The underappreciated trade-offs at the frontline of development finance

Charting a path to economic prosperity that also addresses climate change relies on increasing investment in developing countries, but these countries are not yet receiving the finance they need. So why are development finance institutions (DFIs) not doing more and acting quicker, and how can they manage the trade-offs they face, ask Timothy Randall and Tristan Knowles?

Recent discussions about World Bank reforms highlight the widely expected increase in commitments by the multilateral development banks (MDBs) to address systemic global issues such as climate change. Greater ambition is urgently needed to increase investment to avoid global temperatures increasing by more than 1.5°C and to fund adaptation to the impacts already locked in. Annual climate finance flows are nowhere near the trillions required globally every year, putting developing countries in particular at increasing risk.

The countries that act as shareholders in the MDBs and other development finance institutions (DFIs) and the recipients of development finance have legitimate questions to ask about the ambition and speed of action by these institutions. In this context, it helps to understand the trade-offs these organisations face in their decision-making at a deal level.

Trade-offs between commercial and developmental considerations

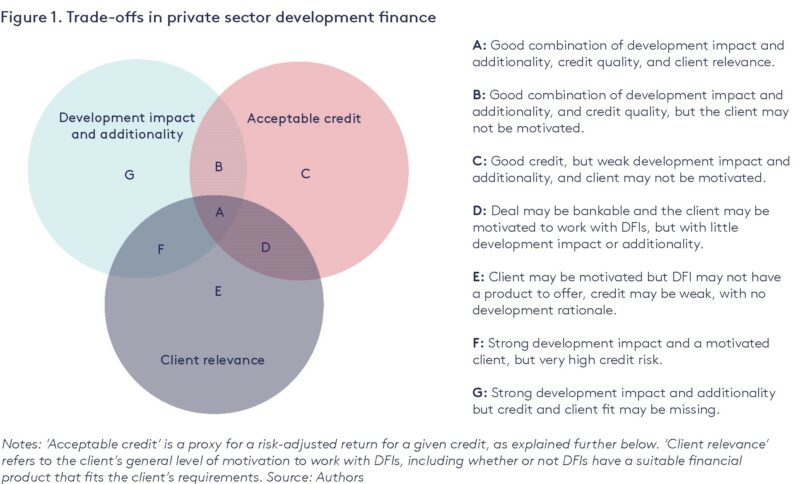

When structuring and executing a private sector investment, DFIs have to make trade-offs that may slow them down but are fundamental to the day-to-day work of investment officers. While DFIs look to achieve meaningful development impact and additionality, they must also account for credit risk and relevance to clients. Figure 1 presents an overview of these trade-offs, which are explained further below.

Development impact and additionality

Stimulating sustainable economic growth, aligned with developing countries’ stated development objectives or the Sustainable Development Goals, is the core purpose of development finance. DFIs strive to achieve ‘additionality’ – meaning that finance goes beyond what would already be available otherwise and does not ‘crowd out’, i.e. displace, the private sector. Additionality can be financial or non-financial in nature, as outlined in a guiding framework published by several MDBs.

Alongside impact and additionality, credit risk is also important. Clients or projects that have high development impact and additionality may not always have the best credit (scenario G, Figure 1). For example, a large renewable energy project in a least developed country may have strong development impact and additionality but higher credit risk due to a weak credit rating of the off-taker (the power purchaser) and generally higher country risk. A comparable project in a middle-income country (MIC) may have a weaker incremental development impact and additionality but a stronger credit profile. Neither project is inherently better or worse: rather, they involve trade-offs between development impact, additionality and credit risk. In addition, it is in MICs that DFIs are often able to make investments with higher technology risk and demonstration impact, such as the first fully electric ferries or the first project to integrate wind power and energy storage.

Acceptable credit: expecting a risk-adjusted return on investment

Credit risk is a key constraint when considering how DFIs can best maximise development impact. Any lending institution will have to assume some degree of credit risk. DFIs are still investors, and their mandates compel them to expect a return on their capital, most commonly in the form of interest paid on loans, or through a return on equity investments. In the case of interest on loans, this compensates DFIs for the opportunity cost of lending, and the risk that a borrower may not repay, and also helps to cover operating costs and limit the need to call on additional public resources.

Weighing up the credit risk against the expected return requires analysis of the creditworthiness of the client. DFIs need to assess what an acceptable level of credit risk is for a given return, simultaneously considering the potential development impacts a project might achieve. Importantly, for DFI investments to have a lasting development impact, the long-term commercial success of a project or company is essential. An investment with high credit risk also faces a high risk of failing to meet its stated development objectives.

What constitutes an adequate risk-adjusted return is subjective and ultimately up to the DFI’s shareholders. DFIs will typically charge interest margins that consider market benchmarks and internal hurdle rates. If the risk-adjusted return is inadequate, even if the development impact is very strong, the financing may be difficult to justify based on a DFI’s risk appetite. Such projects may even be suited to philanthropy, grants or other forms of non-repayable funding.

Prudent policies on risk-adjusted returns are important because many DFIs, particularly MDBs, raise funding on bond markets, subjecting them to rating constraints. The credit rating that DFIs receive from the major rating agencies (Fitch, Standard & Poor’s and Moody’s) has a direct impact on their borrowing costs. A lower credit rating implies higher risk, compelling bond investors to demand a higher return, resulting in more expensive lending costs for development projects. Credit risk considerations will inevitably remain relevant to DFIs. No DFI will last long if it continually loses money by optimising solely for development impact while disregarding risk. Most DFIs will therefore tend to look for opportunities that fall into the area marked ‘A’ in Figure 1.

No deal without a client

Even if a DFI identifies an investment opportunity with strong development potential, additionality and an acceptable risk-adjusted return, there is no deal unless the potential client wants to work with the DFI. This is not a given, as DFIs typically promote stringent standards for legal documentation, due diligence, environmental and social safeguards and gender impacts that commercial investors may not require to the same degree.

As a result, there is a cost to working with DFIs that clients must weigh up against the perceived financial and non-financial benefits. Referring again to Figure 1, a DFI may find that an investment opportunity in area B is highly attractive, but the client may not be sufficiently motivated to adhere to the high standards that the DFI requires.

Potential solutions

To maximise the development impact and additionality of projects, DFIs must overcome credit risk constraints while staying relevant to potential clients. DFIs also need to take care that the risks they take are ambitious enough to widen the range and change the nature of the projects they finance, ensuring what they provide is truly additional, and not a replication of something that could come from a commercial bank. Some of the ways in which these trade-offs can be addressed include:

- Taking a portfolio approach: DFIs can ensure the composition of their overall portfolio includes projects with both higher and lower credit risk and development impact. This may require that DFIs sometimes invest in projects that could potentially be financed by other lenders, thereby ‘cross-subsidising’ more challenging projects.

- Using specialty funds or allocations with a higher risk appetite: DFIs can allocate additional resources targeting high-risk and high development-impact projects without compromising a DFI’s credit risk profile. This approach could be based on allocating a portion of the DFI’s own balance sheet to higher risk investments while still achieving an acceptable average portfolio risk rating, or by working with donors on blended finance solutions. ADB Frontiers and ADB Ventures are examples of the latter approach.

- Blended finance can rebalance the trade-offs and enhance development impact, additionality and client fit. For example, blended finance can be used to reduce credit risk by taking a subordinated position in the capital structure of a project at a concessional interest rate or can enhance the development impact of a project, e.g. by incentivising the borrower to enhance environmental and social policies.

- Reforming approval procedures to suit a particular development objective, financing product, and risk appetite. Some DFIs, such as the International Bank for Reconstruction and Development, a core component of the World Bank Group, were historically focused on large-scale infrastructure projects. As a result, internal processes are often very tailored to these kinds of investments, which typically have long lead-times and require substantial due diligence. To scale up investments in early-stage venture investments, equity deals, corporate finance loans and bond investments, however, more streamlined approaches may be required. DFIs need to reconsider whether current approval procedures are fit for purpose, and where they might be an impediment to processing certain investments more efficiently.

Critical issues for DFIs

The need to address climate change and promote equitable development is critical for DFIs. The trade-offs they face at the deal level in the private sector need to be better understood when discussing whether DFIs are doing enough and at the required speed. They should be considered in the high-level policy debates concerned with reforms of the global system of development finance. The solutions above are just some ways in which these trade-offs could be addressed to the benefit of global development goals.

Tristan Knowles is an Investment Specialist (Climate Finance) in the Asian Development Bank’s Private Sector Operations Department. Timothy Randall is a Mercator Fellow working on Blended and Climate Finance, former Visiting Fellow at the Grantham Research Institute and currently on secondment at the Asian Development Bank.

The authors would like to thank Hans-Peter Lankes, Daniel Wiedmer and Suzanne Gaboury for their feedback on an earlier draft.

The views expressed in this commentary are those of the authors and do not necessarily reflect the views of the Grantham Research Institute or their employers.