What France’s experience of energy price rises tells us about the likely impact of pricing carbon on jobs and the environment

New research by Giovanni Marin and Francesco Vona finds that increases in energy prices substantially reduce energy consumption and carbon dioxide emissions, and only modestly reduce employment and productivity.

Meeting the ambitious emissions reduction targets set by the Paris Agreement requires decisive and rapid policy responses. While environmental economists suggest that carbon taxes are the least costly way to reach these targets, politicians have so far remained hesitant to tax emissions, afraid of losing jobs and harming competitiveness.

Our understanding of the possible trade-offs between socioeconomic and environmental goals is not helped by the lack of stringency in the European emissions trading system, the most comprehensive policy scheme to price carbon emissions. However, there is an opportunity to simulate what would happen to companies and workers in a scenario where carbon prices are rapidly increased, through evaluating responses to significant past energy price rises.

This commentary reports the results of a study that uses large historical increases in energy prices for French manufacturing firms to assess the direction and magnitude of price impacts on a wide range of environmental and socioeconomic outcomes. The main takeaways from our research are that trade-offs exist, but costs in terms of job losses and competitiveness are smaller by an order of magnitude than the benefits in terms of reducing carbon dioxide emissions.

Estimating the impacts of France’s energy price rises and proposed carbon tax

One concern over using energy price changes to estimate the consequences of a carbon tax is that such changes are correlated with characteristics of the firm that are difficult to observe and that may also influence the firm’s socioeconomic and environmental performance. For instance, a firm with technological knowledge that does not keep pace with the times becomes less efficient in the use of energy, purchasing more energy than is needed and thus paying higher prices. At the same time, a firm that is this inefficient is also more likely to lose customers and make workers redundant. A plain estimation of the impact of energy price on employment for this type of firm would be misleading as it would attribute job losses to energy prices rather than correctly to technological factors.

To deal with this problem of correctly isolating the effect of energy prices, we combined the past energy mix of the firm, which depends on the technological choices it made in the past, with current national-level changes in energy prices for different energy sources. A firm with a higher share of coal will be more exposed initially to a change in the national price of coal – which may be due to carbon pricing or to global changes in coal prices.

Over the time period of our analysis (2000–2015), the increase in price for fossil fuel energy sources in France was mostly driven by massive growth in demand from emerging economies. In turn, increases in electricity price were triggered by a French policy to finance renewable energy generation. Overall, price changes at the national level can be confidently considered as independent of the evolution of the characteristics of firms that are difficult to observe, such as technological know-how, lending credibility to our research design.

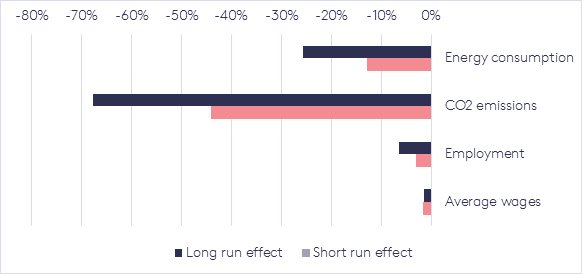

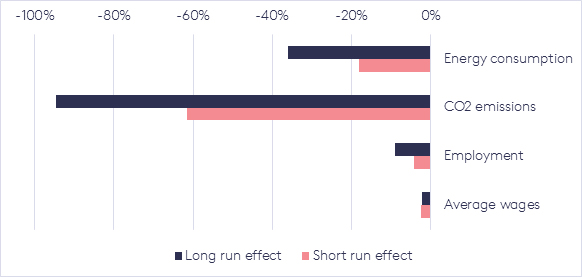

Figure 1 shows the impacts of the historical increase in energy prices (1A) and of the planned French carbon tax at €56 per tonne of carbon dioxide (1B), according to our evaluation.

The main result is that, with the exception of average wages, the long-term effects are significantly larger than the short-term effects, which is good news for the prospects for reducing energy consumption and carbon dioxide emissions over time to realise the goals of the Paris Agreement while having minimal impact on manufacturing jobs.

The historical increase in energy prices (which grew 51 per cent from 2000 to 2015) explains 26 per cent of the long-term reduction in energy demand, 68 per cent of the long-term decline in carbon dioxide emissions and only 7 per cent of the long-term contraction of manufacturing employment. The corresponding effect for a €56/tonne carbon tax is modestly larger, consistent with a larger predicted increase in energy prices, at 72 per cent.

A small trade-off between environmental and social goals

In estimating a negative impact from energy prices on employment, we are acknowledging that there is a trade-off to be had between environmental and social goals. However, the trade-off is generally small: a 10% increase in prices has only a modest negative impact on employment (-0.8%), and for each decline in jobs of 1 per cent, the environmental gain is 4 per cent in terms of reduced energy consumption and 10.5 per cent in terms of reduced carbon dioxide emissions. Importantly, a trade-off of a similar order of magnitude is observed for productivity, which is a close proxy for competitiveness, pointing to a generalised trade-off between socioeconomic and environmental goals.

Should we, then, worry about the socioeconomic effect of a carbon tax? The answer is clearly no. At the macro level, we have shown that increasing energy prices have a negligible impact on industry employment and productivity in European countries. Our methodology is also designed to replicate a kind of worst-case scenario where we do not account for jobs created in emerging green sectors, which are typically in engineering services and machinery production. Many of these new jobs will offset those that are lost in the low-carbon transition. Indeed, we have shown for the United States that the job gains from creating green jobs can be large for the local labour market and thus even outperform the losses in polluting firms.

The concentrated negative effects of environmental policies need to be planned for and mitigated

At the microeconomic level, certain sectors and workers would be significantly harmed. Our estimates of energy price impacts highlight a great deal of variation across sectors and groups of workers. As expected, energy-intensive and to a lesser extent trade-exposed sectors will be affected more than the average by increases in energy prices, and workers with manual skills more so than those with technical skills – though still not to a large extent. Middle-skill technical workers such as engineering science technicians will actually tend to see a benefit because their skills will be well suited to emerging ‘green’ tasks.

The fact that costs are concentrated in certain areas and among certain workers, and that the employment benefits are widespread but small, can cause the ‘losers’ to lobby against ambitious climate policies. Consistent with the debate on the so-called ‘just transition’ to a low- or zero-emissions economy, compensation is needed to reinforce support for ambitious climate policies.

However, the ethical foundations of such support may appear weak in societies where the working conditions for the least skilled have already been dramatically degraded as a consequence of globalisation and automation. Using the revenues of a carbon tax to reduce income tax might be the most appealing solution to support unskilled workers in general, not only those displaced by climate policy. Tax cuts can also be combined with targeted retraining policies to provide the technical skills that are in high demand for the low-carbon transition. These can be key ways to build comparative advantage in green technology, too.

The bottom line is that the political acceptability of climate policies will remain low if they are not combined with a wider plan to support those left behind by these policies and by other structural transformations.

Giovanni Marin is associate professor of applied economics at the University of Urbino, Italy and Francesco Vona is a senior economist at the French Economic Observatory of Sciences-Po (OFCE), adjunct professor at Ca’ Foscari University of Venice, and a visiting fellow at the Grantham Research Institute. Download their new working paper, The impact of energy prices on socioeconomic and environmental performance: Evidence from French manufacturing establishments, 1997–2015.