Winners 2025

There was an extraordinary range of ideas presented, and some great connections between economic history and the opportunities investors face today

We have had another excellent round of our annual Economic History Investment Competition. The winning proposal came from Group 3: Amreeta Sekhon, Olivia Gauvin, Jingkun Zhang and William Splatt, who focused on investing in property in Brisbane ahead of the Olympics.

The competition challenges students to identify and prepare a case for an investment opportunity. Teams combining undergraduate and masters’ students from our programmes work together over one intense weekend. Their ideas are then judged by three city professionals. This year the judges were Miguel Fidalgo of Project X capital, Simon Macadam of Capital Economics and Greg Salter, formerly of KPMG.

Brisbane Property Investment: An Olympic and Mining Opportunity

The team’s investment proposal makes the case for financing residential property development in Brisbane ahead of the 2032 Olympic Games, based on converging economic trends.

Why is this a good opportunity? Brisbane's Economic Foundation: Brisbane is Australia's fastest-growing major capital city, benefiting from Queensland's mining boom without the volatility of actual mining regions. Research shows Brisbane house prices respond positively to rising iron ore prices but remain more stable than mining towns during downturns—capturing the upside while avoiding the worst crashes.

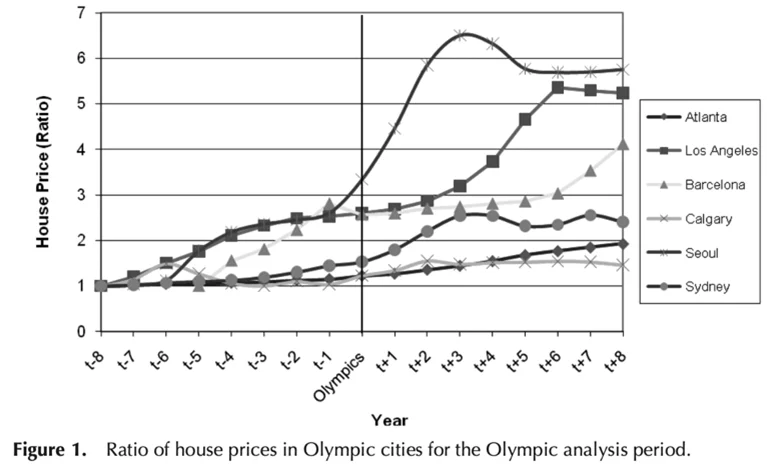

Add to this the Olympic Catalyst: The proposal identifies a well-documented pattern where Olympic host cities experience substantial property price increases. Historical evidence is compelling:

Sydney (2000 Olympics): Property values jumped 60% between the 1993 announcement and the actual games

London (2012 Olympics): Host boroughs saw property prices increase 3.3% immediately after announcement, with dramatic long-term gains shown in the data tables

The figure tracks house price ratios across multiple Olympic cities over time, showing a consistent pattern: prices begin rising around announcement, accelerate during infrastructure construction, peak near the games, and then stabilize at elevated levels rather than collapsing.

Brisbane prices have already risen from below $750,000 to over $1 million in Olympic-adjacent areas, with median apartment prices currently at $717,000 growing at 14% annually.

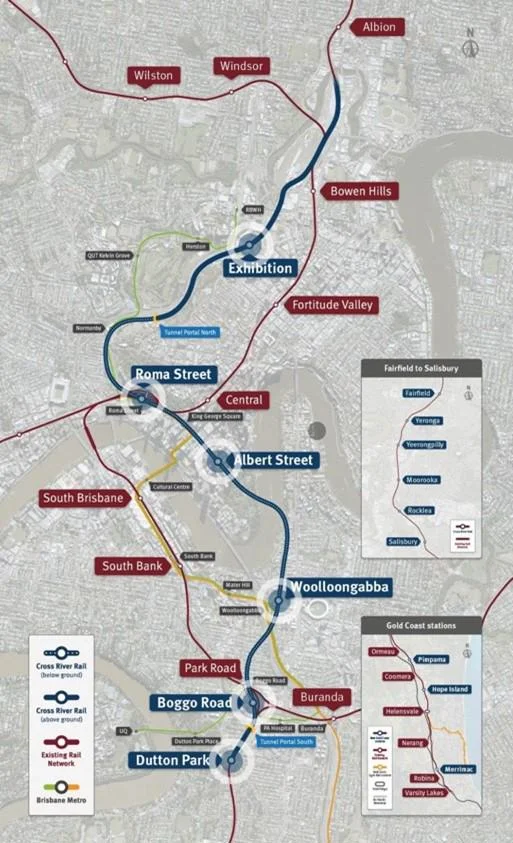

The Infrastructure Advantage: The proposal focuses on Woolloongabba, which sits near major Olympic infrastructure including the $5.4 billion Cross River Rail project and will be part of a 16,000-home development zone. Unlike past Olympics with "white elephant" venues, 84% of Brisbane's Olympic infrastructure is existing or temporary, reducing post-games risk.

The proposal essentially argues that Brisbane presents a rare convergence: structural economic strength from mining spillovers, proven Olympic-driven property appreciation patterns, massive infrastructure investment already underway, and market entry timing that aligns with the historically high-growth pre-games phase.