How to price carbon to reach net-zero emissions in the UK

Downloads

This report (64pp) and accompanying policy brief (8pp) set out the importance of pricing carbon as a key component of any strategy to reach net-zero emissions in the UK (balancing carbon emissions with carbon removal).

Headline issues

- The UK government needs to reform its approach to carbon pricing if its new commitment to net-zero emissions by 2050 is to be credible.

- It is sensible to implement a politically feasible ‘medium-level’ carbon price that is higher than today’s price.

- To ensure full decarbonisation, this carbon price must be complemented by regulation, technology support and incentives for negative emissions to remove residual carbon dioxide from the atmosphere.

Summary points

- Consensus on the need for a net-zero emissions target is growing in the UK. The Committee on Climate Change recently published its case for net-zero, and the target is in line with the latest evidence from the Intergovernmental Panel on Climate Change on the need to hold warming to 1.5°C above pre-industrial levels. But it will be very hard to achieve net-zero emissions in the UK without a proper price on carbon.

- Pricing carbon encourages emissions to be reduced where it is cheapest to do so, is easier to get right than regulation, and sends a clear signal that the polluter must pay.

- The cost of achieving net-zero at the margin will be higher than the cost of the UK’s current target of reducing emissions by 80 per cent on 1990 levels by 2050. This calls for higher carbon prices than those currently in place.

- Carbon has been under-priced in most sectors to date, stalling the development of low-carbon solutions, particularly in sectors that are more difficult to decarbonise.

- The Government will have to adjust the shadow price of carbon – the price it uses internally to guide public-sector decisions. A shadow price that is consistent with net-zero would start at £50 (with a range of £40–100) per tonne of carbon dioxide (tCO2) in 2020, reaching £75 (£60–140) in 2030 and £160 (£125–300) per tCO2 in 2050, which reflects the likely cost of negative emissions technology.

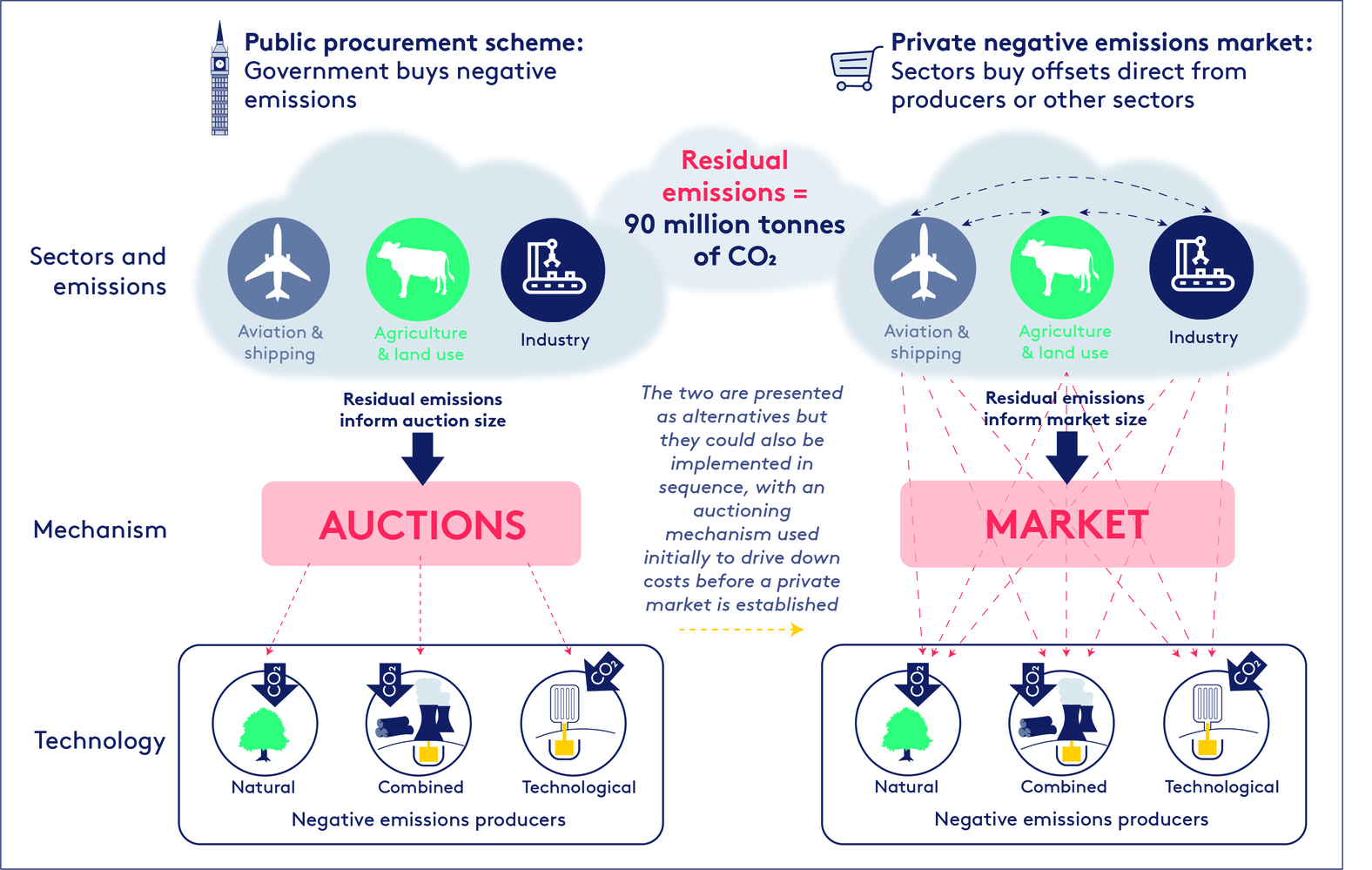

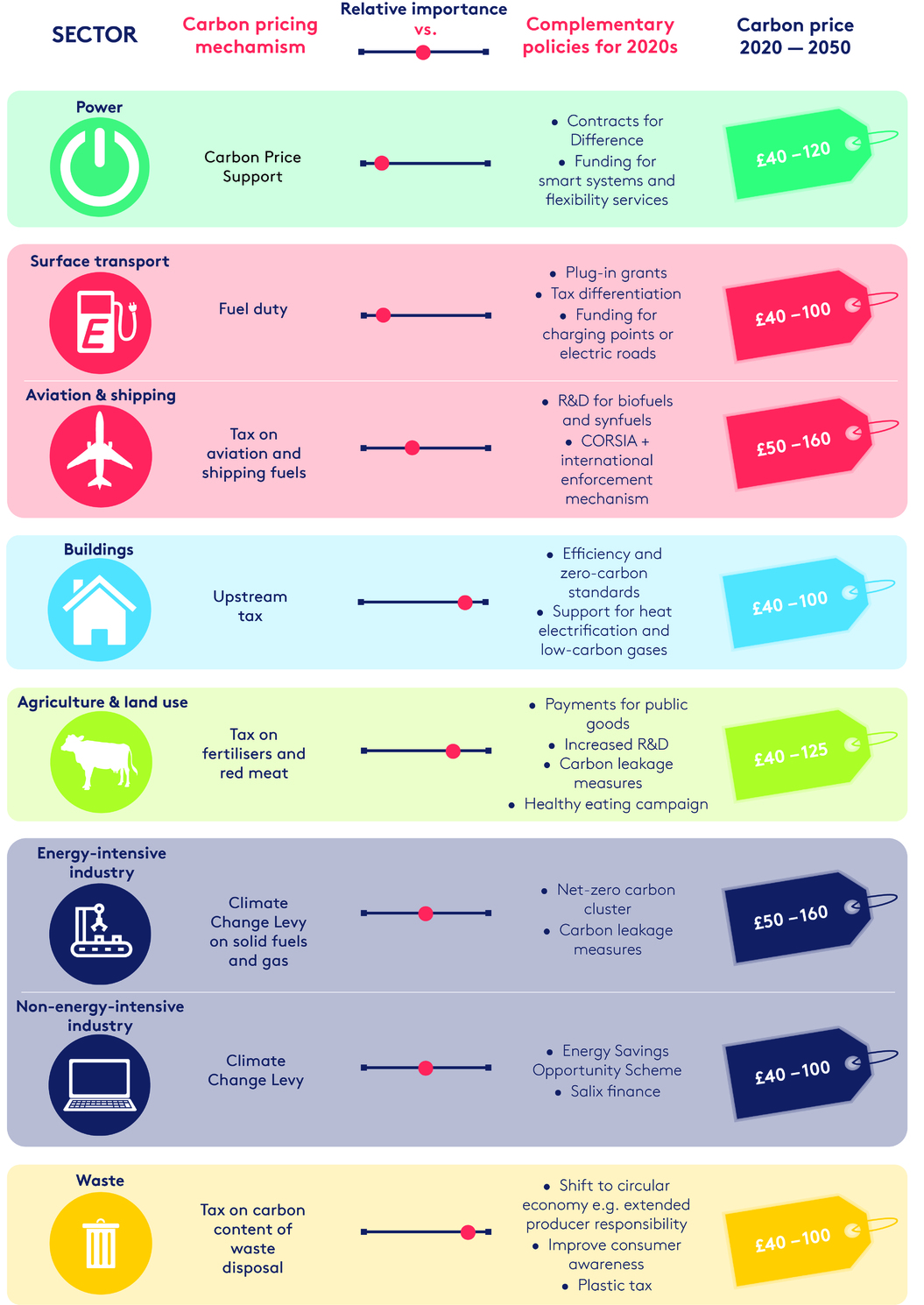

- There may be differences in price levels between sectors to account for differing contexts. The carbon price may rise more slowly in sectors where full decarbonisation is cheap, and be higher in sectors where remaining emissions would otherwise be too high. (See Figure 1 below.)

- If imposed through a tax or the auctioning of emissions allowances, the proposed price levels would raise public revenue of around £20 billion a year until the early 2030s, before falling gradually as emissions reduce to net-zero. This is equivalent to about two-thirds of the total revenue raised through fuel duty. If fully redistributed it would equate to a carbon dividend of about £300 per person and year.

- To ensure a net-zero target is met, remaining emissions will have to be treated through complementary policies or offset through negative emissions elsewhere.

- A net-zero target will probably move the balance between carbon pricing and complementary policies in favour of the latter.

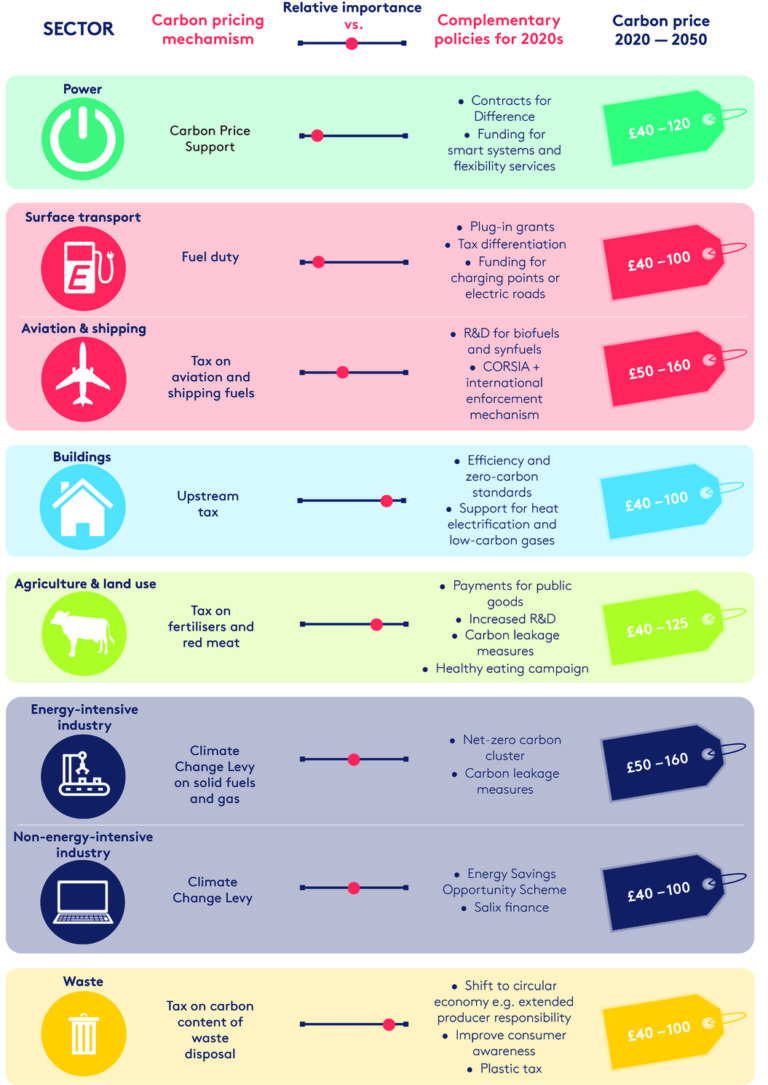

- A complementary price mechanism must be set up to encourage the development and use of negative emissions technology. This could take the form of a public procurement scheme, through which the Government would purchase negative emissions in proportion to the residual carbon output that its policies have not succeeded in avoiding. A second possible mechanism is a private but regulated offset market, in which market participants would buy negative emissions in place of paying the carbon price. (See Figure 2 below.)

Figure 1: Differentiated carbon prices and the relative importance of carbon pricing versus complementary policies by sector

Figure 2: Pricing schemes for negative emissions