Charting new waters: blue finance at the UN Ocean Decade Conference

With a shared commitment to prioritise ocean sustainability, policymakers, marine scientists, representatives from coastal communities and researchers convened at the UN Ocean Decade Conference in Barcelona in April 2024. Elena Almeida, Lea Reitmeier and Torsten Thiele capture the discussion on blue finance.

The UN Ocean Decade (2021–2030) aims to harness scientific knowledge for the sustainable development of ocean-based economic activities and to maintain a healthy ocean ecosystem. Among the 10 key challenges of the Ocean Decade, the fourth sets out an ambition to foster a sustainable and equitable ocean economy, necessitating the strategic mobilisation of finance. Funding from public sources, philanthropic contributions, official development assistance (ODA) and the private sector to date has been insufficient to ensure ocean health. Indeed, Sustainable Development Goal (SDG) 14 on ‘Life below water’ has received the least investment of all the SDGs.

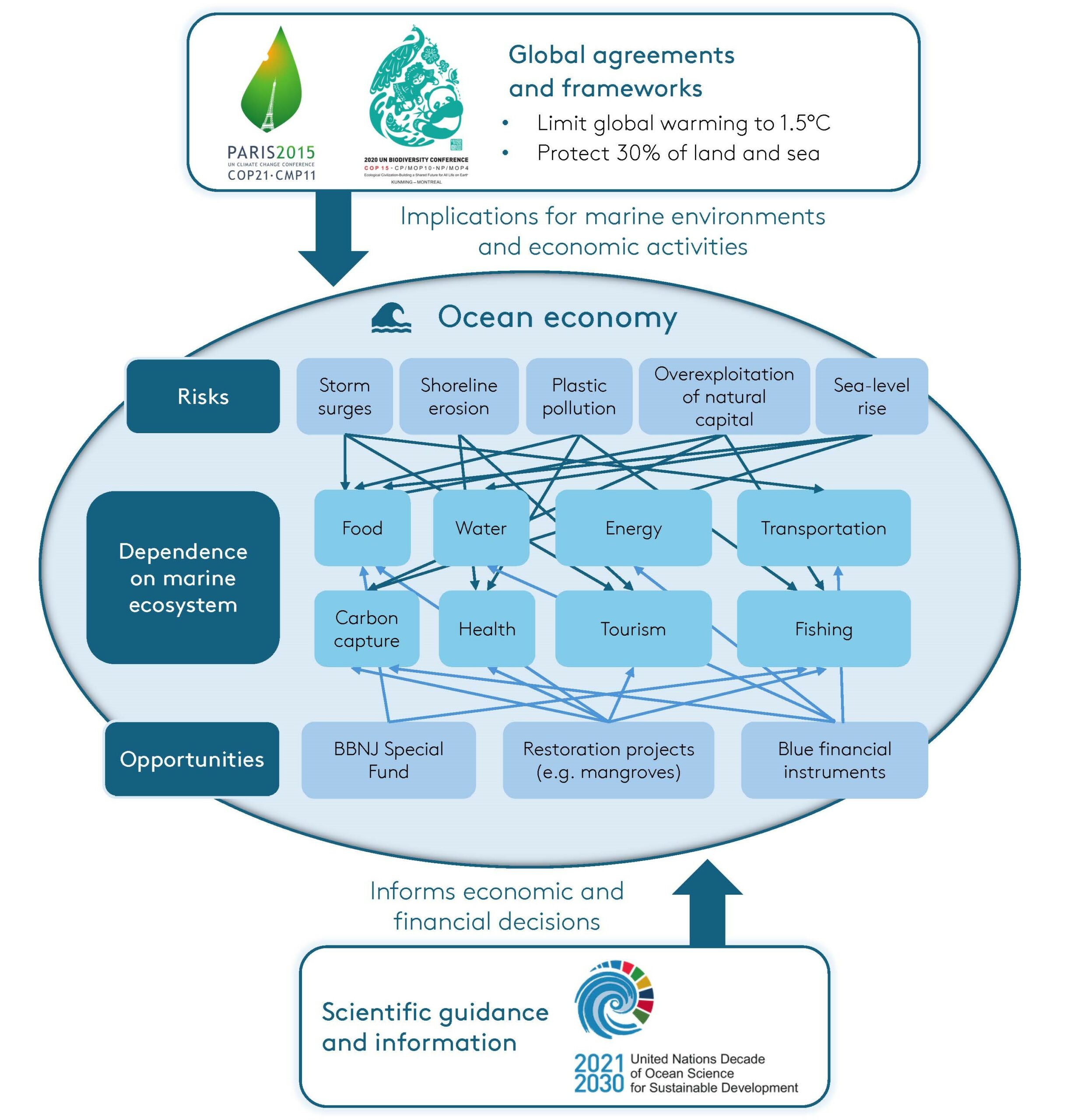

How to scale up blue finance was a recurring theme at this year’s Ocean Decade Conference, where a dedicated session provided a much-needed opportunity to facilitate dialogue with the finance community, who have been notably absent at Ocean Decade discussions to date but are a critical part of the solution. Finance experts were able to showcase key developments in blue finance and highlight financial opportunities and projects that are addressing challenges in the ocean environment at this session. They underlined the urgency for greater engagement from the finance sector with the ocean, due to the systemic risks it can pose – and considered key obstacles they face, how these could be overcome, and further opportunities to achieve the aims of the Ocean Decade. We provide an overview of the discussion in this commentary, some of the main themes of which are summarised in Figure 1 below.

Figure 1. Ocean economy interactions: risks, dependencies and opportunities

Barriers to scaling up blue finance – and how to overcome them

Complexity of ocean governance frameworks and ambiguity surrounding tenure rights

Ocean governance structures are fragmented, characterised by overlapping jurisdictional boundaries and regulatory regimes. Ambiguity surrounding tenure rights, particularly in areas beyond national jurisdictions or regions with contested territorial claims, undermines investor confidence in projects dependent on secure access to marine resources, which can prevent investment into ocean-related sustainability efforts. The evolving legal and regulatory landscape introduces further uncertainty and poses potential risks for financial institutions, requiring careful assessment of legal, social and environmental considerations.

To address this, a number of frameworks offer guidance to the financial sector on responsibilities, standards, reporting metrics and certifications, such as the UN Global Compact Sustainable Ocean Principles, WWF’s Sustainable Blue Economy Principles and the Taskforce on Nature-related Financial Disclosures. Together with high-level principles and examples of good practice, these can provide the clarity needed to catalyse blue investments. Financial taxonomies and guidance such as UNEP-FI’s Sustainable Blue Economy Finance Principles and the International Capital Market Association’s bond guidance for financing a sustainable blue economy also contribute to this landscape. Such frameworks have helped to raise awareness, identify sectors that support a sustainable ocean and provide guidance on metrics to measure the impact of investments.

Overlooked dependence of economic and financial systems on marine ecosystems

The economy depends on the ocean for a myriad of ecosystem services, such as the provision of seafood, recreation, sea routes and regulation of the climate. Beyond fishing and shipping, sectors such as air travel, hospitality, manufacturing and retail also derive financial value from the ocean. The degradation or collapse of marine ecosystems therefore affects a wide range of economic activities beyond those directly dependent on the ocean, which in turn have implications for the wider financial system.

At the governmental level, several tools have been identified to advance the identification, measurement and communication of ocean dependencies, including developing sustainable ocean plans. Facilitated by marine spatial planning frameworks, these plans can unite different stakeholders and identify priorities and impactful actions. To develop such plans, diagnostics and scientific assessments can support the economic valuation of marine ecosystems and their natural assets. The use of economic tools can support engagement with a variety of stakeholders, including Ministries of Finance, which are vital to the reform of harmful subsidies and can catalyse public and private investments for a sustainable and healthy ocean. Importantly, demonstrating the economic benefits of investing in the ocean reframes it as a strategic investment in building a sustainable future, rather than a cost.

Limited understanding of the ocean hindering communication and creating financial risk

A lack of information and knowledge about the ocean within the financial sector can cause issues at different levels. Financiers may overlook nuances specific to the ocean and coastal communities when considering project financing. Project developers, particularly smaller ones, struggle to provide the necessary information for financing, which leads to funding gaps. And financial institutions tend to underestimate ocean-related risks illustrated in Figure 1, despite over US$ 8 trillion in marine-related assets being at risk from declining ocean health globally. The way the ocean system is interconnected across the globe, and the links between the ocean and the climate, means these risks can quickly become systemic, potentially leading to unforeseen ‘blue swan’ events – where the collapse of marine ecosystems and the crossing of tipping points catch financial markets off guard.

An improvement in ocean literacy is overdue, particularly in understanding the interconnected nature of the ocean and climate. Financiers need to better integrate ocean impact assessments into financial evaluations, particularly when it comes to discerning which activities are exposed to ocean-related risks and which align with sustainability outcomes. Further, engagement with local communities can facilitate knowledge-sharing and help to identify and support impactful projects.

Mismatches between projects and available capital impede financial flows

As blue finance is a small and emerging market segment, funding sources are limited. Furthermore, investors seek different risk–return ratios which can narrow the pool of projects that align with investment criteria. For project owners seeking financing, a good understanding of the needs and preferences of different financiers allows them to strategically align funding proposals with the investment mandates and risk appetites of potential investors.

Tools like the Octopus Desk, a global blue finance marketplace developed by the Ocean Risk and Resilience Action Alliance (ORRAA) and Investable Oceans, can help overcome this challenge by connecting blue finance project developers with investment partners.

Scaling up blue finance for a healthier marine ecosystem and sustainable ocean economy

Opportunities for marine-related nature-based solutions

Currently, only 9% of investments in nature-based solutions to climate change mitigation (i.e. approaches that harness the natural world to lock in carbon, thus avoiding emissions) involve marine solutions. This is despite the finding that ocean-related actions have the potential to close the ‘emissions gap’ in 2050 – i.e. the difference between where emissions are heading and where they need to be to meet the 1.5°C target – by up to 35%. Initiatives such as Mangrove Breakthrough include a financial roadmap for investments in blue carbon ecosystems, showcasing the impact of projects that are eligible for blue finance and helping to catalyse financial flows into preserving ocean ecosystems.

A role for private finance

There is an abundance of projects related to the blue economy, from community-level initiatives to larger-scale infrastructure investments, but a need for the private sector to fill funding gaps for the ‘missing middle’: projects in the range of US$ 2–5 million in small island developing states that struggle to receive finance through existing mechanisms and instruments. These investments play a crucial role in enabling entrepreneurs to progress beyond seed funding and scale up their projects and companies.

New emerging financial instruments and mechanisms

Blue bonds, blue insurance and impact investment funds are pivotal to unlocking financial flows for a sustainable and equitable ocean economy, enabling stakeholders to overcome funding barriers and accelerate progress towards achieving marine conservation and sustainability goals, and therefore need to play a larger role. Meanwhile, targeted mechanisms like the BBNJ Special Fund (for protecting biodiversity of areas beyond national jurisdiction) and the proposed Ocean Sustainability Bank can also play a role in funding ocean-related initiatives, particularly for capacity-building initiatives, scientific research and technology transfer. By targeting specific challenges and priorities in the management of marine resources, these mechanisms can help mobilise resources and foster international cooperation for ocean conservation.

What are the next steps for blue finance?

The Barcelona Statement 2024, published at the conclusion of the UN Ocean Decade Conference, sets out the next steps for action on the ocean. This includes a call to “significantly increase investments” and provide the science-based data needed to inform the economic and financial decisions that can foster a sustainable ocean economy. Collaboration between the scientific research and financial communities is crucial to driving meaningful action for a sustainable ocean economy. The participants of the blue finance session agreed that making finance a core component of future conferences, rather than a peripheral session, will be critical to future progress.

The authors would like to thank the speakers and participants of the session ‘Blue finance: Barriers and opportunities to financing a sustainable ocean’, whose contributions have informed this commentary.

The views in this commentary are those of the authors and do not necessarily represent those of the Grantham Research Institute, the authors’ host institutions or the roundtable participants.