- Programme studied: MSc Management of Information Systems and Digital Innovation

- Year of Graduation: 2017

- LinkedIn profile

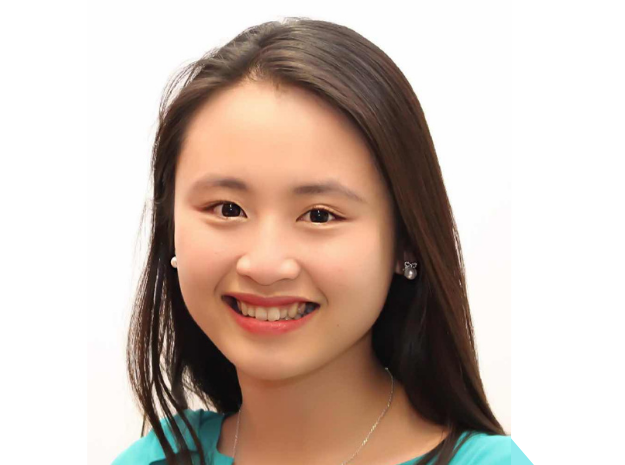

Meet our December Alum of the Month, Joyce Li. Joyce is a Fintech Research Advisor at Ant Group’s Research Institute in Shanghai, China. By exploring the ever-changing FinTech market landscape and regulatory trends, Joyce is revolutionising the foundation of financial services along with her teammates across the world.

Tell us about your career journey since graduating from LSE.

“Change is the only constant” comes to mind when I read this question. At the end of my LSE programme, I participated in the LSE Generate start-up competition with three friends I met in school, and we started a cryptocurrency arbitrage service. Right around graduation, we successfully completed several funding rounds. However, our entrepreneurial undertaking was short-lived, and we didn’t continue when the Bitcoin price dropped quickly in early 2018.

Thereafter, I joined Alibaba Group as an analytics adviser in global supplier development. After living 12 years abroad, I moved back to China to explore the fast pace changes happening in the industrialising society. In China’s constantly evolving digital ecosystem, I participated in digitalising cross-border supply chains, creating new B2B financial products, and helping merchants undertake seemingly impossible challenges during the COVID-19 pandemic. This year, after two years of working in the global trade finance business, I shifted gears and switched to Ant Group’s internal think tank as a Fintech Research Advisor.

How has the programme you studied helped your career since you graduated?

I completed the MSc Management of Information Systems and Digital Innovation (MISDI) programme while working part-time, so I was able to leverage what I learned in class instantly to work. For instance, after comprehending the actor–network theory at school, I changed my perspective in understanding how social effects are generated as a result of the intended and unintended interactions between human and non-human actors. I was much more mindful when engaging in a product upgrade or introducing a digital tool change to an organisation. MSc MISDI lectures offered me the tools to frame a complex situation, before diving into the solution.

What has been the biggest challenge you have faced in your career, and what have you learned from it?

Terminating an award-winning financial service for SME due to the early impact from COVID-19 was one of the hardest decisions I had to follow through. I distinctively remember getting phone calls from the CEO of the partnered FinTech firm and being told that the risk was too high to continue the program. The decision to terminate the service was made, and the webpage went offline within hours. Before I knew it, I was picking up phone calls and replying to emails from the merchants asking for financial assistance during the difficult time. We had to quickly find funding alternatives for our merchants while keeping the risk under control. The helplessness and unpredictable nature of the pandemic made this the most difficult challenge in my career.

While the pandemic has shut down many doors, it has definitely accelerated companies’ digital transformation progress across the globe. Fortunately, working at Ant Group, my team and I continue to launch new products for changing financial needs despites all the challenges we face this year. I have learned that being able to embrace change and adjust quickly is crucial for individuals as well as corporations.

How did your time at LSE influence your career journey?

Professor Carsten Sørensen and Professor Will Venters invited me to uncover the secrets behind China’s digital success, by giving me an assistant position in their Huawei sponsored research project during my time at the LSE. The 12-month project was on Huawei’s Digital Innovation Platform, and it gave me a chance to talk to many interesting, driven, and hardworking people. This triggered me to explore job opportunities in a competitive Chinese tech firm soon after the project ended.

What advice would you give to students who are graduating this year and looking to begin or continue to build their own careers within the FinTech industry?

The real path to the work one loves is usually complicated. For students graduating this year, I highly recommend the book “So Good They Can’t Ignore You” by Cal Newport. This book boldly calls out that the ‘follow your passion’ advice is overly simplified. Instead, our professional expertise is built through utilising our varied experiences in our lives and building career capital. As a fresh graduate, it is more important to become good at something rare and valuable, and then invest our energy into the type of traits that make a job great. Therefore, figuring out the career capital you are trying to build is just as important as applying to jobs.

You are currently an active leading member of the LISA Group. Tell us about this. What it is like to be a part of an alumni group, what are the benefits?

I realised the LSE alumni communications might not reach as many Chinese as other countries’ alumni; hence I join the alumni group to offer perspectives and inputs from the Chinese community. Several MISDI alumni recently formed the official LSE Management & Information Systems Alumni Official Group on LinkedIn for alumni from across the past 30+ years! It is a space for us to learn about new IT innovation practices, discuss new research in the IS field, network with like-minded professionals, and more importantly – to reconnect with classmates from the good old days!

How has the Ant Group adapted during Covid-19 as a FinTech company, and what do you foresee as the changes that lie ahead?

Since the start of the COVID-19 pandemic, Ant has launched the “Anti-COVID-19 Express Services,” a dedicated section in the Alipay app, to minimise the impact of COVID-19 on people’s daily lives in China. The section aggregates services such as real-time updates on COVID-19, online medical consultations, online grocery delivery services, and donations to charitable organisations. The Alipay app also enabled multiple regions across China and Southeast Asia to distribute government backed consumer coupons, spurring spending as SMEs resume regular business operations.

Financial services providers are actively responding to the changing needs during COVID-19. More and more consumers turn to “Buy Now Pay Later” type of solutions to pay for their shopping; more and more employees turn to Early Paycheck Access for their income; and more and more businesses turn to remote banking services with their phones. Innovative solutions enabling faster cash flow for everyone, including the unbanked, will continue to grow and eventually consolidate by the firms that survive from the pandemic.