Insurance and climate risk: the critical role of regulators

By Dave Jones, California Insurance Commissioner (January 2011–January 2019)

Insurance regulators have a critical role to play in making sure insurance companies are addressing the risks associated with climate change. The reality of climate change means that we need to change the burden of proof, argues Dave Jones in this post for the Sustainable Finance Leadership Series.

Weather-related catastrophes and natural disasters caused more than US$138 billion in global insured losses in 2017 – the highest insured losses ever. In California, the largest insurance market in the United States, insurers collect over US$310 billion in premiums a year and have US$5.5 trillion in assets under management. As the realities of climate change become clearer by the day, regulators need to require that insurance companies demonstrate that they have considered and addressed the climate-related risks they face to their underwriting, business operations and reserves.

Intensifying actions to get US insurers to consider climate risk

Since 2011, I have led a group of state insurance regulators in the United States in surveying insurance companies about their responses to risks related to climate change. The National Association of Insurance Commissioners (NAIC) Climate Risk Disclosure Survey asks insurers how they are addressing climate change in their business operations, underwriting and reserving. Requiring answers to these questions and making the results public has provided important insights into insurers’ responses to climate change.

From the responses to this survey it became evident that insurers in the US were not focusing on the financial risk that climate change posed to their reserves. In particular, insurers and other investors face climate-related ‘transition risk’ – the risk that the value of certain investments may decline significantly due to government and market decisions to decarbonise the economy. Countries and markets are taking steps to transition away from fossil fuels in order to reduce greenhouse gas emissions and meet the goals of the Paris Agreement on climate change. As this happens, assets in the carbon economy – for example investments in coal, oil, gas and utilities that rely on fossil fuels for energy production, or the automotive sector – may drop in value or become ‘stranded assets’ on the books of insurance companies or other investors.

In order to focus the attention of insurers on transition risk to their investments and to reduce that risk, in 2016 I took two important actions. First, I asked all 1,300 insurers that I regulate to divest voluntarily from thermal coal investments because it is clear that thermal coal faces a significant potential risk of being a stranded asset on the books of insurance companies. Six hundred insurers reported they had no coal investments, 67 pledged to divest from thermal coal which altogether would account for $944 million-worth of coal divestment, and another 325 insurers pledged to refrain from future thermal coal investments.

Second, I required 600 insurers with over $100 million in premiums annually to identify, report and publicly disclose their investments in coal, oil, gas and utilities that rely on thermal coal for more than 30% or mixed fossil fuels for more than 50% of their electricity generation, in order to foster greater consideration of the transition risks faced by these investments.

With this information and supplementary research that we conducted on a total of 1,200 insurers’ investment portfolios, we learned that of the over $5 trillion in assets held by insurers operating in California, they held approximately $527.8 billion in oil, gas, coal and utilities, of which $20.9 billion was in thermal coal. We learned the extent to which each of these insurers holds investments in fossil fuels and utilities exposed to climate-related transition risk and we focused insurers on considering the transition risks faced by these investments.

Insurance supervisors need to stand firm with those who deny climate change or ignore climate risk

The coal, oil and gas industries in the United States were not happy with these actions. I received a formal demand letter from the Attorneys General of 12 states with large oil, gas and/or coal industries threatening to sue me if I did not stop asking insurers to disclose their investments in these fossil fuels. I replied formally that it would be insurance regulatory malpractice to fail to ask insurers to consider climate risk and that my actions were well grounded in insurance supervisory law. No lawsuit has been filed and if one were, I am confident we would prevail.

Other insurance regulators across the globe have also been taking steps to ensure their insurance companies are considering climate risk. In December 2016 in San Francisco, I helped to found, with the assistance of UN Environment’s Inquiry into the Design of a Sustainable Financial System, a working group of insurance regulators from countries around the world to share best practices and approaches to address climate risk. One of the first actions of this new Sustainable Insurance Forum was to review, provide input to, and endorse the report and recommendations of the G20’s Task Force on Climate-related Financial Disclosures (TCFD). Insurers, banks and others in the financial sector and companies in all sectors of the economy should follow the recommendations of the TCFD report and identify and disclose the risks they face from climate change.

One of the TCFD’s recommendations is that investors, including insurance companies, undertake climate risk scenario analysis of their investment portfolios. Earlier this year, through an engagement with the 2° Investing Initiative, I directed the California Department of Insurance to conduct a climate risk scenario analysis of the investment portfolios of the 600 largest insurers. We have provided that analysis to the insurers and asked that they consider it in their investment decision-making.

While the results of the climate risk scenario analysis differ by insurer, one of the important results of the sector-wide analysis of all the insurers is that their investment in thermal coal is misaligned with keeping global temperatures below 2° Celsius – in other words, their investments in thermal coal face significant risk of decline in value because to stay below an increase of 2°C it will be necessary to reduce substantially or eliminate entirely the use of thermal coal. This result confirmed the merits of my earlier action asking insurers to divest from thermal coal.

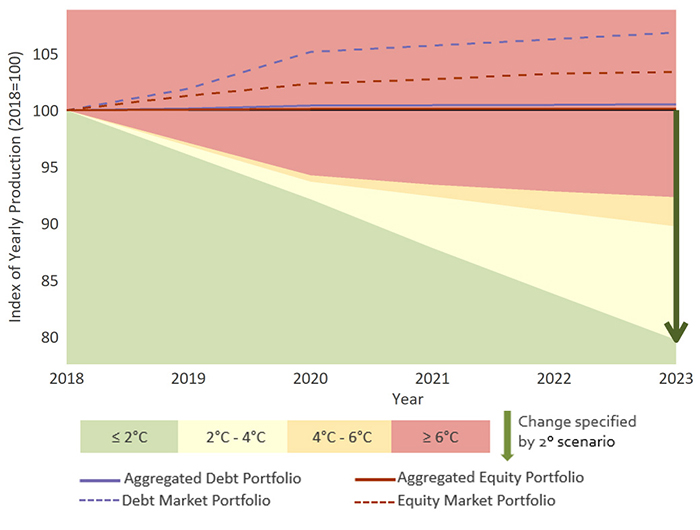

Figure 1. Need for coal-fired power capacity requirements

Figure: The trajectory of aggregated the Californian insurance industry portfolios for coal-fired power production in comparison to trajectories required for 2°C, 4°C and 6°C scenarios. Solid lines are known trajectories for surveyed portfolios; dashed lines show the currently known trajectories of the stock and bond markets. Source: California Department of Insurance, 2° Investing Initiative.

Managing climate risk is now an essential element in supervision – with further action still needed

Perhaps the most important lesson learned from these efforts is that when and where the financial sector lags in considering climate-related risks, it is essential that financial regulators step in to make sure the sector is considering and taking steps to address these risks. The continued wellbeing of the financial sector, and its role in making capital available to people, communities and businesses, as well as the availability of insurance to mitigate risks – depends in no small measure on the identification, evaluation and consideration of climate-related risks.

The TCFD’s recommendations ought to be incorporated into the core supervisory work of all insurance regulators. The Sustainable Insurance Forum authored an important joint paper with the International Association of Insurance Supervisors (IAIS) earlier this year, which maps the TCFD recommendations to the Insurance Core Principals of the IAIS – the DNA of insurance regulation worldwide. The IAIS should explicitly incorporate the TCFD recommendations and other climate risk supervisory approaches into the Insurance Core Principals.

Insurers worldwide need to take up the recommendations of the TCFD and identify, evaluate, disclose and respond to climate-related risks. Insurers also should develop more insurance products to address climate risks faced by people, communities and business. And they can align their investments and underwriting with the objectives of the Paris Agreement.

Insurers should bring their expertise to bear to help communities mitigate and adapt to climate change. More work needs to be done to improve modelling of climate-related risks and impacts and those models should be made available to regulators for review. Insurance regulators can and should make sure that insurers are identifying, considering and addressing the evolving risks of climate change. Our future and the sustainability of insurance markets depends on it. For my part, until midnight on 6 January 2019, when my term as California’s Insurance Commissioner ends, I will be working to ensure that the insurance sector takes account of climate risk.

This commentary is published as part of the Grantham Research Institute’s Sustainable Finance Leadership Series.

The views in this commentary are those of the author and do not necessarily represent those of the Grantham Research Institute.