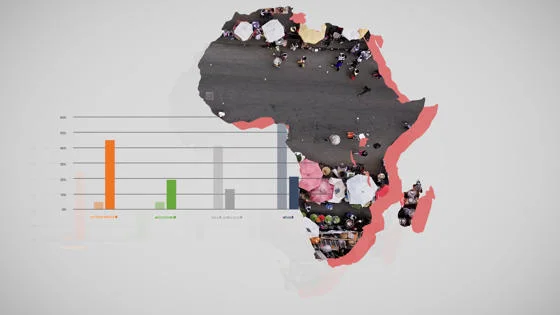

EU strategy to reach net zero could cost Africa billions

Contents

The Paris Agreement of 2015 signalled a step change in the world’s approach to climate change, holding all countries to account by requiring ambitious climate action plans to reduce emissions, while acknowledging that developing countries on the frontline of the climate crisis would require “enhanced support” from the developed countries historically responsible for higher levels of emissions.

“There is clearly a need to decarbonise trade and we are seeing positive policy responses beginning to emerge to get us to the net-zero world we clearly need to reach,” says David Luke, Professor in Practice and Strategic Director of the Firoz Lalji Institute for Africa at LSE. “But we need to be aware of their implications for poor countries, especially as the Paris Agreement is predicated on common and differentiated responsibilities capacities.”

One of these responses is the EU's Carbon Border Adjustment Mechanism (CBAM). This new set of rules and requirements will apply to a number of carbon-intensive imports entering the European Union (EU). Its aim, “to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.”

But does a “fair price” also mean a fair impact on the EU’s trading partners? This is one of the questions Professor Luke and his team – comprising Jamie MacLeod, Geoffroy Guepie and Oluwasola Omoju, with legal analysis by Colette van der Ven – set out to answer. Their report, published in collaboration with the African Climate Foundation, is the first comprehensive study into the implications of the CBAM on Africa - home to 33 of the world’s 46 least developed countries.

For African countries it is the extent of product coverage that is the most important. What appears to be less important is whether Japan or the UK or US decide to copy the EU’s model in the future.

The CBAM could potentially cost Africa $25 billion

“There were two things we particularly wanted to understand - what CBAM’s impact would be at an aggregate level, so for the African continent as a whole, and what it would mean for specific countries,” says Professor Luke.

“From the outset it was clear that we would need to do some economic modelling to get a sense of how EU policy could impact Africa, which was tricky because the EU’s policy was evolving as we were working to understand the context, parameters and scenarios that we would need to factor into the modelling. It became very clear by the end of last year, however, where the EU was going and what their landing zone was.”

To forecast the CBAM’s potential impact on both the continent and its individual countries, the team used two economic models and considered six scenarios, looking at what might happen should the price of carbon increase, or more products be added to the CBAM in the future. They also explored what the additional implications could be should other major trading partners – the US, UK, Canada and Japan – decide to emulate the CBAM in the future.

“Looking at the CBAM’s potential impact from different angles gives this more robustness,” explains Jamie MacLeod, who led the modelling team in the study. “By piecing together all those different parts, we’re able to better understand what parts of the CBAM could be most problematic and what areas policymakers might want to specifically focus on to mitigate its economic impact.

“Our figures show that, for African countries it is the extent of product coverage that is the most important. What appears to be less important is whether Japan or the UK or US decide to copy the EU’s model in the future, which they have indicated they might. The reason for that is that African countries have a particularly strong trading partnership with the EU, and are far more dependent on the EU market for their exports.”

Why is Africa so impacted by the CBAM?

In one model, the CBAM is forecast to only moderately reduce the Gross Domestic Product (GDP) of individual African countries. The other, however, predicts a more dramatic reduction of GDP of the continent equivalent to a fall of $25 billion, at 2021 levels of GDP.

Across all scenarios, the CBAM is predicted to have a larger economic impact on African countries as a share of their GDP than on all other regions. This is partly because products included in the CBAM – fertiliser, cement, iron and steel for example – are not just key African exports to the EU but are relatively more carbon intensive to produce in Africa than its competitors. This could lead to a potentially significant fall in exports in certain sectors from Africa to the EU, the models indicate.

Furthermore, a lack of carbon markets or established systems for monitoring and measuring carbon content in production in African countries could mean that the continent would be further penalised - again, more so than the richer countries responsible for the majority of carbon emissions worldwide.

[Products] could end up being rediverted to other markets like China or India … creating a world with two parts – one that trades in cleaner products and the other that doesn’t face those influences.

“If countries don’t have the capacity to monitor and report carbon emissions of production then these have to be dealt with in a similar manner to the way the reporting of other environmental or labour standards are handled at the moment, which is to pay for firms in Europe to fly out at great expense to then work out whether the product meets the criteria needed for it to be qualified to export to Europe or not. That’s hugely expensive,” explains Jamie MacLeod. “Either that or they will have to rely on default rates under the CBAM, which would also typically be priced higher.”

The CBAM risks creating a two-tiered global trade system

The report paints a potentially stark economic picture for African countries. But the CBAM could also have wider ramifications for global trade, the LSE researchers argue.

“One of the findings that particularly surprised me was the extent to which some of the commodities listed under the CBAM are substitutable in different markets, which allows them to be exported elsewhere,” explains Jamie MacLeod. “Aluminium, for example, could end up being rediverted to other markets like China or India. This could undermine the intended impact of the CBAM, by creating a world with two parts – one that trades in cleaner products and the other that doesn’t face those influences.”

Professor Luke agrees, saying: “I think this underscores the risk for the EU, that it could create a trade diversion.”

There is a concern that some African negotiators and policymakers may not yet have fully grasped what is coming, and so we hope this report will help in that respect.

Helping Africa respond to the CBAM

Having identified potential ways the CBAM will impact both Africa and its individual countries, Professor Luke and Jamie MacLeod hope that their findings will help policymakers to respond to the challenges coming their way.

“This report was done in partnership with the African Climate Foundation, who are very much a campaigning organisation and are planning briefings and workshops to communicate the findings,” says Professor Luke. "There is a concern that some African negotiators and policymakers may not yet have fully grasped what is coming, and so we hope this report will help in that respect.”

Jamie MacLeod adds: “It’s important to understand what some of these enormous climate policies, which have been developed in some of the leading countries elsewhere, imply for African countries, but we also need to think strategically about what African countries can do to best take advantage of them or deal with consequences from them. What can be done internally within the African continent – and that might be developing regional policies or their own carbon markets that can interface with other ones.

“Ideally, Africa can develop ways of monitoring and reporting, maybe even markets for carbon in those countries, and that these can be developed in the right way, so they can interface with such external systems. We don’t want to end up with a complex spaghetti ball of overlapping and differing kinds of carbon monitoring and reporting requirements for all these different markets.”

This would be a positive step in helping Africa prepare for the CBAM, agrees Professor Luke. He adds: “One of our recommendations is the need for African countries to begin to develop their own systems, and there are talks happening now about establishing a regional carbon market, so we would like to do more work in this area to see how we can perhaps be part of how that regional carbon market is designed.”

How severely the CBAM impacts Africa will depend on its ability to develop cleaner production processes and robust regional monitoring systems. With the policy due to enter a transition period on 1 October 2023 before being phased in between 2025 and 2034, now is the time for policymakers to focus on ways the continent can adapt to ensure it is as ready as possible to meet the EU’s new requirements - a difficult yet urgent task that Professor Luke and Jamie MacLeod hope their research will continue to support.

Professor Luke and Jamie MacLeod were speaking to Jess Winterstein, Deputy Head of Media Relations at LSE.

Download a PDF version of this article