Course details

- DepartmentDepartment of Finance

- Application codeSS-FM225

Apply

Applications are open

We are accepting applications. Apply early to avoid disappointment.

Overview

Interest in the fixed income market is ever-growing. With increasing uncertainty in the global financial market, debt markets have been in the spotlight as investors seek income-generating investments.

In this environment, it is vital to have a thorough understanding of the functions and objectives of the major players in debt markets, of the various fixed income instruments and the risks associated with them, and of the models and methods used to value fixed income securities and their derivatives.

This course helps to develop the relevant knowledge and understanding of fixed income instruments and interest rate models.

Providing you with an overview of the major institutions, organisations and investors, you will cover both the theoretical background of fixed income markets and its practical implementation. Gaining hands-on experience using real-world examples, you will develop the critical thinking and analytical skills to engage in fixed income markets globally.

Key information

Prerequisites: Basic mathematics and statistics, as well as Introductory Finance (to the level of FM250) or Introductory Microeconomics (to the level of EC101).

Level: 200 level. Read more information on levels in our FAQs

Fees: Please see Fees and payments

Lectures: 36 hours

Classes: 18 hours

Assessment: Two written examinations

Typical credit: 3-4 credits (US) 7.5 ECTS points (EU)

Please note: Assessment is optional but may be required for credit by your home institution. Your home institution will be able to advise how you can meet their credit requirements. For more information on exams and credit, read Teaching and assessment

Is this course right for you?

This course is suitable if you are aiming for a career in the fixed income field or if you want to understand how fixed income is incorporated into an existing investment portfolio.

Outcomes

- Understand the organisation and structure of debt markets with a focus on the US and the UK

- Identify the role of monetary policy and the central bank in setting interest rates

- Illustrate the relationship between interest rates and future economic activity

- Articulate the basics of interest rate risk management

- Apply state-of-the-art interest rate models to real-world examples

- Relate the course topics to the credit crisis of 2007-2009 and discuss the implications for the future of debt markets

Content

Faculty

The design of this course is guided by LSE faculty, as well as industry experts, who will share their experience and in-depth knowledge with you throughout the course.

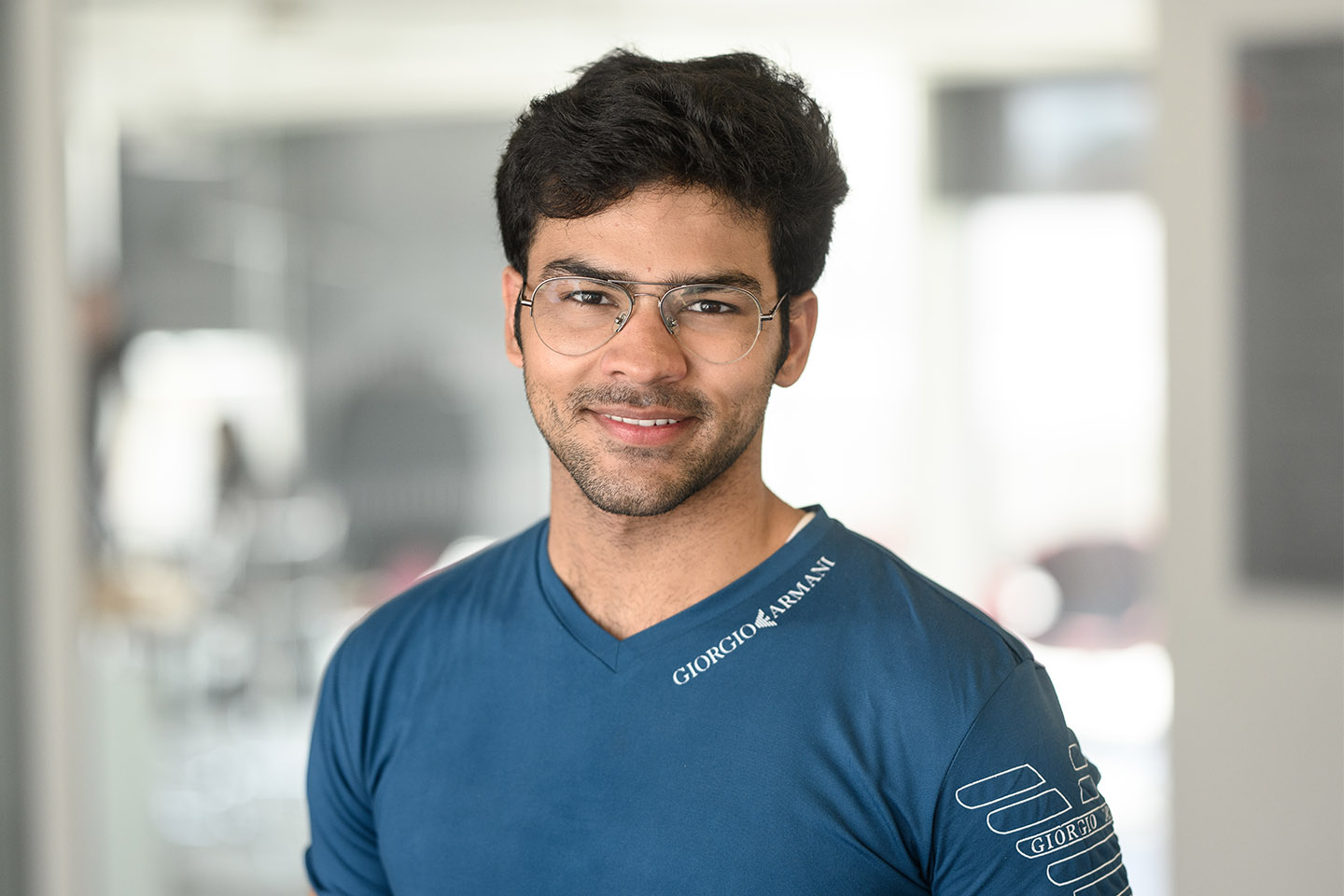

Dr Christian Julliard

Associate Professor of Finance

Dr Cameron Peng

Assistant Professor of Finance

Department

The LSE Department of Finance is devoted to excellence in teaching and research in the full range of the subfields of finance including corporate finance, asset pricing theory, risk management, empirical analysis of capital markets, behavioural finance, portfolio analysis, derivatives pricing, microstructure and financial econometrics.

The Department of Finance (formerly part of the Department of Accounting and Finance) has grown in recent years to become one of the largest and most highly-regarded finance groups in the UK and Europe. It is closely associated with the LSE's Financial Markets Group and Systemic Risk Centre which regularly host a wide variety of seminars, conferences and public addresses by leading academics and practitioners.

With over 200 post-graduate students selected from a pool of top applicants world-wide, a faculty recruited from the top departments internationally, and a steady flow of distinguished visitors, we have a stimulating environment for research and learning that is on par with the best in the world.

Join our mailing list

Join our mailing list to be notified when applications open for next summer.

Apply

Applications are open

We are accepting applications. Apply early to avoid disappointment.