How the EU learned to love sustainable finance: the inside story of the HLEG

By Christian Thimann, Chair of the EU’s High-Level Expert Group (HLEG) on Sustainable Finance (2017–2018), and CEO of Athora Germany

Sustainable finance has become a core part of the EU’s policy agenda, thanks in no small part to the European Commission’s high-level expert group (HLEG). In this article for the Sustainable Finance Leadership Series, the group’s chair, Christian Thimann, sets out how the HLEG managed to seize the opportunity and points to work that still lies ahead.

Finance is a remarkable tool for both good and ill. In my time as adviser to the President of the European Central Bank from 2008–2013, I had seen the darkest days of finance: hedge fund managers seeking the trade of their lives through the destruction of a country’s prosperity, positioning themselves against a whole string of countries in Europe’s South; bankers breaking down in tears after realising how they had been misled by credit rating agencies into buying worthless assets. I had experienced full system failure and economic freefall.

A future-building model of finance

Coming out of the crisis, it was clear that one needed to move from this narrow, self-centred and speculative model towards something quite different, what I call the future-building model of finance. More than this, finance needed once more to be placed in service to a global economy facing wrenching challenges of climate change, resource shocks, inequality, demographic shifts and technological disruption. What this meant in particular was much more long-term investment into real economic assets: for example, corporate investment into new technologies, such as energy or transport, and job creation; and public investment into R&D, education and infrastructure.

This is why I leapt at the opportunity to chair what became the High-Level Expert Group (HLEG) on Sustainable Finance. I did this next to my main responsibilities as a senior executive at AXA, as it was clear that the insurance sector had a particular interest in sustainable finance and long-term investment. Instead of reporting to the environment or climate change wings of the European Commission, what made this special was that the group was established by Valdis Dombrovskis, the vice president responsible for financial services and markets, and Olivier Guersent, his director general. Yet, my long experience in European policymaking – Olivier and I had initiated the fiscal compact back in 2011 and banking union in 2012 – had taught me that these advisory groups can often end in insignificance. I was determined that we would do something different, in terms of both process and impact.

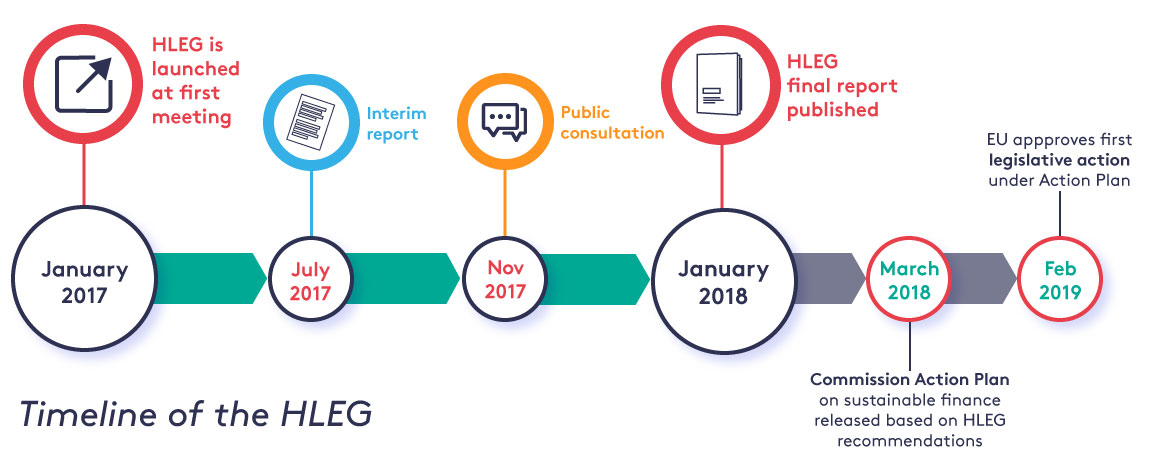

What is striking today is that sustainable finance is now viewed as an entirely normal goal for Europe’s policymakers, regulators, capital markets and civil society. This was by no means the case when the HLEG was established at end-2016 and launched its work with the first meeting in January 2017. The Paris Agreement and the Sustainable Development Goals had created a new target zone for finance to aim at. The Task Force on Climate-related Financial Disclosures (TCFD) – where I am also vice chair – had pointed to a new dynamic between regulators, investors and business. And China had given green finance a geopolitical boost through the G20. But there was no shared vision within Europe on what this all meant for the policy architecture that governed the financial system.

To resolve this, the HLEG brought together 20 individuals from different countries, sectors and professions of the EU, along with a group of close to 10 observers and initially five supporting officials from the European Commission. When we first met, in January 2017, most did not know each other; there were concerns expressed that particular sectors or parts of the Union were not adequately represented. We were given a very broad mandate: “to provide advice to the Commission on how to steer the flow of public and private capital towards sustainable investments”, “identify the steps that financial institutions and supervisors should take to protect the stability of the financial system from risks related to the environment” – and to do this on a pan-European scale. But apart from that we had a blank sheet of paper and one year to deliver a result.

Seizing the opportunity of the HLEG

|

Life is a set of finite occasions – and the HLEG presented a very rare occasion to make a real difference. This vision drove the way that I wanted to chair the group, so that members would grasp the privileged position they were in and thereby bring the necessary excellence in terms of our collaboration and our conclusions. This strategy worked, and the group turned out to be outstanding: competent, motivated and hard-working. The level of support from the European Commission was also outstanding, reaching up to the level of Vice President. Eventually, not fewer than seven Commission Directorate-Generals sent representatives to HLEG meetings, and at the final meeting with collaborators there were about 60 people who had substantively contributed to the HLEG’s work.

A special tribute is due also to the group’s observers. Knowing that we would need all expertise and resources, I asked them to see their role not as ‘to watch’ but ‘to make observations’, and they became fully involved in the HLEG’s work, while always respecting the group members’ prerogative.

We started by putting everything on the table and setting everyone’s wish lists out in the open. With such a vast and interlocking agenda, we created a stylised Greek temple to structure our thoughts – and then abandoned this as our understanding deepened. We kept the thinking mobile, delegating work to small teams with no fixed compartments. And like a child’s kaleidoscope, we kept changing the composition of these teams so that the expertise of the group was continuously refracted into new patterns.

We created working groups, then workstreams, then a structure of champions and challengers, surpassed by chapter and section heads. The purpose was to keep the momentum in the group, rotate responsibilities and involvement and thereby ensure that the whole group owned the whole report.

Building up momentum step by step

We had a mountain to climb and so we focused on making the ascent in stages. This meant working closely with the Commission so that our emerging thinking could be digested by policymakers as we went along. Our first target was the mid-term review of Europe’s Capital Markets Union (CMU) programme. When the CMU was established in 2015 there had been minimal focus on sustainable finance. We quickly organised a submission from the HLEG and were delighted to see the Commission recognising in June the need for “deep re-engineering of the financial system” to support sustainable development. In July 2017 we released our interim report with eight early recommendations – including first mention of the need for a sustainable finance classification system (or taxonomy) – and 13 areas for further work.

This was a tough process and not everyone’s favourite ideas were included, not least my own: I strongly believed that a new European credit rating agency was needed, and that high-frequency trading on stock exchanges is incompatible with sustainable finance. We brought in reinforcements to turn a mass of separate proposals into a single text belonging to all. The working method chosen proved critical to success: we created a drafting team and an editorial team that held two dedicated retreats near Paris, working two-and-a-half days non-stop each time to get a basis for the report. This was not easy, but the only way to advance, knowing that one cannot draft in a large committee.

Once the draft was there, discussions in the larger group could focus on substance and the exchanges were of remarkable quality. In the end, we had created the springboard for our next phase, which all of us could promote across the EU.

The process of a dialogue and live policymaking

When we started, we were told that as an expert group, we could not hold a formal consultation. Yet we believed this was essential to test our findings and build support for our emerging proposals. It did not take long for us to win the argument. Ultimately, we received 300 responses to our online consultation and held over 50 outreach events in almost a dozen member states. I got invited as HLEG chair to the European Parliament, first to the meeting of rapporteurs for the Economic and Monetary Affairs (ECON) committee, then to a full ECON meeting. I also presented the HLEG plans and ongoing work to the EU’s Financial Stability Committee, a subgroup of the Economic and Financial Committee (EFC). Soon after, we got invited to the EFC itself. Ultimately, I got to present the HLEG report to the Ecofin Council of Ministers, where ministers debated the work and discussed their role in taking forward sustainable finance.

Our interactive tag-team approach with live policymaking continued as we entered the final stretch of our climb, continuously passing the baton between us and the Commission. In September 2017 the Commission announced that the European Supervisory Authorities would henceforth include sustainability in their actions; in November, it picked up a recommendation from the interim report and announced a review of fiduciary duties; in December, the Commission pledged to release Europe’s first sustainable finance action plan, an entirely new commitment. Before we had published our final report, we had in a sense achieved our goal: to make sustainable finance a permanent part of Europe’s approach to governing capital.

In January 2018 we passed the baton for the last time and released our final report. Inevitably, there were difficult moments to bring the views of 20 talented (and opinionated) members into complete alignment. We had our moments of tension about some of the recommendations, but the trust we had built up meant that calm could be restored. Humour helped and we had great laughs, too. Despite our closeness with the Commission, we did not always see eye to eye on policy specifics, with the HLEG being not enthusiastic about proposals for a ‘green supporting factor’ to use capital regulation as a tool to promote investment in climate action.

Two months later, the Commission released its own action plan, with a striking correspondence between our core recommendations and its proposals for hard policy and regulatory action.

Now one year on, the intensity of EU action on sustainable finance is truly impressive, whether on developing a common taxonomy, introducing new labels and standards, incorporating sustainability into investment advice, integrating environmental, social and governance (ESG) into credit ratings, clarifying investor duties, upgrading prudential regulation, or strengthening disclosure and corporate governance. At the end of February 2019, the EU approved the first legislative action under the Action Plan focusing on investments benchmarks.

The test of whether the HLEG made a difference will be determined in the real world by the ways in which finance reconnects with societal and planetary needs. The risk is that we simply create a culture of ESG compliance, add another layer of regulation and do not change the core functioning of finance. For the latter, very often it was not new regulation that was required, but rather changes in existing regulation. We realise that this is much harder to do.

Sustainable finance can only emerge once we have less speculation

For me, one thing has become clear in the work on the subject: there exists a sphere of financial investment and there exists a sphere of financial speculation. The economy needs the former but not the latter, and the latter damages the former.

It has also become clear how one can distinguish between these two domains: the domain of financial investments is interested in real world returns. It seeks to buy and monitor assets in line with the time needed for underlying, real world returns to materialise. This can take years in some areas – when speaking about equity or debt instruments, for example.

The sphere of financial speculation tries to extract short-term profits from the trading of such long-term assets. This ‘short term’ can range from microseconds to days or weeks. It seeks to extract profits not from the longer-term, underlying economic returns of these assets but from their short-term price movements on financial markets. The bulk of financial trading is based on this activity, which creates practically no economic value, aggravates financial cycles and delivers market liquidity that is spurious. Resources used up in this activity would be deployed much more usefully in the real economy.

My personal view is that we will only get to a system of sustainable finance once politics and regulation dramatically reduce the scope of such financial speculation. Once – and only once – this is done, the domain of financial investment, long-term investment and sustainable finance will thrive.

Focusing on the ultimate objective – financing a healthy economy in all of Europe’s regions

My hope is that we are soon coming to a second phase for sustainable finance and can build on the fabulous momentum created. Many fault-lines still exist: I mentioned above the time-wise disconnect between short-term speculation (ab)using long-term instruments.

There is another disconnect, which is the spatial disconnect between Europe’s financial centres and the needs of its regions in the hinterland, a cleavage highlighted by the gilets jaunes. If financial globalisation and European integration have so far benefitted capital cities, many of Europe’s regions have not seen nearly as great an impact. But this is where many European citizens live, and they too have a right and desire for a flourishing economy.

Reforming the EU’s agricultural policy towards sustainability and moving from mass production oriented at globalised prices to local, sustainable production represents one of the biggest opportunities for the EU to foster sustainable regional development. This, too, is a subject highlighted in the HLEG’s report.

A lot needs to be done, and a lot can be done. It is not intellectually difficult but politically difficult. The EU needs to orient its compass on economic, social and environmental sustainability and then take tough decisions. The ultimate objective is not maximal aggregate GDP growth, nor maximal financial trading volume: it is to achieve sustainable employment and a socially and environmentally healthy economy in all of Europe’s regions. That is what sustainability is all about and this is where finance needs to play its role.

It is sometimes said that we have just 10 years to save the world. Perhaps one lesson from the HLEG is that a lot can happen in a single year.

The author would like to thank Nick Robins for his contributions to developing this article.