Trading carbon removals: establishing the rules of the game

Carbon dioxide removal (CDR) is acknowledged as a necessary element of the pathway to net zero but rules to govern how to credit different methods are yet to be established. To aid policy in this area, Josh Burke and Felix Schenuit outline a framework for deciding which methods of CDR could become tradeable within and between jurisdictions.

For the first time in the international climate negotiations, the final deal agreed at COP28 formally recognised the need to transition away from all fossil fuels to reach net zero emissions globally by 2050. However, the negotiations failed to resolve disagreements over the rules to govern global carbon trading mechanisms, or how to credit carbon dioxide removals (CDR), with a rulebook for CDR now not expected until 2026. This could undermine credibility and governance in a sector that desperately needs it.

Agreed rules around CDR are urgently needed to avoid replicating past errors seen in the voluntary carbon market and the Clean Development Mechanism (CDM), especially as bilateral trades are already being negotiated. Governing how long CDR stores carbon for (i.e. the permanence of CDR) should be at the heart of emerging strategies for integrating CDR into net-zero-compatible policy, as we have discussed previously. This is critical as contestation over the use of non-permanent CDR credits to offset ongoing fossil fuel emissions is already contributing to disagreement over Article 6.4 of the Paris Agreement, which is about contributing to the mitigation of emissions and supporting sustainable development.

What is the policy context?

Interest in integrating CDR into existing domestic compliance carbon markets has been growing even if COP28 did not manage to agree a global rulebook for trading carbon removals. However, if CDR will be included in carbon markets remains an open question and even if it is, there are further decisions to be taken over which policy design is pursued and which methods will be eligible.

There are a number of reasons why compliance carbon markets are attractive to policymakers. First, carbon markets can include emitters from hard-to-abate sectors. Second, with governments announcing packages of fiscal tightening, market-based mechanisms that channel private capital to scale up the market for CDR look increasingly appealing. Third, new allowances in compliance markets such as the UK and EU emissions trading systems are expected to end around 2040. With a tighter cap, prices are expected to rise. Integrating CDR can enhance liquidity and help retain the political salience of these markets. In part, CDR inclusion is being driven by these pressures, rather than whether the policy is the best solution to financing the net negative economy. However, if CDR is used as a tool to manage the cap, it raises the question of the risk involved in lowering ambitions for reducing emissions, which underscores the need for a responsible governance architecture.

Pre-conditions needed for trading CDR credits and critiques of the markets

For CDR credits to operate efficiently within compliance carbon markets, the credits must be tradeable with fossil fuel CO2 emissions. In other words, CDR credits created by different methods must be considered to have equivalent value and therefore be comparable and interchangeable. This is what is meant by tradeability (fungibility) and it is a pre-requisite for CDR integration in compliance markets.

However, in practice achieving this is very difficult. Despite the common feature of removing carbon dioxide, different CDR methods vary in terms of their cost, technological maturity, storage duration, risk of reversal (i.e. sequestered carbon is emitted through forest fire) and degree of additionality (i.e. that the carbon removed by a project or activity is over and above what would have happened in its absence). In particular, managing the different levels of CDR permanence remains a key challenge that hinders the integration of CDR into existing and new policy frameworks.

For these reasons, it has been argued that markets are inherently unsuitable to incentivise the development of carbon removal methods and policymakers must break the magnetism between carbon markets and carbon removals. Others have argued that treating emissions and removals as equivalent and tradeable obscures emission reductions, resulting in mitigation deterrence.

These critiques are certainly valid. But since we are already seeing moves towards tradeability of removals in compliance markets, it is necessary to think about how this could be done in a responsible way, regardless of whether or not one believes carbon markets are the right tool for ambitious climate policy.

A conceptual framework for thinking about fungibility

Given the substantial differences between CDR methods in terms of the permanence of carbon stored, we propose a conceptual framework to distinguish types of removal activities that can be considered both fungible with each other and with fossil fuel emissions.

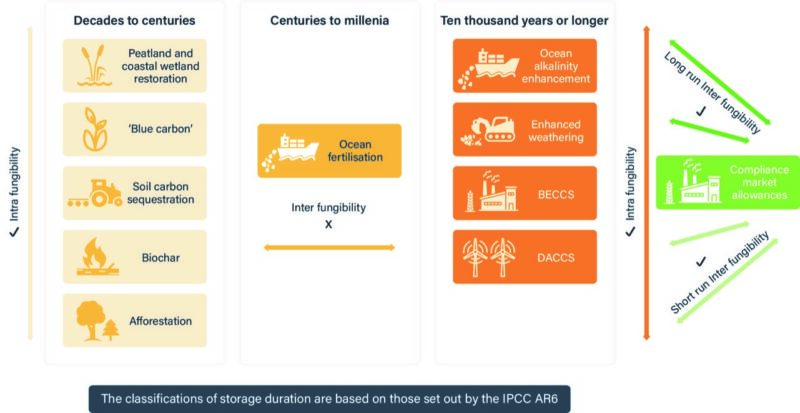

Although some have called for no fungibility at all, here we argue that this assertion can be relaxed if certain criteria are met and make the case for allowing conditional fungibility. Thus, rather than thinking about fungibility as being binary – a commodity either is or is not fungible – it can be regarded on a sliding scale. Policymakers could determine there is either no fungibility (differences are just too difficult to reconcile), partial, or intra-fungibility, or full, inter-fungibility – see Figure 1 below. Only CDR that achieves full fungibility could then be considered tradeable with compliance market allowances. Intra-fungibility (or vertical fungibility) refers to fungibility across CDR methods with broadly the same level of permanence. Inter-fungibility (or horizontal fungibility) refers to fungibility between CDR methods with different levels of permanence. The classifications used above are not intended to be fixed in perpetuity. As new evidence emerges, CDR methods may be reclassified to have either longer or shorter carbon storage durations.

Figure 1. Intra- and inter-fungibility of CDR methods (Source: Burke and Schenuit, 2023)

Applying the framework

Although inter-fungibility is theoretically possible through the application of equivalence ratios and other governance mechanisms, it is not advisable. Standardisation between near permanent and non-permanent methods could mask important differences between methods. Undoing these equivalences would better account for the potential for impermanent implementation, project failure or non-additionality (arising from poor land use governance, extreme weather events, disease or the absence of strong institutions to enforce monitoring, reporting and verification).

If CDR that leads to carbon being stored for decades to centuries is not fungible with CDR that leads to carbon being stored for centuries to millennia or 10,000 years or more, it is therefore not fungible with carbon market allowances either. Hence, not all CDR can be traded in one harmonised carbon market, as non-equivalence between non-permanent CDR and emissions reductions could be obscured under a policy framework that promotes carbon markets. This has implications for policymakers seeking to include afforestation or other non-permanent CDR within compliance markets. It also potentially deprives non-permanent CDR from an important source of demand and revenue but ensures the integrity of the market.

Creating an alternative viable business case for non-permanent CDR remains important. This is where inter-fungibility becomes useful. Standardising groups of technologies with similar permanence can enable policymakers to devise bespoke policy instruments for these methods. For example, establishing intra-fungibility for methods that lead to removals lasting decades to centuries opens up the possibility of a separate standalone carbon market for these non-permanent CDR or the integration into an emissions trading system that only covers land use and agricultural emissions. This has potential as the low level of permanence can then be used to balance out non-CO2 emissions in the agricultural sector rather than fossil fuel CO2 emissions from other sectors.

It is also vital to note that while certain CDR methods may be considered intra-fungible, they may have varying co-benefits or even negative outcomes (such as transgressing planetary boundaries for land system change and biosphere) – factors that, alongside the carbon stored, ought to be taken into account in responsible CDR policy.

Only CDR that stores carbon for 10,000 years or more might be considered fungible with compliance market allowances. However, there are varying levels of technical maturity even within this classification and vastly different levels of readiness of monitoring, reporting and verification (MRV) techniques between methods such as bioenergy with carbon capture and storage (BECCS) and direct air carbon capture and storage (DACCS) compared with enhanced weathering and ocean alkalinity enhancement (OAE).

As a result, not all methods in this group are currently fungible with compliance market allowances. As shown in Figure 1, BECCS and DACCS have the potential for short-term fungibility, meaning that the timeline for carbon market integration is a near- to medium-term option. In contrast, enhanced weathering and OAE have the potential for long-term fungibility due to their high levels of permanence, but this is only a long-term option as MRV protocols have yet to be fully developed due to the complexity involved in the foundational science.

The integration of permanent CDR into the compliance market should be designed in a way that encourages innovation, i.e. it enables expansion to new methods that meet permanence standards over time and facilitates cost reduction of currently expensive CDR methods such as DACCS.

Determining what is fungible will be contested

Determining what is fungible depends on nuanced concepts in climate science, climate economics, and real-world market practices. The issue of fungibility should not be skated over or simply cast as technocratic and value-free – especially if decisions for creating tradeability in compliance markets are prepared and taken.

Certification schemes, such as the CRC-F in the EU, will be an arena for political struggle over the future of specific CDR methods. Actors with stakes in CDR development and deployment are aware of the key role of MRV and accounting schemes, which is why their design will become increasingly contested.

It may never be possible to have certainty that a tonne of CO2 sequestered by a land-based sink is equivalent to either a tonne of CO2 removed by BECCS or DACCS, or a tonne of CO2 simply prevented from being emitted in the first place. Expectations for policy that attempts to reconcile these challenges may need to be dampened and policy frames adapted accordingly.

This commentary is based on a recent policy report by the authors, published by CO2RE: ‘Governing permanence of Carbon Dioxide Removal: a typology of policy measures’.