What does justice demand of individuals in an unjust society? Chris Marshall considers the personal implications of distributive justice.

The distribution of wealth and other goods in the actual world is unjustly unequal and will continue to be unjustly unequal for the foreseeable future. For the fortunate few, life is better than it might be if our unjust world were transformed into a just one. By contrast, many people are worse off than they could be if unjust inequality were removed.

Most egalitarians think that the state has an egalitarian reason to coercively reduce unjust inequality through redistributive policies. But philosophers have said little about whether individuals have an egalitarian reason to reduce unjust inequality through redistributive personal choices. Does justice demand that individuals voluntarily redistribute what they could be justly forced to redistribute through taxation? Or something else entirely?

One answer is that justice demands nothing more of individuals than compliance with their legal obligations to social institutions that are just, and perhaps that they play some part in the reform or abolition of unjust institutions. Yet this doesn’t seem to go far enough.

For example, people who avoid tax by using legal offshore accounts are condemned for not doing their just share, even though they are not breaking the law. And while many people are attracted to the idea that individuals could do nothing more to promote justice in their personal choices if all of our social institutions were fully just, it does not follow from this that individuals can do nothing to reduce injustice when our institutions are unjust. A view of the latter sort would imply that tiny changes to taxation policies would do more to reduce injustice than the better off directly redistributing their wealth to the point of equality.

Keeping Our “Fair Share”?

Instead, we might want to say that justice requires people to go beyond their legal obligations. We might say that individuals must do their “fair share” to reduce distributive injustice.

But what is a “fair share”? (What most people have in mind in the example of tax avoidance is that individuals comply with the “spirit of the law”, if not the letter. But most theories of distributive justice would imply a more demanding fair share than this.)

One answer is that each person is entitled to what they would have in the counterfactual world in which everything is distributed justly. But this is not so straightforward, for two reasons.

First, injustice can be reduced by increasing or (perhaps) decreasing the total amount of goods to be distributed (by “levelling up or down”), in addition to redistributing the distributive goods that already exist. So which is the correct benchmark to use when deciding what someone’s fair share should be?

Second, even if we adopt the intuitively attractive view that the correct benchmark is the one in which all existing wealth were justly distributed, none of our best ways of measuring distributive injustice imply that individuals have no reason to redistribute further once they reach or fall below their counterfactual fair share.

Comparing Distributive Injustice

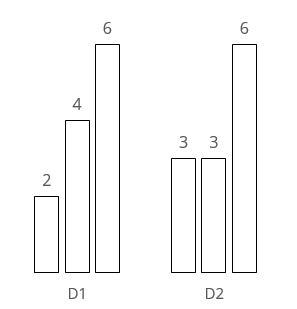

To illustrate this point, it will help to use a simple example. Consider the following two distributions containing the same amount of goods, in which D1 represents the status quo.

Let’s make the simplifying assumptions that each person has an equal claim to a share of the goods to be distributed and (perhaps contrary to fact) that people do not have special claims or entitlements to things they have already legally earned or been given. Given these assumptions, each person’s fair share is 4 units. How do our best theories of distributive justice compare the two distributions?

Some people, like G.A. Cohen, think distributive justice is about distributive patterns. On this view, we compare two distributive patterns and work out which is more just according to the pattern.

Others, like Thomas Nagel, believe that distributive justice is about justifiability. When comparing two situations, we ask which of the two situations can best be justified to each of the individuals in that situation.

Still others, like John Rawls, believe that distributive justice is about what it would be in everybody’s rational self-interest to agree to if they were behind a veil of ignorance which strips them of all knowledge of who they are.

When comparing the distributive patterns, D2 is more equal than D1 (this is somewhat controversial, but is true on most measures).1 D2 is also more justifiable to each person than D1, due to the fact that, being worse off, the first person in D1 has a stronger claim to goods than the second person. D2 would also be rationally preferable to D1 behind a non-probabilistic veil of ignorance, since it would be rational to maximise the size of the worst-off person’s share in such a situation.

Yet D2 could be brought about from D1 if the second person transferred one unit of advantage to the first person, placing the second person below their counterfactually fair share. So none of these views imply that individuals can do nothing more to reduce injustice once they have done their “fair share” according to a counterfactual fully just benchmark.

Taken together, these claims have two implications. First, not only do we have an egalitarian reason to go above and beyond what the law requires in our redistributive actions, but we have an egalitarian reason to make ourselves worse off than we would be in a counterfactually fully just world (insofar as we can identify what that world would look like). Second, some of our best theories of egalitarian justice have similar practical implications for individuals, despite their different moral foundations.

By Chris Marshall

Chris Marshall is a PhD student in the Department of Philosophy, Logic, and Scientific Method. His thesis concerns what egalitarian theories of justice imply for individuals faced with unjust inequality, and normative constraints on reducing inequality in the actual world.

Further reading

- G. A. Cohen, If You’re an Egalitarian, How Come You’re So Rich? (Harvard: Harvard University Press, 2001), Chapter 10.

- David Miller, “Taking Up The Slack? Responsibility and Justice in Situations of Partial Compliance”, Carl Knight and Zofia Stemplowska eds., Responsibility and Distributive Justice (Oxford: Oxford University Press, 2011).

- Larry Temkin, Inequality (Oxford: Oxford University Press, 1993).

[1] On some measures, D2 is more equal than D1. For example, the gap between the best off person and the worst off person is smaller in D2 than D1, and there is equality between two individuals in D2.

However, on some measures, there is the same amount of inequality in D1 and D2. For instance, if we measure inequality by the amount of deviation from the “ideal” distribution, or the (non-weighted) sum of the differences between each person and the best off person, then D1 and D2 are the same regarding inequality.

It might also be claimed that there is more inequality in D2 than D1. This would be true if the amount of inequality was determined only by how many people are worse off than average. But this measure has implausible implications (for example, it would imply that inequality remains unchanged if goods are transferred from the very best off person to another person whose share is just above the average amount.)

See Larry Temkin’s book Inequality for a full discussion of the different dimensions of unfair inequality.

Featured Image: Wellcome Images (via Wikimedia Commons) / CC BY 4.0

Very interesting article, thanks for sharing. Only by moving beyond the very narrow homo economicus view of humanity as purely rational self-interested beings can we hope to develop true ‘justice’. We are more than just isolated egos in bags of skin striving in the world for our own interest. Denying our interconnectedness to each other and nature more generally is flawed. Jung called it the “collective unconscious” and Einstein described the feeling of separateness we may encounter as an “optical delusion of our consciousness.”

Human beings are capable of incredible cooperation, empathy, love and care for one another.

Evidence of this is all around us — from the way we work together to create amazing feats of engineering, to how we take care of the most vulnerable in our communities.

It seems then that we have a choice about how we live as a people. We can choose to perpetuate the narrow view of homo economicus or we can embrace our power to make the best of each other through cooperation and compassion. It is a shift in mindset at the individual, which if multiplied could result in a fundamental shift in our collective social behaviour.