What is carbon leakage? Clarifying misconceptions for a better mitigation effort

During a recent oral evidence session on Carbon Border Adjustment Mechanisms in the House of Commons, British MPs raised questions on the conflicting evidence on carbon leakage. Misato Sato and Josh Burke explain that this apparent conflict is caused largely due to the term ‘carbon leakage’ being used to describe two related but distinct concepts, before discussing options to reduce leakage.

The increasing convergence of two important multilateral issues, trade and climate, has meant that discussions around Carbon Border Adjustment Mechanisms (CBAMs) have crept up the political agenda. Here in the UK, the EU Energy and Environment Sub-Committee took evidence in March 2020 on the implications for the UK of the EU’s proposed CBAM. This was followed by another evidence session heard by the Environmental Audit Committee on CBAMs on 24 November 2021.

Towards the end of the most recent evidence session, Jerome Mayhew MP rightly highlighted that the Committee had “heard a lot about carbon leakage, and that there has been a conflict of evidence”. Mr Mayhew pointed out that one member had said “there’s no real evidence of it, it’s highly questionable whether it exists in reality at the moment”, while at the same time “some of the written evidence we’ve received, say from the chemical industry, [is] saying it’s not just something that happens in the future, [but] there is clear evidence it is happening to their sector right now”, and the economist Sir Dieter Helm “also gave strong evidence saying this is a factor right now”.

The confusion is worth disentangling because it is obscuring the debate on how to act. The apparent conflict in the evidence presented to the Audit Committee was caused largely due to the term ‘carbon leakage’ being used to describe two related but distinct concepts. The distinguishing feature is whether the leakage is caused by climate policy or other factors.

What drives emissions to ‘leak’ out of a country?

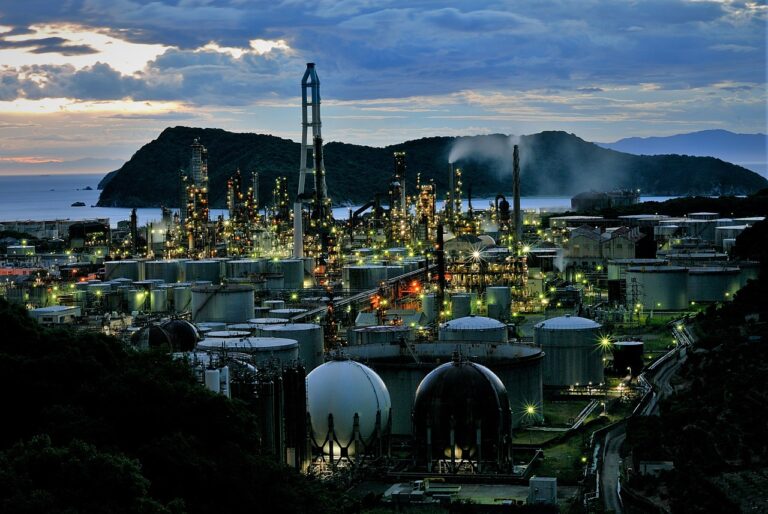

Over the last century, globalisation has led to a remarkable growth in international trade. Consequently, the share of carbon emissions associated with the production of traded products has also surged, now accounting for a quarter of global emissions. Confusingly, some refer to this phenomenon of offshoring of emissions – that which is not specifically driven by climate policy differences but that results from broader determinants of international trade and investment – as carbon leakage. When it is claimed that leakage is already happening, this may be pointing to the fact that many rich countries are in trade-embodied carbon deficit, and their consumption is driving emissions to go up elsewhere in the world. Keeping an eye on a country’s consumption-related emissions is certainly important. Recent research shows that in 24 European countries, emissions have been declining over the last 48 years, from both production and consumption. The UK’s production and consumption emissions have also been declining since 1997.

Against this global backdrop, critics point to the offshoring of emissions or ‘carbon leakage’ as potentially undermining the effectiveness and legitimacy of policies designed to tackle emissions from industry. The primary concern here is not the offshoring of emissions through trade per se but rather the emissions offshoring that results specifically from international climate policy differences and their impact on trade flows.

Indeed, the term ‘carbon leakage’ typically refers to the subset of ‘trade embodied emissions’ that are specifically caused by climate policy asymmetries. Leakage concerns arise when one country decides, ahead of others, to implement ambitious policies to encourage industries to transition to carbon-neutral production. Compliance costs are either passed through to consumers or absorbed by the regulated companies, raising the possibility of being undercut by imports that have not paid equivalent carbon prices, leading to leakage. Therefore, carbon pricing policies usually incorporate anti-leakage mechanisms to ‘level the playing field’.

Despite the global convergence towards net-zero goals, leakage remains a focal point in discussions around the ambitions and implementation of climate policy in many countries, including the UK and Europe. Providing robust protection against leakage gives firms and investors the confidence that they can recover the costs of low-carbon investments and drive rapid mobilisation of low-carbon production investments in industry.

When people claim there is no evidence of carbon leakage, they are talking about leakage induced by climate policy, much of the evidence for which would come from analysing phases 1-3 of the EU emissions trading system (ETS).

Although modelling exercises predict that leakage will occur where there is a significant difference between a country’s own carbon price and the carbon price elsewhere in the world, it is not surprising that this has not been widely observed in practice, for two reasons: firstly, carbon pricing policies often exempt or compensate trade-exposed sectors, for example with free allocation in emissions trading, precisely to prevent leakage; and secondly, carbon prices have been low in most regions until recently.

Experience, for example, with the EU ETS has revealed the idea that carbon leakage is about companies packing up in response to climate policy and moving production abroad to be simplistic. Far more important is companies’ fear of being undercut by foreign competition (sometimes known as operational leakage) depressing domestic prices, eroding domestic profit margins and ultimately making other countries seem a safer place to invest new capital for their sector (also known as investment leakage).

Clearly, though, differences in climate policy between countries is one of many factors driving trade and investment, and the associated emission flows. The rise in trade-embodied emissions is almost an inevitable artefact of several long-term trends, including the shifts in global locus of manufacturing driven by rapidly industrialising countries, most prominently China; the ‘deindustrialisation’ and a relative shift towards a service economy in many high-income countries; the globalisation of complex supply chains; and the falling costs of international trade. Consequently, most OECD countries are net importers of trade-embodied emissions.

With many underlying trends and factors driving trade and investment flows, in reality it is extremely difficult to attribute changes to trade-embodied emissions to any one specific factor, such as climate policy differences. Economists point out there are a multitude of factors that influence investment and trade flows, including: relative factor prices (labour, capital, energy, land); raw material availability and access; non-climate policy differences, including corporate taxation differences; other environmental regulations, labour and trade union regulations, income tax and renumeration; trade tariffs; transport costs; exchange rates; and political stability. Where multinationals locate their next investment is likely driven by a combination of factors.

Given the difficulty in precisely attributing trade-embodied emissions to any one cause, and the impossibility of having a globally uniform climate policy regime, the potential for climate-policy-induced leakage will remain. Therefore, the lack of evidence on this kind of leakage does not mean it can be ignored: far from it.

Keeping the focus right

The confusion over terminology is distracting the debate on what to do about leakage, so it is important to get past it. Countries are currently trying to build clear and ambitious policy frameworks that make investments in carbon-neutral production technologies economically viable – technologies such as electrification, carbon capture and storage, and green hydrogen. Addressing leakage that is induced by climate policy must be an integral part of this policy framework until carbon prices converge globally or low-carbon technologies become economically viable, as they have in renewable electricity generation.

Trade-embodied emissions are not a problem per se and cannot be addressed by climate policy design. They are a by-product of global trade, from which the gains are large. If domestic producers are being undercut by imports due to lower labour and capital costs abroad, for example, this competitiveness loss cannot be prevented by climate policy exemptions or compensations.

However, it does raise the question as to whether we should be responsible for the emissions created overseas that arise due to domestic consumption. There is a growing consensus emerging that industrialised countries should take on responsibility for the emissions attributable to their imports as well as their domestic emissions (including those attributable to their exports).

Reducing and preventing leakage

The current debate on CBAMs acknowledges the problems around free allocation of allowances: while this policy may have successfully prevented leakage up till now, it has also dampened incentives to ramp up modernisation and decarbonisation in industry. Now the need to transform traditional polluting industry such as steel, chemicals, cement and aluminium is far more urgent.

Several alternative approaches to reducing leakage are being discussed. In addition to free allocation and CBAMs, excise duty, carbon labelling or product carbon requirements also provide ways to address potential competitive distortions between domestic and foreign-produced goods. While these solutions seek to limit climate-policy-induced leakage, they also offer protection from broader emissions offshoring because they apply to all imports and not just the imports that arise because of differences in climate policy between countries.

Leakage solutions should not be created in isolation but rather as part of a broader, comprehensive policy package to deliver the mission of rapid industrial decarbonisation. There is a need to combine leakage protection with support measures to accelerate technology development and enable investors to recover the incremental costs of carbon-neutral investments, e.g. carbon contracts for differences, providing access to cheap, low-carbon electricity and hydrogen, green procurement, and support for multilateral cooperative agreements such as the breakthroughs at COP26, including on steel.

As the EU moves forward with the CBAM, the UK should consider close multilateral cooperation with the EU on these issues, given the UK’s strong trade links and supply chain integration with the EU, especially as uncertainty around its post-Brexit climate policy and particularly around anti-carbon leakage measures is further reducing the long-term investment security for carbon-neutral production processes for UK industry.

Does the distinction matter to all?

We have argued that clarifying between climate-policy-induced carbon leakage and broader emissions offshoring is important for resolving the apparent conflicting evidence on the scope of the problem, and thus where to focus policy effort.

This is particularly important to policymakers and politicians who really worry about the threat of leakage. Attempts by governments to extract revenue from industry sectors with climate policies invariably will be met by opposition. Yet when faced by claims that climate policy will drive away jobs at the expense of domestic workers while having little impact on emissions anyway, policymakers and politicians must be able to explain the underlying causes which, as the evidence suggests, are not always to do with climate policy. Of course, it will be difficult for any politician to stand up and argue either form of leakage is acceptable, but understanding the differences can at least enable the policy effort to be focussed where it matters most – on policy-induced carbon leakage.