Net zero central banking in Africa’s diverse economies: challenges, opportunities and policy options

Downloads

Africa’s economies are contending with a diverse set of challenges and opportunities in relation to building low-carbon, green economies and the transition to net zero emissions. Central banks can play a pivotal role in enabling the transition in Africa if they choose the right policy responses, adapted to the specific contexts in which they operate.

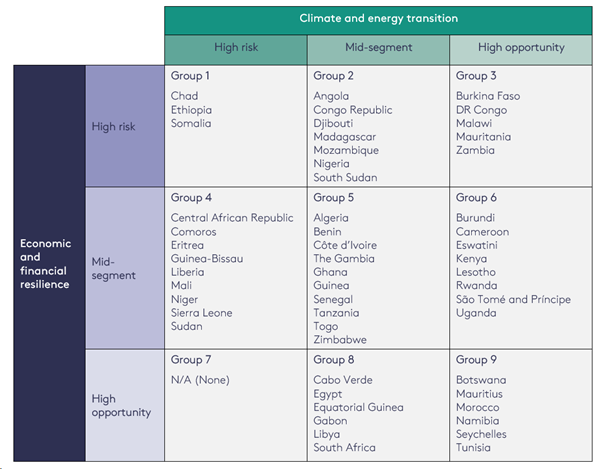

This report presents a country classification for all 54 African economies based on each country’s unique climate- and transition-related risks and opportunities to guide a nuanced response by central banks (see Table 1 below).

Key messages

- The transition to net zero is a strategic imperative for economic development in Africa. African economies will need to invest in low-carbon technologies and maximise renewable energy potential so that they can leapfrog the carbon-intensive stages of growth that characterised the development of today’s high-income countries.

- Many African countries are highly exposed and vulnerable to climate-related risks: both physical risks, such as changing rainfall patterns threatening predominantly rainfed agriculture; and transition risks, particularly where countries rely heavily on fossil fuel revenues. These vulnerabilities are disproportionately high in Africa, while the continent’s contribution to global greenhouse gas emissions is minimal.

- The transition to net zero offers African countries economic opportunities, but several challenges must be overcome to take advantage of them. The continent is endowed with extensive renewable energy sources, arable land, critical minerals and natural carbon sinks. However, low agricultural productivity, low-value raw material exports and environmental degradation linked to land use and biodiversity loss limit their full exploitation.

- The country classification for African economies developed in this report categorises all 54 countries as either high risk, mid-segment or high opportunity for: (i) the climate and energy transition; and (ii) economic and financial resilience. This results in nine country groups which reflect the various intersections of risk and opportunity across the two dimensions. Download the full rankings and classification data here.

- Central banks in Africa are at different stages of integrating climate considerations into their activities. Some progress has been made in the policies and interventions of central banks in the region, but this is uneven across the continent.

- Climate change and the transition to net zero are likely to have a significant and structural impact on several dimensions relevant for central banks in Africa. The transition could have stabilising effects, such as more stable energy prices due to increased contributions from renewable sources, while climate shocks could be a source of financial instability.

- Central banks could be instrumental in both mitigating risks and capitalising on transition opportunities in Africa. They can communicate the impacts of climate change on price, economic and financial stability, inform other policymakers about the economic consequences of climate change, and foster favourable funding conditions for the transition through sound supervision.

- Now is a defining moment for African central banks to shape the continent’s sustainable future. Options for central banks range from maintaining financial stability in the face of climate-related risks to championing and deepening sustainable finance initiatives.

Table 1. Classification of 54 African economies by risks and opportunities from the transition to

net zero