The ‘Climate Spring’ of 2019: what it means for finance

Nick Robins explores what the recent upsurge in commitment to a net-zero economy could mean for Europe’s financial system.

Spring is traditionally the season of regrowth and new hope. And this is certainly the case with the resurgence in efforts this year in Europe to confront the climate crisis. Over a few short weeks in April and May – what I like to call the ‘Climate Spring’ of 2019 – an extraordinary pattern of events converged to swing the political compass firmly towards accelerated action for a net-zero economy. Leading central bankers and financiers played a small but significant part in this blossoming. The full implications of what this means for the financial system have yet to be explored, however.

The gathering storm

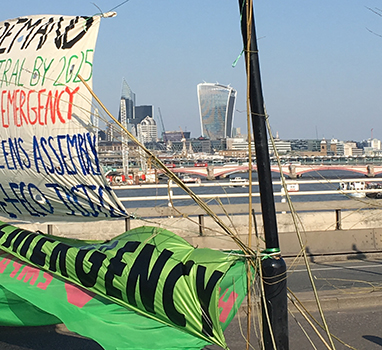

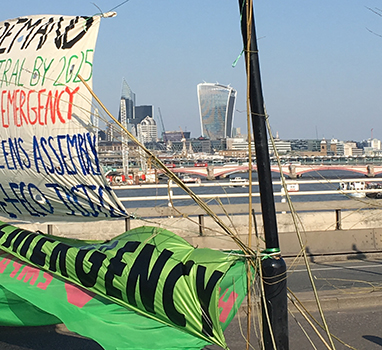

In March, the global School Strike led by Greta Thunberg had already given a foretaste of the potential for new forms of public engagement, with the young shaming the old. Then in the run-up to Easter, Extinction Rebellion’s protests took off, occupying central London, and the UK Parliament declared a national climate emergency shortly afterwards.

Across the Channel at the Banque de France in Paris some of the world’s central banks were also gathering as part of the Network for Greening the Financial System (NGFS). In an open letter, central bankers Mark Carney, François Villeroy de Galhau and Frank Elderson made clear that getting to a net-zero world “requires a massive reallocation of capital”, adding that “if some companies and industries fail to adjust to this new world, they will fail to exist”.

By early May, in response to the Committee on Climate Change’s landmark report, the UK government had announced that it wanted to be the first major economy to legislate for a net-zero emissions target, matching similar proposals already on the table at the European Union level. And then at the end of the month, all of this was capped by the ‘green surge’ in the European Parliament elections, with strong results for parties explicitly campaigning for ambitious climate action, including Greens (notably in Germany), liberals (in France and the UK), and Spain’s socialists.

Winter is ending: increasing the pressure on high-carbon assets

One immediate implication of these events is that we may finally be seeing an end to the long winter of ignorance, complacency and denial that has held back climate action. For those in the financial system, there really are no more excuses: not for fund managers who do not support shareholder resolutions that bring companies into line with a net-zero world; not for financial institutions that back additional investment in fossil fuels that take us beyond the carbon budget that would hold global warming to 1.5 °C.

The momentum looks impressive. According to the Institute for Energy Economics and Financial Analysis, well over 100 globally significant financial institutions have restricted financing and/or insurance for coal. Investors with more than US$33 trillion in assets are also taking part in increasingly forceful shareholder engagement with major energy companies such as BP, Exxon and Shell through the Climate Action 100+ initiative.

Yet, in spite of all these efforts, the International Energy Agency’s latest investment analysis has concluded that capital flows into renewables fell in 2018 and rose in oil, gas and coal supply. The IEA’s conclusion was damning: “…there are few signs in the data of a major reallocation of capital required to bring investment in line with the Paris Agreement and other sustainable development goals”. So far, only a minority of financial firms have started down the path to full alignment with the Paris Agreement. According to a survey released by the UK Sustainable Investment and Finance Association, “only 21 per cent of fund managers have a policy of aligning all the funds they manage with [the] Paris [Agreement]”.

Redressing market and policy failures

The persistence of climate-damaging capital flows is explained in part by entrenched market and policy failures. The International Monetary Fund estimates that fossil fuel subsidies and the failure to price the costs of carbon provide a perverse incentive – amounting to 5.2 per cent of global GDP in 2017 – with China, the US, Russia, the EU and India the lead offenders. Remorseless policy reform to remove these perverse incentives is essential to increase the downward pressure on fossil-fuel financing. A new Coalition of Finance Ministers for Climate Action could help in this task by joining forces to accelerate the transition “to a low-carbon and climate resilient economy through macroeconomic and fiscal policy, public financial management and, where applicable, financial regulation”. Thirteen of the Coalition’s 26 members are European, but China, the US, Russia and India (and some leading EU member states) are as yet conspicuous in their absence.

Strategic regulatory action within the financial system itself by central banks and financial supervisors is a vital complement to this. Some of the steps that are needed to complete this course correction are well-known and promoted by the NGFS (such as enhanced market transparency and forward-looking stress tests). In light of the climate emergency, mandatory reporting of both climate risks and the alignment of financial portfolios with net-zero emissions is now a necessary step forward. Importantly, this information needs to be readily available and useable by ordinary citizens so they can take action with their savings and pension plans.

Added to this, regulators will need to become more insistent in their supervision of financial firms. In the UK, for example, the Bank of England as part of its contribution to the ‘climate spring’ has given the banks and insurers it regulates a deadline of 15 October to submit their plans to manage the financial risks of climate change.

To be commensurate with the urgency of climate action, this prudential track will ultimately mean establishing the level of high-carbon investment that is compatible with long-term financial stability. Bank balance sheets and investment portfolios need to match the Paris Agreement’s goals for financial flows to be consistent “with a pathway towards low greenhouse gas emissions and climate-resilient development” (Article 2.1.c). Looking ahead, this could involve financial regulators setting and enforcing ‘climate consistency thresholds’, placing quantitative limits on how much carbon can be funded and owned.

It is here that financial action to deliver a just transition will be essential. In the UK, the Committee on Climate Change has warned that there is a “significant risk that there will be resistance to change, which could lead the transition to stall”, unless the impacts of the transition on jobs and living costs are addressed and managed, and those most affected included in decision-making. Globally, over 130 investment institutions with US$8 trillion in assets under management have now signalled their support for action to deliver a just transition through shareholder engagement, capital allocation and policy advocacy. This recognition now needs to extend to the rest of the financial system, notably within the banking sector.

Summer is here: a new ‘golden age’ for sustainable finance

Cutting the oxygen of finance for carbon-intensive activities is certainly set to be one consequence of the ‘Climate Spring’. Scaling up funding for a sustainable economy by financing assets that deliver environmental targets in an inclusive way is another.

A highly attractive future lies ahead, where extra investment in clean energy could save the global economy “up to $US160 trillion cumulatively over the next 30 years in avoided health costs, energy subsidies and climate damages”, according to the International Renewable Energy Agency (IRENA). IRENA estimates that every dollar spent on the energy transition will pay off up to seven times over in terms of wider benefits. In the words of Carlota Perez, seizing this opportunity could unleash a new ‘golden age’ of development where finance is recoupled with long-term societal needs and helps to deploy rapid technological innovation for broad-based benefit.

In the near term, financing transformational climate action could well become a key feature of the EU’s policy programme for the next five years. One sign of the times is the call by the European Commission’s former vice president, Michel Barnier, for a ‘Green EU Deal’ to drive the massive investments that are needed.

An idea born in the UK during the global financial crisis and relaunched last year in the United States by Alexandria Ocasio-Cortez, there remains considerable debate over what a Green New Deal would involve precisely. But what is clear is that it currently has the greatest chance of implementation in some form at the European level.

This will mean taking the sustainable finance agenda to the next level. Many of the building blocks are currently being put in place. To move capital at speed and scale, a starting point is to have a shared understanding of what is ‘green’. This is why the EU’s work to develop its taxonomy of environmentally sustainable activities is so important, creating “the metric system for the 21st century” in the words of BNP Paribas’ Helena Viñes Fiestas.

Institutional innovations and green bonds

A metric system on its own, however, does not get runners over the finishing line of a marathon: resources must be mobilised. For finance, this could bring institutional innovations, such as the establishment of a new European ‘climate bank’, as proposed by France’s President Macron, as a way of channelling the €1 trillion needed by 2024. Working with existing promotional banks (such as the European Investment Bank) as well as long-term investors, the critical role that this institution could play is to create efficient transmission mechanisms between pools of savings and the multitude of often small-scale, decentralised projects that will be needed to decarbonise Europe’s economies. Institutional innovation will also be required in the UK, whatever the outcome of Brexit, to establish an effective vehicle for investing in resilient net-zero infrastructure, with some calling for a National Infrastructure Bank to be established with an explicit sustainability mandate.

All of this provides the basis for a step-change in the issuance of green and sustainable bonds, notably by local authorities, public agencies and countries themselves. Growing numbers of countries are issuing sovereign ‘green bonds’, including, most recently, COP25 President Chile and the Netherlands. These public sector bonds provide a critical mechanism for channelling private savings into the real economy, notably for activities that the market will under-supply, such as research and innovation, new enterprise development and the regional revitalisation so essential to the just transition. Central banks can also play an important monetary policy role as buyers of these bonds, with leading economist Paul de Grauwe concluding that “it is perfectly possible for the European Central Bank to use the instrument of money creation to favour environmental investments without endangering price stability.”

Disruption ahead?

One of the things about spring is that it can be an uncertain season, with surprise cold snaps often following episodes of warmth. Moving from an acknowledgement of climate emergency to sustained action in the financial system will, equally, not be without its dead-ends, setbacks and doubts.

After a strong rebound in the first four months of the year, global equity markets have become spooked once more by rising protectionism led by the United States. If market turbulence deepens, the risk is that the ‘climate spring’ could be derailed by a focus on short-term financial firefighting. Instead, the focus of policymakers, financiers and citizens should be to anticipate these tremors and make 2019 the year when there was an irreversible shift to a more sustainable financial system.

In a follow-up article the author will focus on the implications of the climate emergency for how finance responds to the resilience imperative.

The views in this commentary are those of the author and are not necessarily those of the Grantham Research Institute.

Sign up to receive our Sustainable Finance Leadership Series newsletter here.