Who is buying greenhouse gas removal credits and does it matter?

How can we build momentum and scale in an industry that should be kept as small as possible? And what if demand for its product predominantly comes from sources that should not use it? These are just two of the conundrums faced by the greenhouse gas removal industry, explain Josh Burke and Sam Fankhauser.

How important is greenhouse gas removal?

Greenhouse gas removal (GGR) is an integral part of global decarbonisation strategies. Net zero (as opposed to absolute zero) explicitly allows some residual emissions in hard-to-abate sectors (i.e. those where cutting emissions is too expensive or realistic solutions do not exist), on the assumption they are offset by removing emissions elsewhere.

The State of Carbon Dioxide Removal report notes that across pathways modelled by the Intergovernmental Panel on Climate Change (IPCC), 420–1100 billion tonnes of carbon dioxide removal will be required by 2100 to limit global warming to 1.5°C with limited or no overshoot. However, a growing bank of net zero guidelines and standards state unambiguously that carbon emitters must in the first instance reduce their own emissions before resorting to GGR.

Environmentalists are concerned that net zero targets leave too much ambiguity over who can still pollute and by how much. They also worry that GGR may transfer too much carbon from the Earth’s crust (the lithosphere), where it is safely stored in fossil form, into the biosphere (plants, trees and soils), where storage can be disturbed by pests, wildfires and human intervention. If a substantial amount of ‘removed’ greenhouse gases found their way back into the atmosphere, future generations would have to ramp up their own mitigation efforts yet further – this would represent an unacceptable shift of the climate burden.

Residual emissions are typically related to aviation, long-distance transportation, structural materials, heavy industry, and baseload electricity. Yet they are not well defined, conceptually or quantitatively. Consequently, the level of unabated emissions that are considered ‘acceptable’ and thus ‘residual’ is contingent on values, norms and interests: for example, how is ‘necessity’ defined – and thus how are views on the necessity of flying or eating meat (and acceptance of their related emissions) formed?

The decarbonisation strategies of member countries of the Organisation for Economic Co-operation and Development (OECD), for example, account for 18% on average of current emissions remaining after 2050. The same fifth of emissions that were still allowed under governments’ old 80% reduction targets are now simply covered by GGR, so even though a country may have increased its target to ‘net zero’, there is no appreciable increase in ambition. Such dynamics underscore the increasing importance of considering the politics of residual emissions.

Who is actually buying GGR?

So what are we to make of recent news that Microsoft, a significant emitter in the easy-to-abate IT sector, has entered into the largest GGR transaction yet, agreeing to buy 2.76 million tonnes of GGR from a Danish bioenergy and carbon capture and storage (BECCS) project?

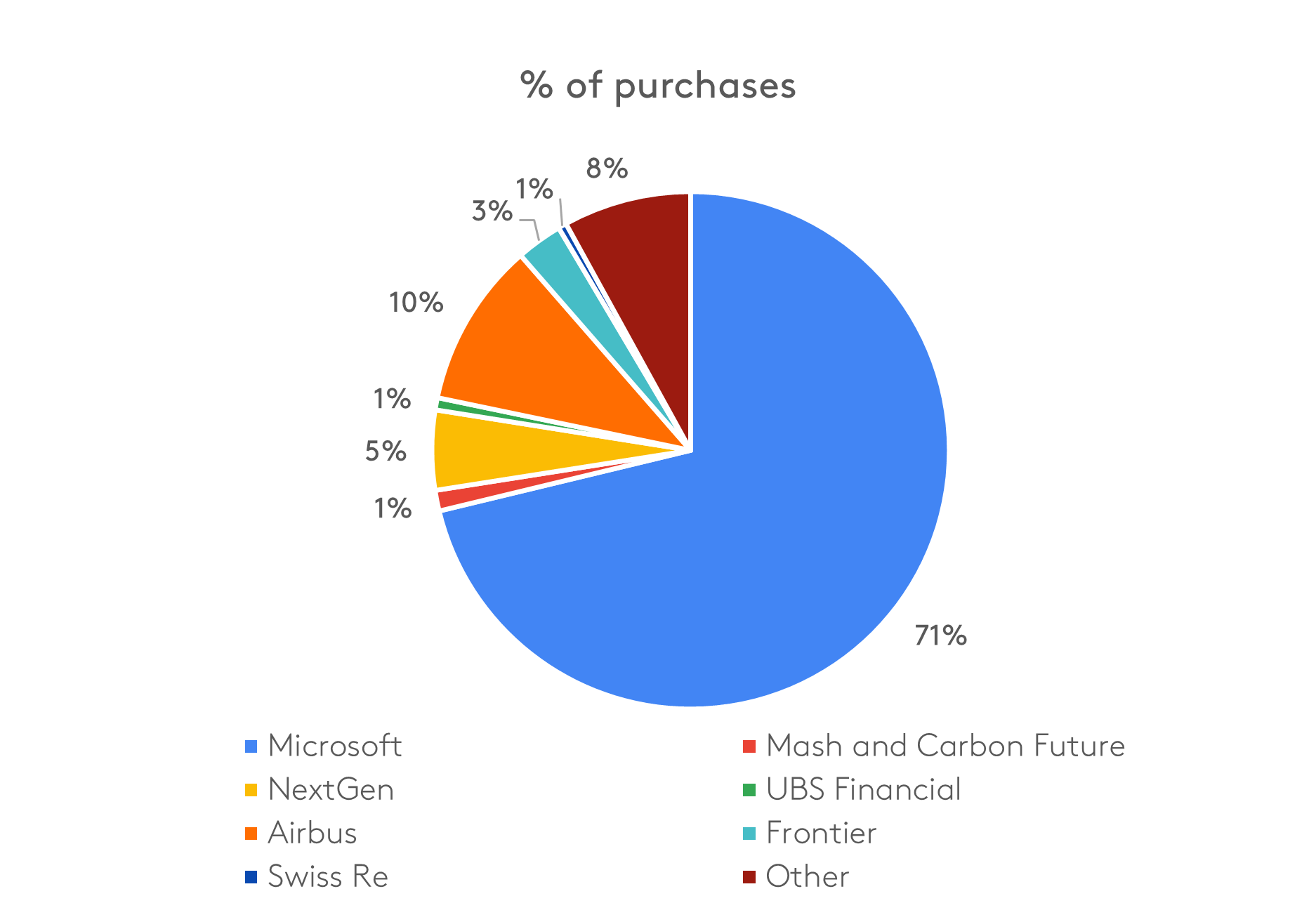

The transaction dominates the statistics on currently contracted (though not necessarily delivered yet) GGR (see Figure 1). Microsoft is the largest among a group of seven purchasers, which account for 92% of the market by volume (in tonnes). The remaining 8% is made up of hundreds of small purchases by many different organisations.

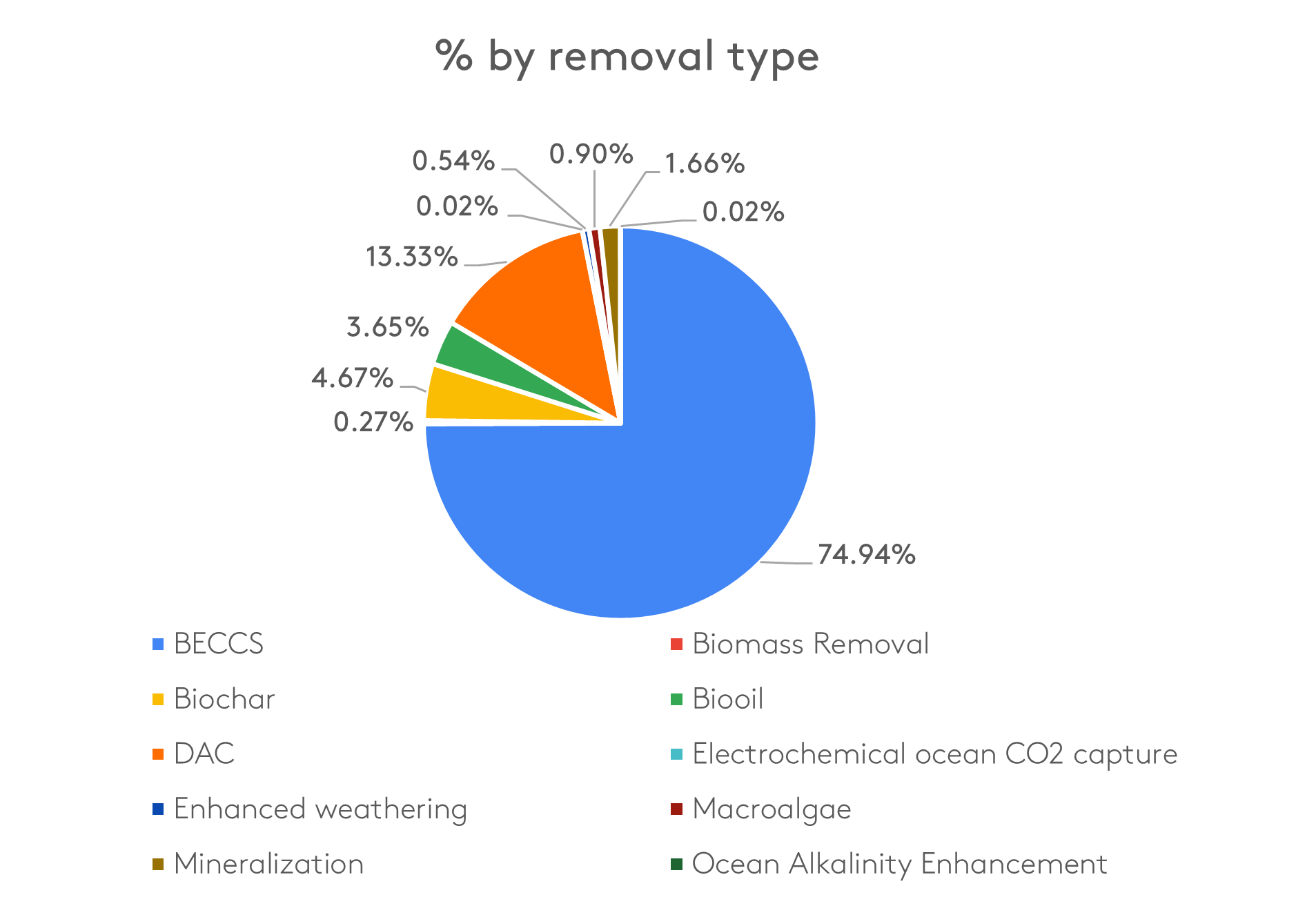

The transaction boosts the share of GGR linked to highly durable geological storage to almost 90%, comprising 75% BECCS and 13% direct air capture (DAC). Purchases of bio-oil and biochar account for most of the remainder (these are by-products from heating biomass through pyrolysis, which can be deposited in soils where they become a carbon sink). This will be welcomed by observers concerned about permanent carbon storage (for thousands of years). It also tilts the balance between BECCS and DAC (the two main options for geological storage), in favour of the former. In the long term, this may raise concerns about sustainable biomass supply, but for the moment the market is still too small for this to be a binding constraint. However, it will be essential to ensure sustainable sources of biomass are used, with close monitoring.

Figure 1. GGR purchase statistics

Data source: www.cdr.fyi (accessed 22 May 2023)

The Microsoft purchase means that over 80% of purchases are now made by organisations from sectors like IT, consulting and finance, which are not considered hard to abate (given they have no heavy industrial processes to decarbonise), and which should therefore be striving for absolute rather than net zero emissions. The biggest purchase from within a hard-to-abate sector is the 400,000 tonne DAC purchase by Airbus, which accounts for 10% of the market by volume.

What are the implications of current demand patterns?

In the short term, the voluntary demand and advanced market commitments from purchasers in relatively easy-to-abate sectors, such as Microsoft and the Frontier and NextGen consortia, are very welcome. In the absence of meaningful compliance demand or government purchases, the demand pull created by voluntary transactions is essential to induce investment – and consequent improvements – in GGR technologies. Cash-rich firms like Microsoft can play an important role in kick-starting the market, generating scale and reducing costs. More broadly, increased adoption may also help to establish greater public acceptance.

The willingness of early buyers to purchase some of the most expensive carbon mitigation options is intriguing and perhaps counterintuitive, since cheaper options to offset or abate emissions are available. The role they play in developing the GGR market and driving down costs is a positive externality. The benefits of a lower-cost GGR market will be enjoyed by society at large.

We should not assume that the voluntary activities of a few progressive companies will be sufficient to create a GGR market of the size and at the speed that net zero pathways require. As always in the presence of externalities, government intervention will be required. Policymakers have different options on how to kickstart the market for GGR. With the Inflation Reduction Act, the United States has opted for a regime of GGR tax breaks, for example. Elsewhere, government procurement schemes, which were successfully deployed in the promotion of renewable energy, may play a role.

Policymakers should think hard about how to involve emitters from hard-to-abate sectors. The relatively minor role they play in the current GGR market is striking. As major emitters and the main users of GGR under net zero, it seems reasonable to expect a prominent contribution to market development from those sectors. This contribution may have to be mandated through regulation, for example in the form of an extended producer responsibility or by financing GGR procurement schemes through a carbon tax.

Welcome as it is, the demand for GGR from easy-to-abate sectors may have to be temporary, and it must not come at the expense of a company’s own emission reductions. In the long term, when the GGR market is at scale, competition in demand from easy-to-abate sectors for scarce GGR may become problematic.

The global-scale availability of GGR is not unlimited, which means it should only be deployed by those sectors that really cannot abate. Political restraint and public acceptability may limit future availability. Nature-based GGR methods also face supply-side constraints relating to competing priorities for land use, where growing more biomass to burn as fuel would take land away from biodiversity conservation and food production. Over-reliance on BECCS could steer the Earth system closer to planetary boundaries for freshwater use and lead to further transgression of planetary boundaries for land system change, biosphere integrity and biogeochemical flow (nitrogen and phosphorous cycles). With regard to direct air capture, analysis suggests that the energy and materials inputs could be precarious, even when the most promising technologies are employed.

There are also considerable risks if GGR is not expanded as envisioned or if prospects for its deployment delay near-term action. For example, if direct air capture alone is not scaled up, this could lead to a global temperature overshoot of up to 0.8°C (on top of 1.5°C). This could rise to 1.4°C if the delivery or promise of a whole suite of GGR instead deters or delays near-term emissions reduction.

Policymakers therefore have to carefully weigh up the benefits of scaling up GGR, while understanding the political, environmental and economic circumstances that require constrained short-run supply. The growth in the voluntary GGR market reinforces the need for stronger GGR governance frameworks that codify the role of GGR versus conventional abatement and define their use in relation to residual emissions. As we see increased purchases of GGR, the difficult discussion of what counts as a legitimate use of GGR will only intensify.

Josh Burke is a Senior Policy Fellow at the Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science.

Sam Fankhauser is Professor of Climate Economics and Policy at the Smith School of Enterprise and the Environment, University of Oxford, Research Director of Oxford Net Zero and a co-investigator of the CO2 Removal Hub (CO2RE).

The views in this commentary are those of the authors and do not necessarily represent those of either host institution.