider two key factors: how the CBAM obligation and CBAM adjustment are calculated, and the sensitivity of Britain’s electricity net exports to the electricity price difference between Britain and the EU.

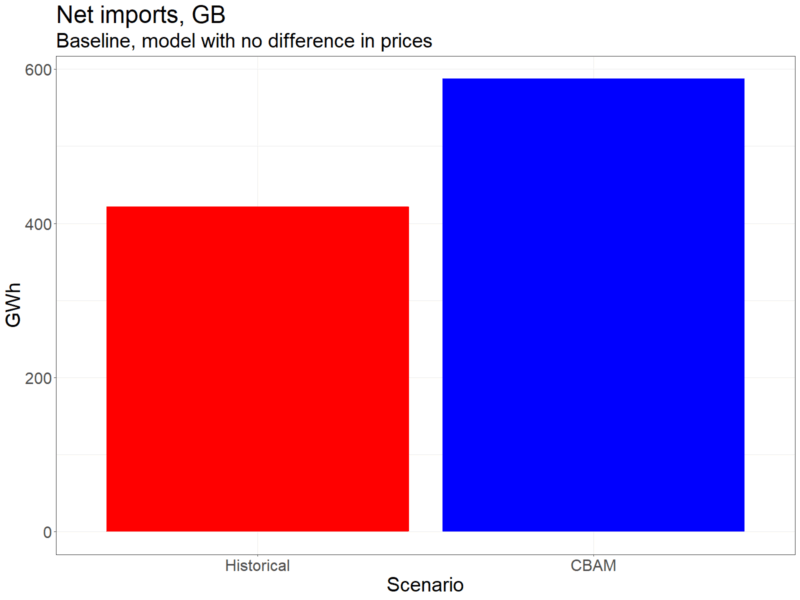

By combining the CBAM obligation and CBAM adjustment with the sensitivity of net exports, we can simulate the overall impact for the year 2023, assuming the CBAM had been active during that period. This exercise illustrates that the introduction of the CBAM would have resulted in a daily net export reduction of approximately 0.45 GWh, amounting to a total of 164 GWh over the course of 2023, as depicted in Figure 3. Assuming an average annual electricity consumption of 3 MWh per household, this could potentially impact the equivalent amount of electricity used by a city the size of Lancaster (around 52,000 inhabitants).

Figure 3. Scenario analysis of the CBAM’s hypothetical impact in 2023

Policy implications

The simulation of the impact of the EU CBAM on Britain’s electricity flow highlights its potential to undermine British renewable energy exports and, by extension, the future deployment of additional renewable capacity in Britain. This is a critical issue, as reduced export opportunities could dampen investment in renewable projects, slowing Britain’s progress towards its clean energy goals. Therefore, strategic policy measures are needed to mitigate these impacts and ensure Britain’s transition to a net zero economy remains on track.

One obvious solution is for Britain to link its ETS to the EU’s ETS. Logistically, this is feasible, as the British and EU emissions trading systems have remained nearly identical. Additionally, European countries that lie outside the EU such as Iceland, Liechtenstein, Norway and Switzerland already participate in the EU ETS, demonstrating that participation from outside is possible.

Linking the UK ETS with the EU ETS would grant Britain ‘virtual exemptions’ for electricity exports to the EU. Carbon prices in both regions would converge, creating uniform carbon costs. This would effectively eliminate, or significantly reduce, the costs associated with CBAM obligations for UK exporters.

Alternatively, the British Government and the European Commission could collaborate to develop and implement their respective CBAM policies, focusing on exempting electricity trades from CBAMs on a reciprocal basis. This means both Britain and EU countries would agree not to impose CBAMs on electricity traded between them, benefiting from reciprocal price differentials and cleaner electricity production.

For a longer version of this commentary and background data, please see https://github.com/GianVriz/CBAM-electricity-GB-

Amendments were made to this commentary on 8 July 2025 to correct ‘GW’ and ‘MW’ to ‘GWh’ and ‘MWh’.