The EU emissions trading system at a crossroads: the Market Stability Reserve review as a defining moment

The Market Stability Reserve (MSR) aims to provide carbon price stability for the EU emissions trading system (EU ETS). But serious questions are being asked about how much stability – if any – it provides, say Michael Pahle and Simon Quemin. They argue that the MSR rules are too complex, have difficulty accommodating changing EU and national policies, and can cause regulatory uncertainty as well as market speculation. The authors recommend a reform of its core design – focussing on prices, not quantities of carbon allowances – instead of adjustments that make it even more complex and vulnerable to its existing weaknesses.

The future of the EU ETS and its capacity to deliver on the more ambitious climate targets formulated in the EU Green Deal will crucially hinge on what becomes of the Market Stability Reserve (MSR). With the twin objective of reducing the historical ‘surplus’ of emission allowances in the market and improving its resilience to future shocks, the MSR was substantially strengthened as part of the 2018 reform. Notably, an add-on cancellation mechanism (CM) post 2023 was introduced.

While the subsequent run-up in prices is often attributed to these revised features, concern lingers about the stability of the now higher price regime. Additionally, MSR-induced resilience is expected to be limited in the face of the demand-curbing impacts of the COVID-19 crisis, complementary EU decarbonisation policies such as renewable targets, or emerging overlapping unilateral policies at the national level such as the German coal phase-out.

The importance of the 2021 MSR review

It thus comes as no surprise that many observers expect that significant changes will have to be made to the MSR as part of its review starting next year. Yet concerns have been voiced that the MSR review might be an ‘empty shell‘, with significant changes being deferred to a coherent ETS reform as part of the Green Deal.

Drawing on extant research, we critically discuss the functioning of the MSR and caution against such a deferral. In particular, taking the review too light-hearted bears the risks of falling short of understanding the MSR’s complexity and respective impact on price formation, which may destabilise the market rather than stabilise it. If this risk is not accounted for and addressed head on in the review, a future substantial reform of the ETS may ultimately be built on shaky ground.

MSR price impact: An observable increase in transitional stringency…

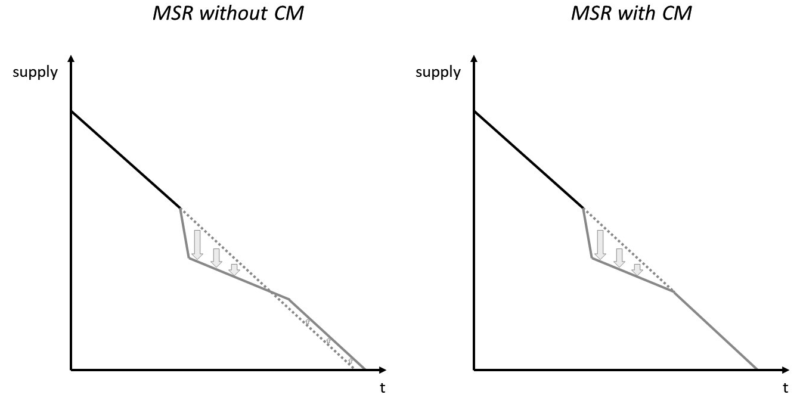

Even though it was never explicitly stated this way, in essence the 2018 reform aspired to increase prices back to a ‘meaningful’ level. And indeed, as an automatic apparatus of auctions backloading, a key impact from the MSR is an increase in transitional stringency relative to the linear cap trajectory (see Figure 1), reflected in higher short-term prices. Importantly, this also reinforces the cumulative stringency of the system via the CM. Yet, the relevant question is whether the price increase just comforted concerned observers – or if it actually triggered abatement.

Does it actually reduce emissions?

The mere frontloading of long-term shortage, as it were, can force firms to behave more consistently with long-term emissions targets. By preponing stringency it can trigger more investments in clean capacities early on, which has beneficial long-term emission impacts: Once substantial clean capacity has been built up, there is little incentive to rebuild fossil capacity, even when allowances start to ‘trickle’ back into the market.

However, so far there has only been anecdotal evidence of such impacts, for example lower emissions from coal power generation. Accordingly, empirically measuring the MSR impacts on firms’ behaviours and investments would thus be a most valuable indicator of the MSR performance for the 2021 review – beyond merely looking at price and ‘surplus’ impacts, which are respectively hard to comprehend or simply mechanistic.

Figure 1: Supply trajectory over time with the MSR in place relative to the linear cap path (source)

What are the actual mechanisms affecting prices?

Indeed, it is hard to precisely pin down the mechanisms behind the 2018 run-up in prices and therefore to determine how exactly the MSR influenced – and still influences – price formation. True, the run-up was driven by anticipated MSR supply-reducing impacts in the future, but these remain uncertain and, crucially, also depend on market actors’ (possibly self-fulfilling) beliefs about them.

While the MSR rules per se are clear and simple, its effects on intakes, cancellations and in turn prices are not – for instance, total cancellations vary from 2 to 13 GtCO2 according to a panel of available simulations. In turn, recent research has shown that the run-up may be an overreaction to the good news of the reform itself – i.e. irrespective of its specific features – taken as a signal that the doctor (the EU) cares about its patient (the ETS). Surprisingly though, price projections by analysts for the more distant future converge, which might instil undue confidence that the market will settle into a stable regime after cancellations have set in.

Arguably, the uncertainty about the MSR impacts to come is the flipside of the smokescreen politics used to indirectly sneak higher ambition targets through the back door as part of the 2018 reform. While this approach is certainly reflective of political-economy constraints, we think that the MSR review should now be seized as an opportunity to clarify and simplify the existing regulatory framework and the implications thereof, not to maintain its degree of complexity and associated uncertainty – or worse, to increase it even further.

Does the MSR provide stability, or just support?

The price effects also allude to how the MSR is meant to achieve its twin objectives:

(1) Reducing the historical surplus

(2) Increasing resilience to future shocks

Beginning with the first objective, the MSR was engineered to drain past supply-demand imbalances, and unconditionally acts as a price support mechanism. True, building in some support was a necessary fix to absorb the historical ‘surplus’ and elevate prices from prevailing rock-bottom levels. In this sense, the first objective of the MSR may be deemed attained.

Yet, the chosen approach, based on the regulation of the intertemporal allowance use and hedging needs, is unnecessarily complicated – say, relative to a direct cancellation of those excess allowances.

In particular, we wish to debunk the often-purported myth of a causal link between high ‘surplus’ and low price levels. Not only has such a link always been deductively unfounded – in fact, one could argue that prices were low because banking (the ‘surplus’) was not high enough – it is also no longer borne out by observations: in 2018 the price quadrupled while the ‘surplus’ stayed put. Indeed, what matters for price formation is the anticipation of future net shortage rather than present net shortage.

Stability is yet to be proven – and likely limited and one-sided

Regarding the second objective, crucial for the MSR’s design element was the notion of a hedging corridor that motivated the MSR intake and outtake thresholds. However, this is not theoretically nor functionally consistent with the purported induced resilience.

Indeed, the ‘surplus’ is not a simple, innocuous accounting measure of ‘oversupply’ but rather a dynamic, multifaceted quantity whose regulation interacts with firms’ strategies in non-straightforward ways. As a result, it may not be adequately reflective of demand shocks as they occur. And even if it were, there would still be a minimum one-year lag between shocks and ensuing MSR operations.

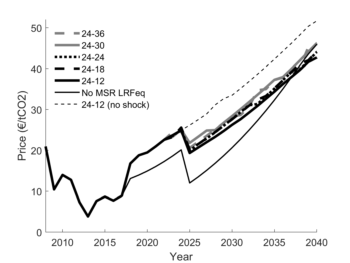

Recent research shows limited responsiveness in MSR intakes to lower-than-expected demand conditions, suggesting that the MSR would only limitedly absorb such a shock and sustain price recovery (see Figure 2). It is therefore our contention that that the limited price impacts of the COVID-19crisis is not so much due to the presence of the MSR as to the anticipation of higher ambition targets to be endorsed soon. More research on this issue can be found here and here.

Figure 2: Price effects of a permanent negative demand shock in 2025 with the MSR and different intake rates (source)

This limitation is even accentuated for higher-than-expected demand conditions, or if abatement costs unexpectedly shoot up. This is because the MSR core design is inherently tilted towards supply contraction. As a result, changing its parameters (e.g. the intake or outtake rates) would not improve on the MSR’s limited and one-sided stabilising properties. This substantial limitation should be considered in the review. As an alternative to ensure price stability, consideration should be given to indexing the stability mechanism directly on the price level rather than convolutedly meddling with anticipated future net shortage to indirectly influence price formation as the MSR does.

Increased overall regulatory complexity can backfire…

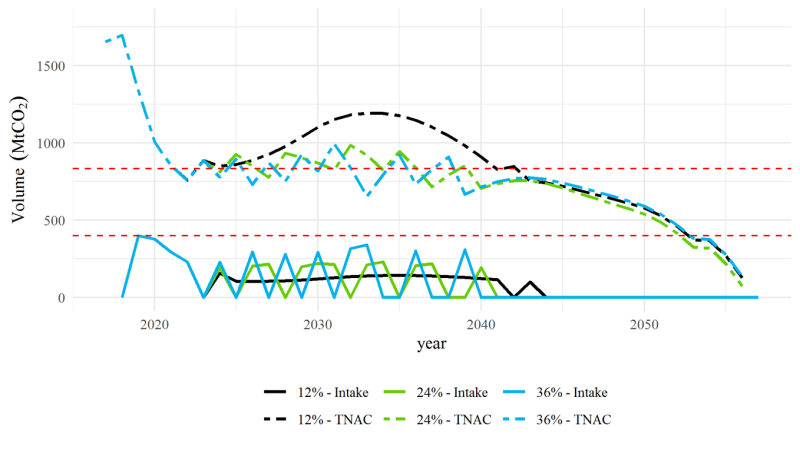

What is more, the MSR may even destabilise the market for two reasons. First, the discrete MSR thresholds induce oscillatory behaviour when the ‘surplus’ nears these thresholds (see Figure 3). That is, the MSR can produce supply shocks of its own, which are shown to be increasing with the intake rate above 12% here and here. This in turn creates additional price volatility.

Second, interactions with overlapping policies further complicate MSR cancellations and price impacts. For instance, a recent analysis of the German coal phase-out shows that the MSR cannot cancel enough allowances to fully alleviate the induced waterbed effect and is also prone to a green paradox. That is, anticipating lower allowance demand due to the phase-out can lower near-term cancellations and lead to a waterbed effect above 100%. Additional national cancellations are thus necessary, but the exact amount of which are very uncertain, and translates into another source of price volatility.

Figure 3: Oscillatory intake behaviour at different intake rates (source)

…and open the door to speculation and regulatory uncertainty

The above described uncertainties also open the door to speculation about its future effects, which has bearing on market functioning and actual MSR outcomes themselves. Speculation may even be exacerbated when the ‘surplus’ approaches the intake threshold. Specifically, in anticipation of the ‘surplus’ falling below it, speculators may squeeze the market by buying and holding enough allowances so that the threshold is not breached. As prices would rise after intakes occur, they could then offload these allowances and thus capitalise on the MSR. This would amplify price volatility even more.

Accordingly, the review should consider the extent to which the MSR and CM make the ETS more vulnerable to speculation. Speculation as such is not a problem per se, but it might destabilise the market and make the price more volatile. In anticipation of these problems, the MSR review should ponder more fundamental reform options besides tweaking existing MSR parameters, which is unlikely to overcome them. More generally, this would avoid the need for further price-correcting interventions in the future, which the 2018 reform has already set a precedent for. This in itself is a source of regulatory uncertainty, which may have detrimental implications for market functioning.

The 2021 MSR review, or the EU ETS at a crossroads

As we approach the MSR review next year, we have highlighted a few words of caution we deem essential for the review itself, as well as for further development of the MSR and the ETS. In our view, of foremost importance for the way forward is the containment of regulatory complexity, especially as the current regulatory framework is on a slippery slope towards greater complexity due to many moving and interacting parts. Not doing so opens the door to speculation and regulatory uncertainty. Both translate into price volatility and uncertainty, and may ultimately destabilise the market rather than stabilise it.

Thinking about remedies could take two directions: a more evolutionary one focussing on adapting the key MSR parameters while preserving its general design, or a more revolutionary one implying a reform of its core design. Such a reform could be a transition from triggering intake and outtake through prices instead of quantities. Many objections have been made in the past against such a hybrid approach, but from an economic point of view there is a strong case for it. Furthermore, it could accommodate a price floor as recently called for by France and Germany and several other member states. The 2021 review may thus appear as the right time to contemplate a reserve based on price thresholds, i.e. reforming the Market Stability Reserve into a Price Stability Reserve.

Michael Pahle is Head of the Working Group ‘Climate and Energy Policy’ at the Potsdam Institute for Climate Impact Research

Simon Quemin is a Research Officer at the Grantham Research Institute on Climate Change and the Environment

This commentary was originally published under the title ‘EU ETS: The Market Stability Reserve should focus on carbon prices, not allowance volumes’ by Energypost.eu on 16 June 2020 and is republished here with permission. For more information on the MSR see coverage by CarbonPulse here.