The joint impact of the European Union emissions trading system on carbon emissions and economic performance

External Links

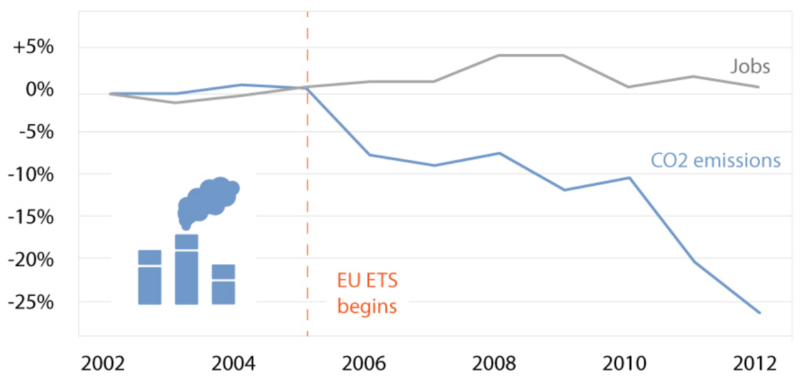

This paper investigates the impact of the European Union Emissions Trading System (EU ETS) on carbon emissions and economic performance using the largest dataset published to date. We compare ETS firms with very similar non-ETS firms in the same country and sector and evaluate how both groups evolve over time, using a matched difference-in-difference methodology. Non-ETS firms often have a set of installations that are just below the minimum production capacity to be included in the ETS. For emissions, we use Installation-level data from national Polluting Emissions Registries in France, Netherlands, Norway and the United Kingdom and find a reduction in carbon emissions in the order of -10% between 2005 and 2012, in line with existing micro and macro evidence. Meanwhile, firm-level data on the 31 ETS-regulated countries shows that the EU ETS had no significant impact on profits and employment, and led to an increase in regulated firms’ revenues (+15%) and fixed assets (+8%). These results are in line with the Porter Hypothesis, suggesting that environmental regulation can spur innovation and economies of scale in energy efficiency.

Antoine Dechezleprêtre, Daniel Nachtigall, Frank Venmans, The joint impact of the European Union emissions trading system on carbon emissions and economic performance, Journal of Environmental Economics and Management, 2022, 102758, ISSN 0095-0696,

https://doi.org/10.1016/j.jeem.2022.102758.